Highlights:

- The LIB recycling industry holds immense potential, as only 10% of Australia's LIB waste was recycled in 2021, as per the government report.

- Lithium Australia’s fully owned subsidiary Envirostream is making serious strides in the battery disposal and recycling space.

- Envirostream has entered several strategic partnership agreements including with Battery World and LG Energy Solution to materialise its battery recycling potential.

- The company has been witnessing continued increases in collection volumes.

Lithium-ion batteries (LIBs), probably the most talked about topic of today's time, can be considered as the heart of new-age gadgets and technologies. They are a level ahead of their traditional counterparts, owing to their higher power density, longer life, and fast charging capacity.

And with electric vehicles (EVs) acting as the flagbearer of greener technologies, industry expects further tailwinds for LIBs in the coming days.

However, all these positive developments are also cumulating to a burning issue related to their disposal.

According to data by the Commonwealth Scientific and Industrial Research Organisation (CSIRO), Australia is responsible for annual production of nearly 3,300 tonnes of LIB waste. CSIRO highlights that this volume could go up to 136,000 tonnes by 2036 as the current annual growth rate of LIB waste production is 20%.

So, how do we address this challenge? The answer is - 95% of the components used in LIBs can be used in new batteries or other industries.

Interestingly, Envirostream Australia Pty Ltd, a 100%-owned subsidiary of Lithium Australia (ASX:LIT), is engaged in providing sustainable solutions for the disposal of end-of-life (EOL) batteries and the recovery of critical energy metals which are used to manufacture new LIBs.

Envirostream -a leader among mixed-battery recycling service providers

Envirostream believes it is well-positioned to gain from the substantial increase in the number of spent batteries because of vehicle electrification and Australia’s national battery stewardship scheme.

The company that has positioned itself among the leaders in Australia’s battery recycling industry has invested to:

(Source: © 2022 Kalkine Media®, data source: LIT update, 31 October 2022)

Envirostream remains committed to increasing recycling volumes, further reducing the number of spent batteries sent to landfill and returning valuable commodities to the market.

The company has inked several partnerships that have led to a substantial increase in battery recycling volumes. Envirostream’s strategic partner list comprises Battery World, LG Energy Solution, Bunnings Warehouse, and Officeworks.

Recycling agreements propelling Envirostream recycling potential

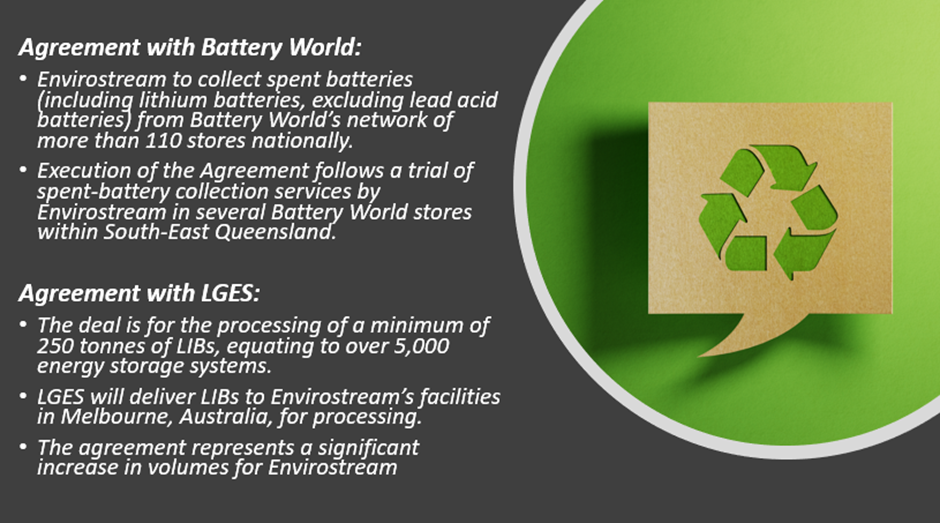

Envirostream has agreements with Battery World Australia Pty Ltd and LG Energy Solution (LGES) that materialise its battery recycling potential.

The major highlights of these agreements are:

(Source: © 2022 Kalkine Media®, data source: LIT update, 31 October 2022)

Govt-backed battery recycling scheme revving up EOL battery collection

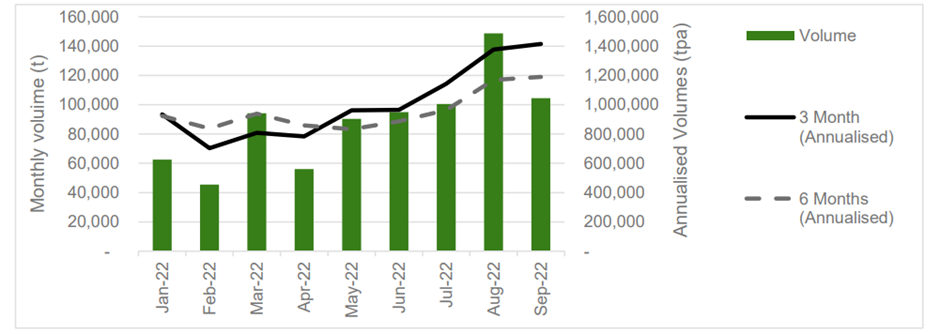

Envirostream has witnessed a substantial increase in the collection of end-of-life (EOL) batteries after the launch of the B-cycle scheme in January 2022. The battery recycling scheme was developed by the Battery Stewardship Council and backed by the Australian government.

The increasing trend is shown in the figure attached below:

(Image source: LIT update, 31 October 2022)

Since the end of FY22, Envirostream has observed continued increases in collection volumes. LIT believes that its subsidiary is at the cutting edge of delivering safe and innovative management solutions to battery disposal and recycling.

LIT shares were trading at AU$0.051 midday on 28 November 2022.