Highlights

- There are robust market conditions for molybdenum, with prices recently reaching a 17-year high of US$100/kg

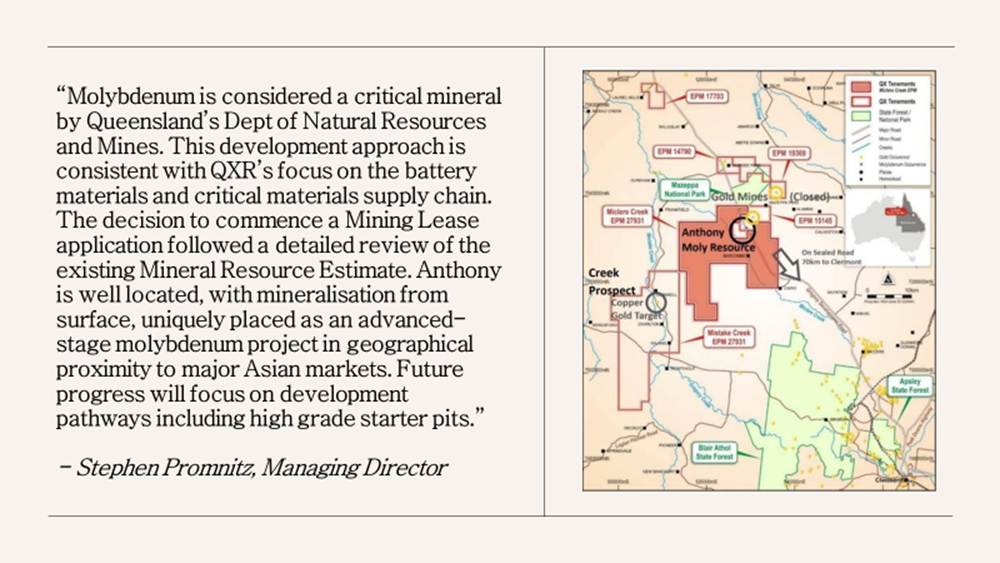

- QX Resources' Anthony Deposit (Central Queensland) is close to key infrastructure including rail and roads

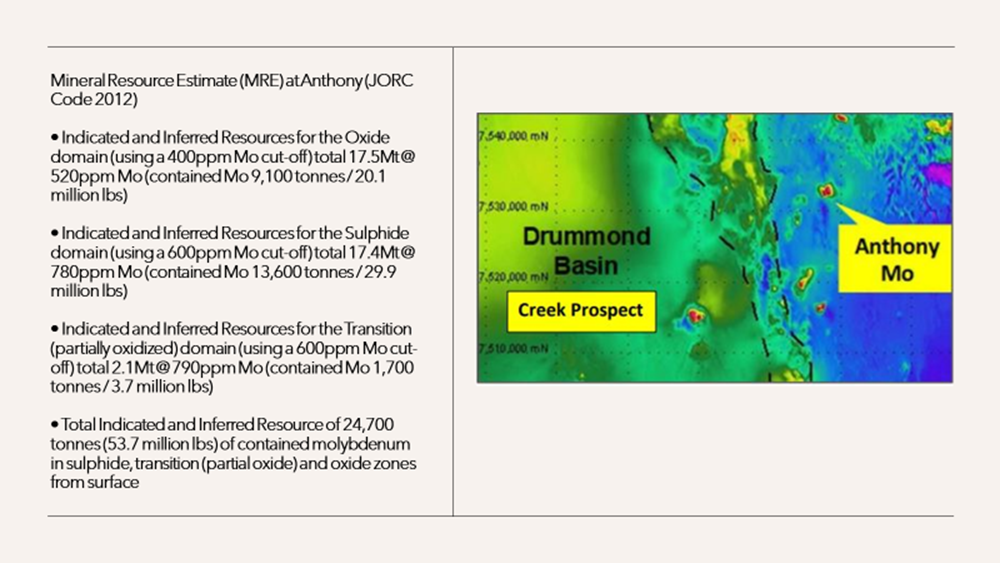

- In 2021, the Mineral Resource Estimate (MRE) at the Anthony deposit was upgraded to JORC Code 2012

ASX-listed QX Resources Limited (ASX: QXR) has announced that the company will start a formal application for a mining lease with the intention of progressing further at its Anthony deposit (molybdenum or Mo) project. The Anthony deposit lies in Central Queensland and has an Indicated and Inferred MRE (JORC 2012) of 24,700 tonnes of contained Mo in sulphide, transition (partial oxide) and oxide zones from surface.

QXR has said that its application would contain an appraisal of numerous open pit mining and processing scenarios.

Source: Company update

Shares jump nearly 3%

QXR shares traded on ASX at AU$0.036, up 2.8%, on 10 May 2023, after the announcement.

More on advanced-stage Anthony molybdenum deposit

The company is looking to start a mining lease application related to its advanced-stage Anthony molybdenum deposit. QXR has stated that this development occurs at a time when market conditions for molybdenum are robust, with prices touching a 17-year high of US$100/kg in February this year. QX Resources' application would have an appraisal of Anthony deposit's open pit mining and processing scenarios.

Notably, QXR’s advanced-stage deposit is in a Tier-1 jurisdiction and has close proximity to major sealed roads, and having nearby rail and energy support. The Anthony Mineral Resource Estimate was upgraded to JORC Code 2012 in 2021. The focus on the resource was on recoverable resources from the near-surface oxidised zones. The below picture has details of Anthony deposit's Mineral Resource Estimate.

Source: Company update

Encouraging molybdenum and market trends

Molybdenum or Moly is used as an alloy to fortify structural steel, with use also in high-nickel stainless steel, besides having utility as a catalyst in the chemicals industry. Demand for structural steel has been rising on a global scale. Molybdenum’s use in wind turbines has created its demand in renewable energy technologies.

QXR has mentioned that outside of China, only two pure molybdenum plays are in operation, both present in Colorado, US. The benchmark ferromolybdenum price hit a multi-year high of US$100/kg this year in Europe and trading continues at a price level of over US$55/kg. Asian ferromolybdenum prices touched up to US$96/kg in early February this year. QXR's Anthony molybdenum deposit, which has expansion potential and exploration upside, is hopeful of tapping these lucrative opportunities.

Next steps

QXR is already undertaking metallurgical test work characterising the oxide material. This would establish the Anthony molybdenum project's economics alongside enabling the evaluation of high-grade starter pits. The steps for mining lease applications by QXR would include formal application to the regulator, notifying landholders, addressing of native title requirements, standard environmental authority, and other aspects.