Highlights

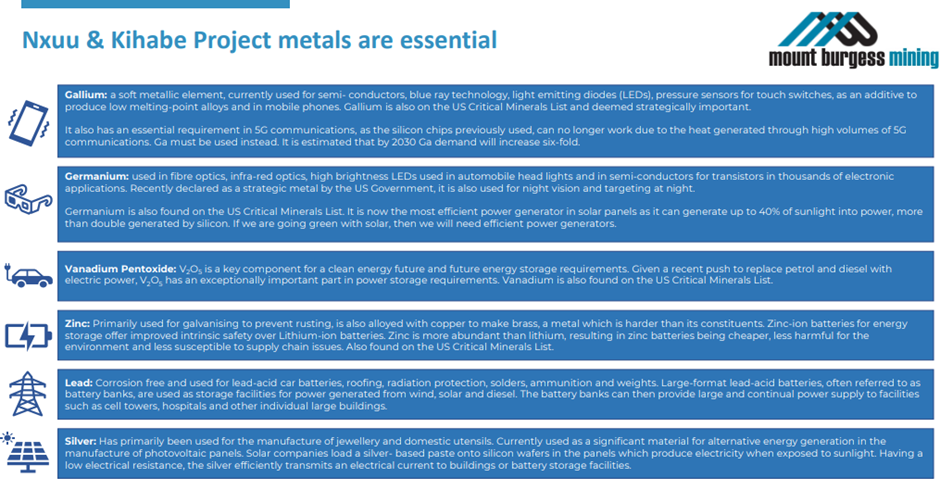

- Mount Burgess (ASX:MTB) has shared an update, announcing some significant test results conducted at its Polymetallic Zn/Pb/Ag/V2O5/Ge/Ga Nxuu Deposit.

- As per the company, ‘Nxuu Deposit presents as a totally oxidized, weathered, shallow basin shaped, low cost, low risk operation, containing Zn/Pb/Ag/V2O5/Ge/Ga mineralisation’.

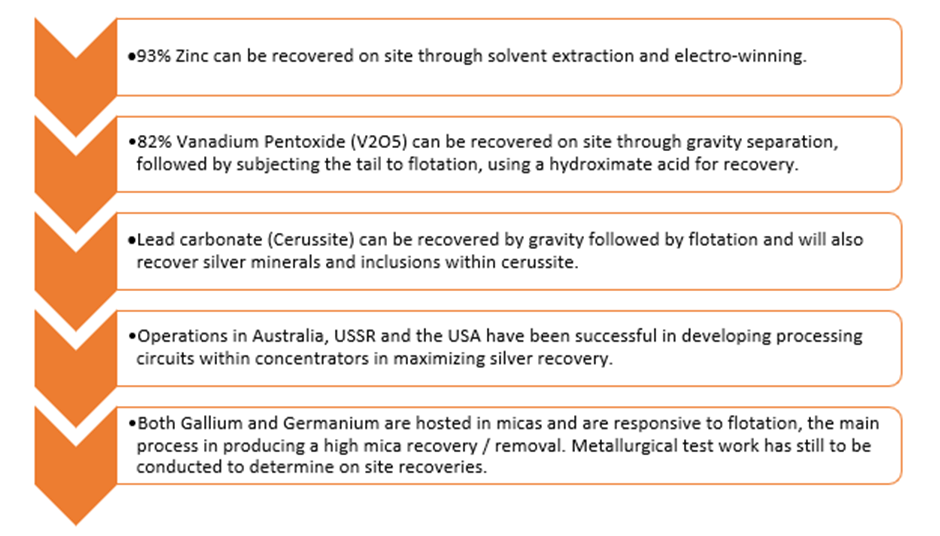

- 93% Zinc can be recovered by way of electro-winning and solvent extraction at the deposit.

Australia-based mineral exploration player Mount Burgess (ASX:MTB) has shared an update relating its Polymetallic Zn/Pb/Ag/V2O5/Ge/Ga Nxuu Deposit. After essential test work at the project site, the company has concluded that ‘Nxuu Deposit presents as a totally oxidized, weathered, shallow basin shaped, low cost, low risk operation, containing Zn/Pb/Ag/V2O5/Ge/Ga mineralisation’.

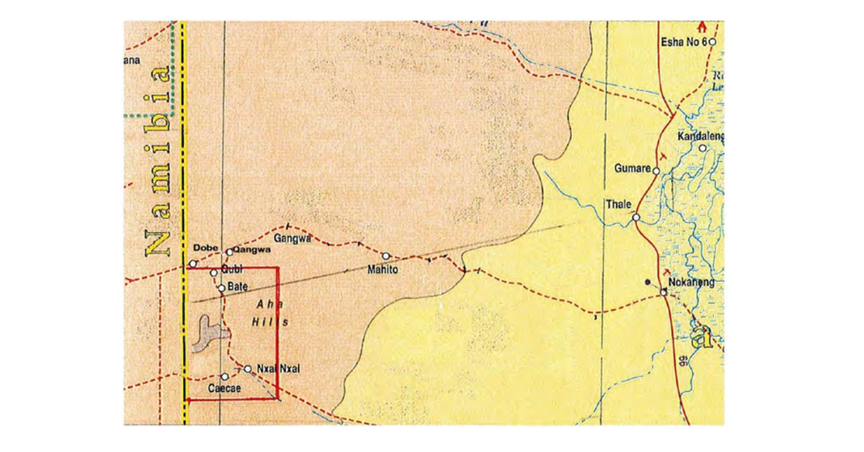

The company continues to forge ahead to achieve the business objectives of exploring and in the event of discovery, develop commercial deposits of mineral resources. Presently, MTB has its focus centered on the development of its 100%-owned polymetallic projects in Botswana.

An insight into the recent test work results:

Data source: MTB update

An overview of MTB’s Nxuu Deposit

The Nxuu Deposit boasts a Mineral Resource of 6 million tonnes estimated @ 1.8% Zinc equivalent grade, with a 0.5% Zinc equivalent low cut, with Zinc, Lead, Silver, Vanadium Pentoxide, Gallium and Germanium.

According to the company, the deposit holds in it the potential to be an open-cut mining operation with 83.4% of the deposit to the base of mineralisation included in the MRE. The remaining 16.6% is made up of 6.9% Kalahari sand cover and 9.7% of low grade or barren quartz wacke.

Since Nxuu mineralisation is present within a totally oxidised quartz wacke, at a barren dolostone basin, potentially Ge/Ga metals as well as Zn/Ag/V2O5 can be produced on site, at ambient temperatures with low acid consumption.

Image source: MTB presentation

MTB shares traded at AU$0.003 on 28 March 2023.