Highlights:

- Platina Resources’ (ASX:PGM) maiden drilling program at the Xanadu project has highlighted the presence of gold mineralisation.

- The gold mineralisation exists at depth and up to 900m of strike on untested ground.

- The company plans to use a diamond drilling rig for the second phase of drilling.

- Phase two drilling and cultural heritage survey are planned in Q2 2023.

Platina Resources Limited (ASX:PGM) has received encouraging gold assays from maiden drilling at its Xanadu project in Western Australia.

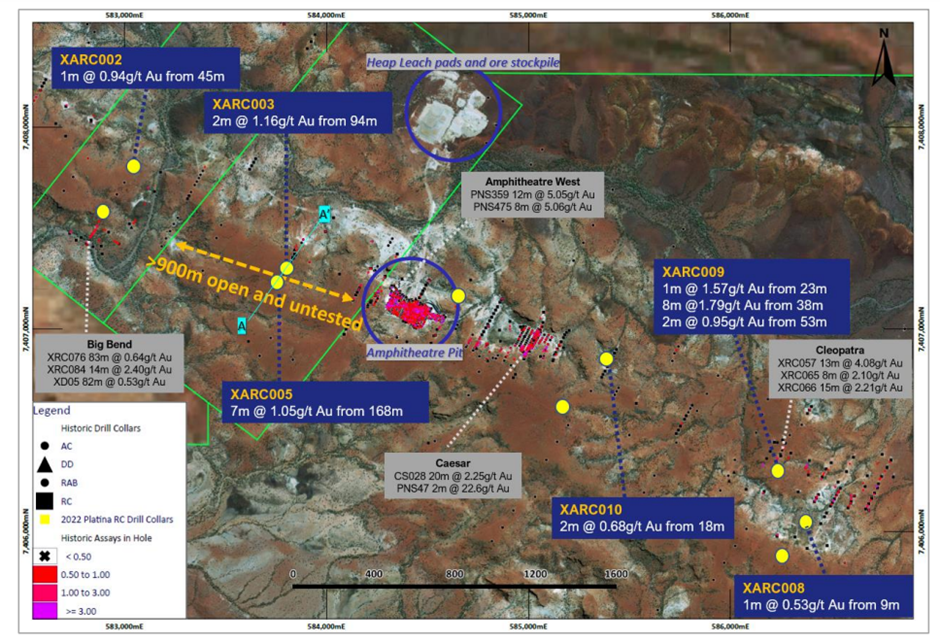

The gold mineralisation exists at depth and up to 900m of strike on untested ground, immediately west of the historical Amphitheatre open pit.

(Source: Company update, 29 November 2022)

Xanadu maiden drilling adds to the knowledge of mineralisation controls

The maiden phase one reverse circulation (RC) drilling at Xanadu covered 2,214m via 11 holes. The widely spaced program focused on a 4km section of the 10km mineralised and altered corridor.

Platina believes that the program has been valuable in identifying various stratigraphic horizons and mineralisation patterns. It has helped enhance the company’s knowledge of mineralisation controls.

Additionally, the company states that the detailed geochemical analysis of the samples will help in future targeting of the drilling.

Encouraging gold assays at Xanadu

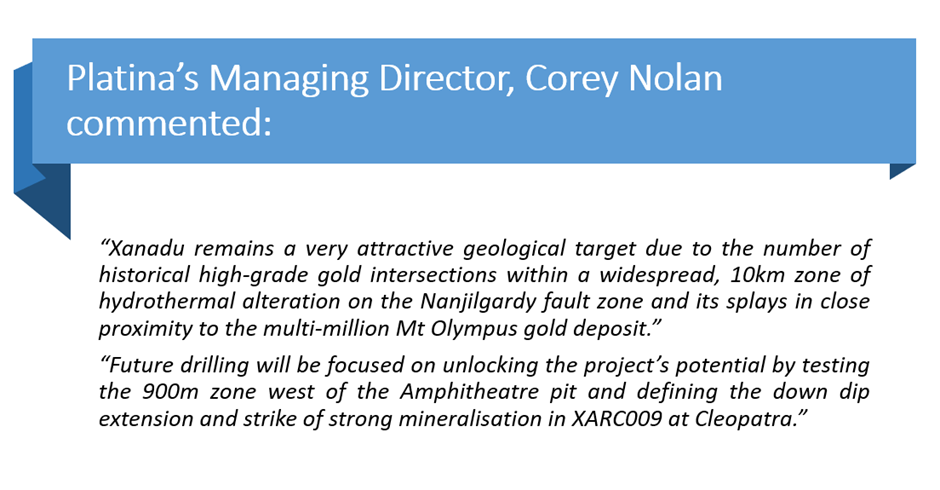

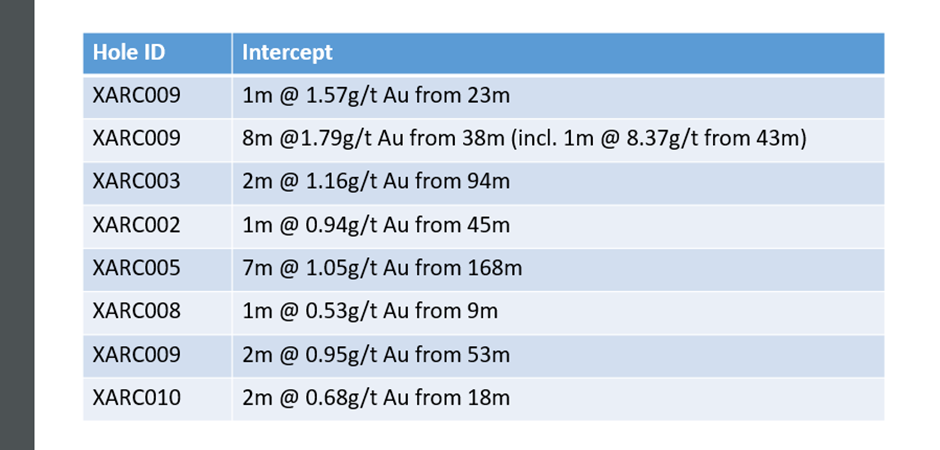

The new results from the phase 1 RC drilling include the following:

(Source: © 2022 Kalkine Media®, data source: Company update, 29 November 2022)

Platina considers the drill results from the section across XARC003 and XARC005 extremely encouraging because of a down-dip trend highlighted by the strong surface expression of historic assays.

A 14m zone of massive sulphides was intercepted in XARC003. In this zone, 14m @ 593ppm arsenic was seen, and just above this zone, from 99-100m, 8.3% copper was also returned.

Platina believes that these assays will assist in future targeting.

Further 120m down dip in XARC005, the company intercepted an aggregate zone of 43m @ 0.36g/t Au from 143m, including a core of 7m @ 1.05g/t Au from 168m. Platina is immensely hopeful for this intersection as it highlights a potential structure feeder and deeper extension of gold mineralisation.

(Source: Company update, 29 November 2022)

PGM plans further drilling and cultural heritage survey in Q1

Platina Resources plans to undertake a geochemistry and structural mapping assessment on areas west of the Amphitheatre pit and east of Cleopatra, followed by the second phase of drilling.

The company intends to deploy a diamond drilling rig for the second phase of drilling to avoid the complications associated with RC drilling. The drilling will aim to define the down dip extension and strike of strong mineralisation in XARC009 at Cleopatra.

PGM also eyes a future diamond drilling program to test the previous chargeability anomalies identified from the Induced polarisation (IP) geophysics survey completed last year.

The company intends to undertake phase two drilling and a cultural heritage survey in the second quarter of 2023.

Furthermore, to initiate the field reconnaissance activities at its Brimstone project (in anticipation of drilling early in 2023) and the Beete project, Platina is currently in discussions around cultural heritage agreements.

Share price action: PGM shares were quoting AU$0.020 in the morning session on 29 November 2022.