Highlights

- Radiopharm Theranostics has announced the successful completion of the retail component of its entitlement offer.

- The retail component raised gross proceeds of approximately AU$1.2 million, in addition to AU$3.3 million underwritten, whereas the institutional component raised gross proceeds of nearly AU$5.5 million.

- The AU$10 million proceeds raised will enable the company to fund its clinical development endeavours aimed at cancer treatment.

Australia-based Radiopharm Theranostics (ASX:RAD) has boosted its capital position with the successful completion of the retail component of its entitlement offer.

Earlier in October, the company announced the fully underwritten 1 for 3.55 pro-rata accelerated non-renounceable entitlement offer, entailing institutional and retail components.

As planned under the offer, new fully paid shares will be issued at a price of AU$0.14, together with one free attaching option for every one new share issued. Each option will have an exercise price of AU$0.20 and will be exercisable on or before 30 November 2026.

Direct retail component raises ~$1.2 million

The retail component of the entitlement offer raised gross proceeds of approximately AU$1.2 million in addition to AU$3.3 million that were underwritten.

Earlier, the company closed its institutional component, raising gross proceeds of nearly AU$5.5 million.

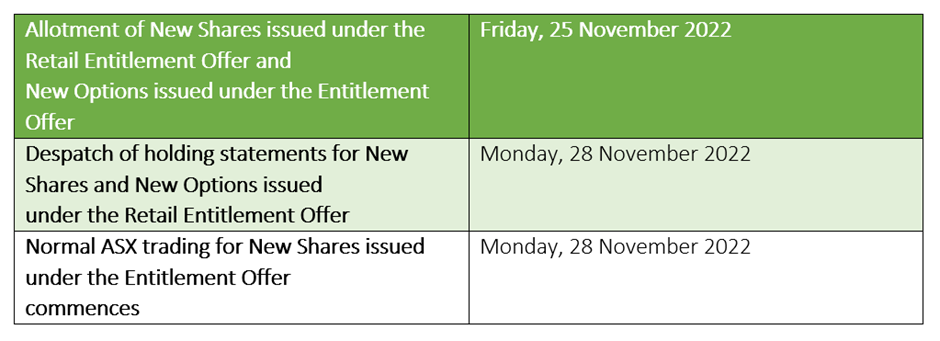

Below is an indicative timetable by the company. However, it is subject to change.

Data source: RAD update

The proceeds raised under the entitlement offer are expected to provide the company with runway until at least the end of 2023, including three new assets acquired since IPO.

To know more about the company’s journey so far, click here

RAD shares were trading at AU$0.120 apiece in the early hours of 23 November 2022.