Highlights

- R3D Resources Limited (ASX: R3D) has acquired the Nightflower Silver Project via an option agreement with Mr Tom Saunders way before the expiry date of 23 February 2023, at the considerably lower price of AU$250,000 (payable in R3D shares) against the original exercise price (per the agreement) of AU$1 million.

- R3D has successfully renegotiated the terms of the option agreement.

- Exploration at the Nightflower Silver Project has revealed significant high-grade surface mineralization and exploration targets, as per R3D.

R3D Resources Limited (ASX: R3D), a copper-gold explorer and developer in the Chillagoe Region of North Queensland, has acquired the Nightflower Silver Project for an exercise price of AU$250,000, payable in R3D shares priced 10 cents apiece that will be held in an escrow for 12 months from the date of issue.

To acquire Nightflower, the company renegotiated the terms of its option agreement with Mr Tom Saunders, which would have expired on 23 February 2023 and entailed an exercise price of AU$ 1 million. The revised terms also include upside payments if a base case resource of 25 million ounces silver equivalent (Ag Eq) at a cut‑off grade of 50 g/t Ag Eq is exceeded. This entails

- Payments of AU$100,000 in R3D shares at the previous 1-month VWAP for every additional 1-million-ounce Ag Eq above the base case resource, and

- Up to a maximum of AU$750,000 or 32.5 million ounces Ag Eq at a cut‑off grade of 50 g/t Ag Eq.

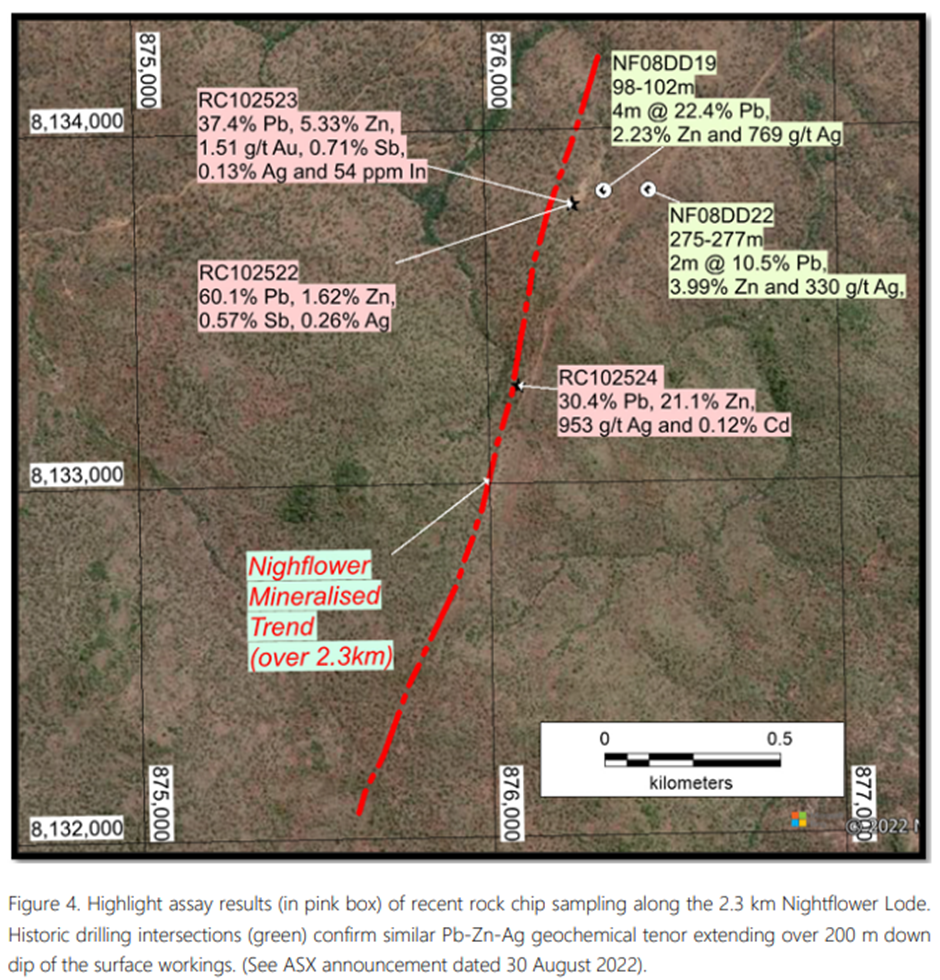

At the end of August, the company said it had received high‑grade assays from rock chips from the Nightflower lode, with maximum values of 60.1% lead, 21.1% zinc, and 2600 g/t silver.

The Nightflower lode stretches for more than 2.3 km, and R3D had previously estimated an exploration target ranging from 2.7 to 5.3 Mt at 134 to 193 g/t Ag Eq for 17.0 to 23 Moz Ag Eq (see ASX announcement dated 6 June 2022).

About the Nightflower Silver Project

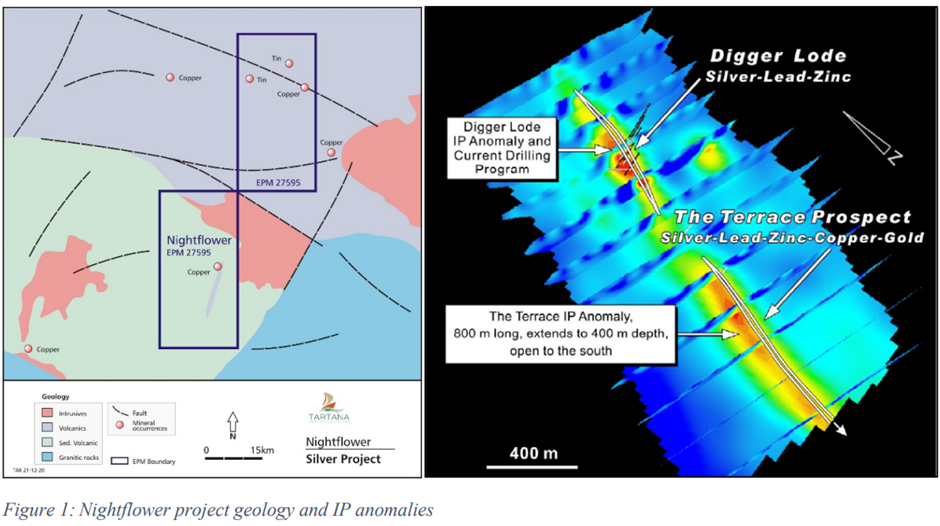

The Nightflower project, which is located 40 km north of Chillagoe in Far North Queensland, spans a considerable part of the northern Featherbed Volcanic Group and the underlying and surrounding Hodgkinson Formation. Additionally, the mineralisation, located within the Nightflower fault zone, is in the form of an epithermal polymetallic (Ag-Pb-Zn-Cu-Au) deposit.

Source: Company update

This project has two prospects, namely the Digger Lode and Terrace, along this fault structure. The mineralisation has been interpreted to represent the upper levels of an underlying porphyry deposit. Also, the fault zone is understood to be part of the northeast-trending Mungana transfer zone, a regional lineament, which connects to the regional Palmerville fault zone, close to the Mungana and Red Dome copper-gold-silver porphyry mines.

The Digger Lode that has seen the most historical work, having been partly defined by surface outcrop as well as 19 drillholes (18 of 19 being diamond), where mineralisation has been intersected between 10 m and 370 m below the surface.

Exploration results from Digger Lode

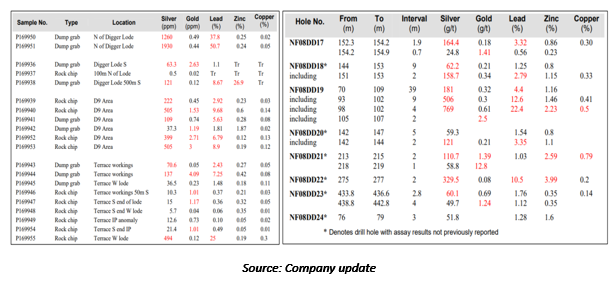

R3D has cited the following exploration results from surface sampling and historical drilling at Digger Lode reported by Axiom Mining in an ASX announcement dated 31 October 2008:

Nightflower Silver Project exploration targets thus far

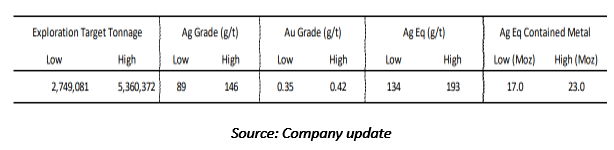

The company, in June 2022, estimated a revised exploration target (see ASX announcement dated 6 June 2022) as follows:

On 30 August 2022, the company announced the assay results for due diligence rock chip sampling. Maximum values of 60.1% lead, 21.1% zinc, and 2600 g/t Ag were obtained from the rock chip sampling, as well as elevated indium (54 ppm) and antimony (0.71%) assays, corroborating the previously reported ore-grade Pb-Ag-Zn geochemistry.

Given the exploration target size and the high-grade surface sampling, the company is confident that future exploration can pave the way for a moderately sized, high-grade precious and base metal project.

Source: Company update

Option agreement details

Tartana Resources Limited, a subsidiary of R3D Resources, signed an option agreement with Mr Tom Saunders for the Nightflower project. This was even before R3D had acquired Tartana. The project is covered by an EPM 27595 application, and the terms of the option agreement were as follows:

- Exclusivity fee (until the grant of the EPM) of AU$5,000 payable in Tartana shares priced 12.5 cents apiece.

- Option fee of AU$20,000 payable in Tartana Shares priced 12.5 cents apiece.

- Option period of two years, from the time of granting of the EPM with a minimum spend requirement including 150 m of RC drilling during the option period.

- Exercise price of AU$1 million payable in Tartana Shares at the VWAP at that time.

Subsequently, in 2021, R3D Resources acquired the Tartana shares that were issued to Mr Saunders in return for R3D shares.

New terms favour R3D Resources

Now the terms of the option agreement have been successfully renegotiated by the company in its favour:

- Exercise price of AU$250,000 payable in R3D shares priced 10 cents apiece, amounting to 2,500,000 R3D shares with an escrow period of 12 months from date of issue.

- Though completion is to occur on or near 17 October 2022, the issue of the 2,500,000 R3D shares will be subject to the granting of ministerial approval for tenement transfer.

- Additional payments of

- AU$100,000 payable in R3D shares at the previous one-month VWAP for each 1 Moz Ag Eq increase in resource, with a minimum cut-off grade of 50 g/t Ag Eq, above a base resource of 25 Moz Ag Eq to a maximum of 32 Moz (thus being no more than a further $700,000 if the resource meets or exceeds 32 Moz), and

- AU$50,000 payable in R3D shares at the previous one-month VWAP if the resource exceeds 32 Moz Ag Eq with a minimum cut-off grade of 50 g/t Ag Eq.

- Additional payments are subject to R3D’s release of a JORC 2012 compliant resource report to the ASX that meets the above criteria.

- All R3D shares issued to Mr Saunders are to be held in a voluntary escrow of 12 months, and they are expected to be issued under capacity available to the company under ASX Listing Rule 7.1 from time to time.

As of 21 Oct, 2:20 PM AEST, R3D was trading at AU$0.091.