Highlights

- MRG Metals (ASX:MRQ) is progressing towards the mine development phase of its Corridor Projects.

- MRQ has commenced an aircore drilling program to test the depth continuity of the Marao tenement’s targets.

- The company has submitted three exploration licence applications, adding rare earth element and uranium projects to its heavy mineral sands portfolio.

- The company is also using TZ Minerals International Pty Ltd’s technical expertise to further understand the marketing potential of concentrates from its Corridor projects.

MRG Metals Limited (ASX:MRQ), an Australia-based heavy mineral sands (HMS) exploration company, recently unveiled its FY22 annual report.

As per MRG, the company possibly holds one of the largest HMS discoveries worldwide in the past ten years – a JORC resource of over 2 billion tons with further upside opportunity from a JORC exploration target.

MRG claims it is pursuing highly prospective exploration opportunities in Mozambique through a dual-speed approach, which includes working on an array of exploration activities at multiple tenements with an eye on mine development in the Corridor Projects.

The Corridor Projects (Corridor Central and Corridor South) also delivered the best 100–200 MT mineral resource estimate (MRE), which is likely to be used for the scoping study that is currently under progress.

MRG carried out multiple augur programs at Corridor throughout the year, obtaining high-grade results, with multiple pits demonstrating MREs that the company feels are conducive for mine start-up operations.

With this backdrop, let us flick through MRG’s FY22 activities.

Corridor Projects: progressing towards the mine development phase

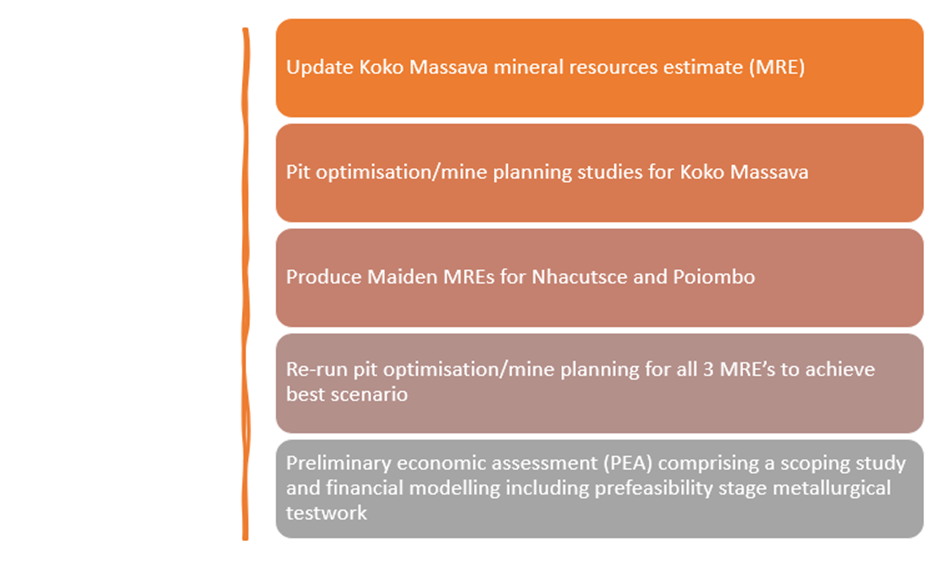

MRG's activities in FY22 were focused on Koko Massava, Nhacutse, and Poimobo targets located within the Corridor Projects. The company kicked off the year by planning activities to progress the projects into their mine development phase. IHC Mining was appointed to chart out a working program, including the scope of work listed below:

Source: © 2022 Kalkine Media®; data source: Company update

The company reported an updated MRE indicating high-grade zones at Koko Massava, Nhacutse, and Poiombo targets.

For detailed insights into Koko Massava's updated MRE, click here.

For a detailed discussion about the MRE at Nhacutse and Poiombo, click here.

Additionally, the company reported 45.3% valuable heavy minerals (VHMs) and 45.9% VHM for Nhacutse and Poiombo, respectively.

The drilling program focused on areas with an amalgamation of better mineralogy (higher VHM%) and high total heavy mineral grades.

MRG commissioned IHC Mining for an engineering scoping study and preliminary economic assessment at the company’s Koko Massava, Nhacutse, and Poiombo deposits, which, the company states, will be augmented by metallurgical and processing test work of a 6.5 t bulk sample from the Koko Massava deposit executed by IHC Mining.

Marao’s aircore drilling program: testing targets’ depth continuity

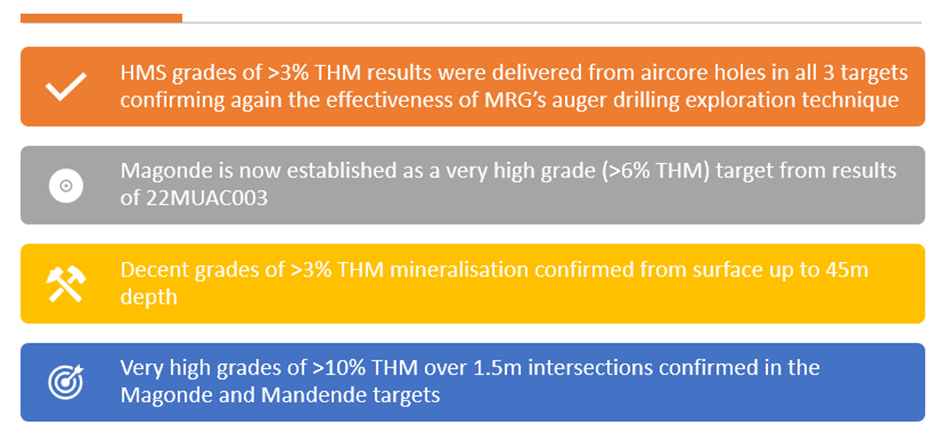

MRG initiated a 10-hole 340.5 m aircore drilling program to test depth continuity at Magonde, Mandende, and Maduacua targets. Fourteen composite samples were collected from the aircore holes drilled into the targets' north, central, and south sections and were sent for mineralogical studies.

The results obtained showed high laboratory grades. Some of the significant ones are as follows:

Source: © 2022 Kalkine Media®; data source: Company update

Diversifying to rare earth elements and uranium assets

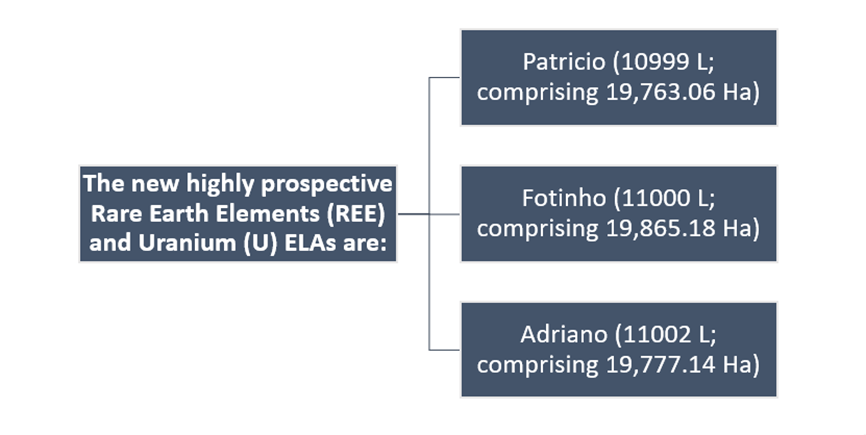

In FY22, MRG expanded into rare earth element (REE) and uranium (U) projects. The company submitted three exploration licence applications (ELAs) over a high-potential REE and U project in the port city of Beira, Mozambique.

Source: © 2022 Kalkine Media®; data source: Company update

Market study of heavy mineral sand portfolio

MRG has roped in TZ Minerals International Pty Ltd (TZMI) to further understand the economic potential of the different product streams in the company's portfolio. The study will be carried out in two phases, primarily focusing on MRG's Corridor Heavy Mineral Sands Project as described below.

Source: © 2022 Kalkine Media®; data source: Company update