Highlights

- Mineral Commodities (ASX:MRC) is committed to enabling a better world through sustainable and responsible production of critical and industrial minerals and products.

- The Tormin Mineral Sands Operation is one of the world’s highest-grade mineral sands operations in the world.

- Amid the strong sales outlook for electric vehicles, MRC is advancing on its Skaland Graphite Mining Operation and the Munglinup Graphite Project as feed source for its targeted downstream battery anode plants

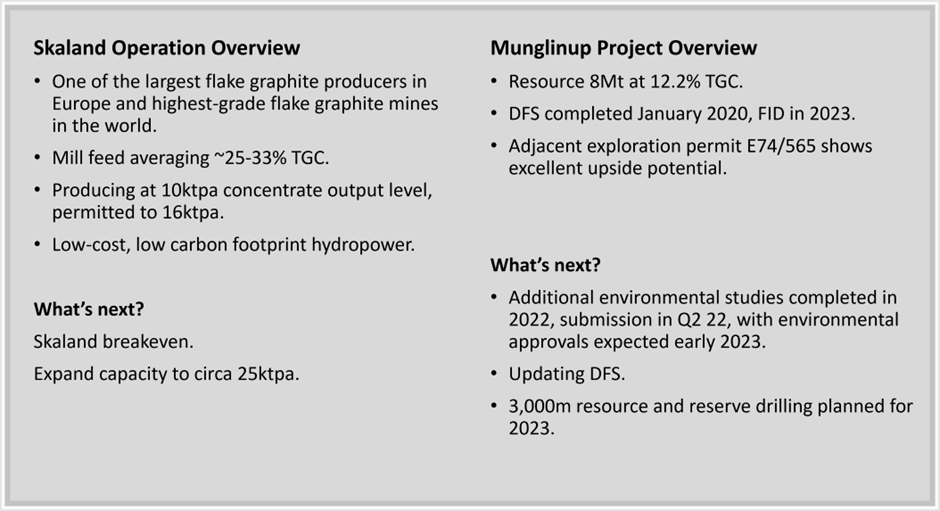

- The Skaland Graphite Mining Operation is one of the world’s highest-grade operating flake graphite mines and is strategically located in Europe.

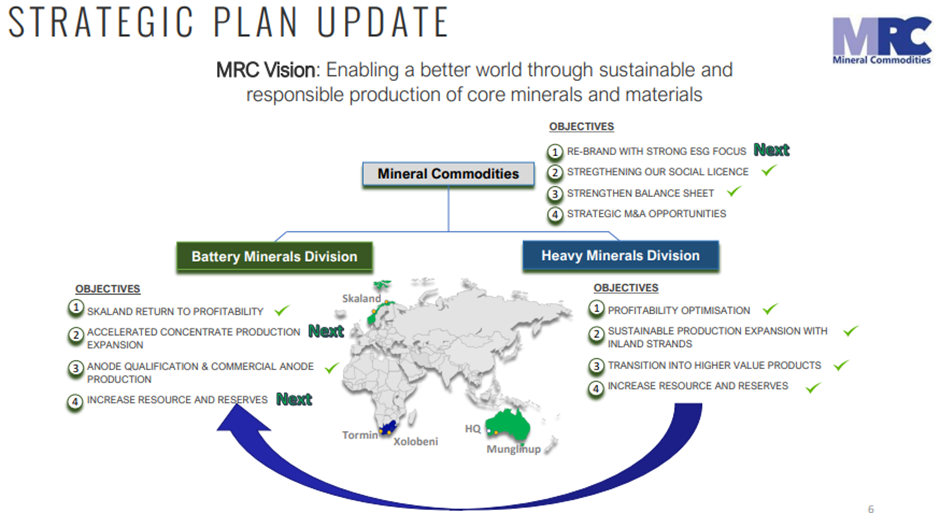

Mineral Commodities’ (ASX:MRC) FiveYear Strategic Plan 2022-2026 (Strategic Plan) aims to return the Company to solid profitability through maximising profitability from existing assets, while expanding its resources and reserves, and presenting a platform to achieve the vision and first goal of becoming a larger diversified, sustainable and responsible critical and industrial minerals producer.

These building blocks are advancing the Company’s second goal of making the Company a sustainable, vertically integrated graphitic anode supplier in Europe, whilst achieving its third goal of becoming a larger sustainable, vertically integrated heavy minerals supplier.

Image source: MRC PPT

Battery minerals division tapping into exciting opportunities

Against the backdrop of the growing popularity of electric vehicles, interest in battery minerals, such as graphite, continues to soar. Analysis by the International Energy Agency forecasts electric vehicle sales to reach 23 million and the total global vehicle fleet to exceed 130 million by 2030. Of all the new vehicle sales, electric vehicles are expected to account for 15% of sales by 2030*.

Graphite, which is used as the primary anode material in EV batteries, is the main mineral component by volume of commercial lithium-ion batteries. Europe, the fastest-growing electric vehicle battery market, currently imports the majority of its anode material from Asia. European battery manufacturers seek environmentally responsible, locally produced anode materials.

MRC believes that it is well positioned to tap into this huge opportunity through production sourced from its Skaland Graphite Mining Operation in Norway and the Munglinup Graphite Project in Western Australia.

The Skaland Graphite Mining Operation has a mineral resource of 1.84 Mt @ 23.6% total graphitic carbon (TGC) and ore reserve of 0.64 Mt @ 24.8% TGC with contained graphite of 0.43 Mt. The Munglinup Graphite Project has a mineral resource of 7.99 Mt @ 12.2% TGC and ore reserve of 4.24 Mt @ 12.8% TGC with contained graphite of 0.97 Mt.

The Company is also advancing its exploration portfolio across its Bukken, Hesten, and Vardfjellet assets in Norway and from the Munglinup exploration licence E74/565 in Western Australia.

Source: © 2022 Kalkine Media®; data source: company’s update

Heavy minerals division – An established cash-generative business

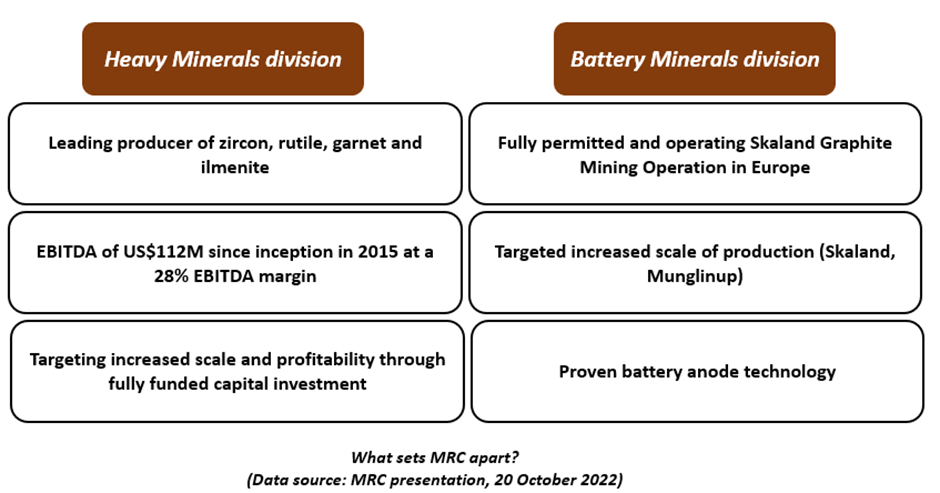

MRC’s heavy minerals division is a leading producer of zircon, rutile, garnet, and ilmenite.

The Tormin Heavy Minerals Operation in the Western Cape, South Africa is an established cash generative operation that has delivered profitability since inception, with an average revenue of US$50M pa and EBITDA of US$14M pa, respectively.

MRC believes that the operations have immense resource growth potential. The Company is in process of commissioning the Inland Strands operations to operate in conjunction with production from the existing Tormin and Northern Beaches mining areas. The Tormin and Northern Beaches are replenishable placer beach deposits, meaning that they are able to be mined multiple times. Since commencement of operations at the Tormin Beaches, the Company has mined in excess of 17 million tonnes. The tonnage mined is more than the original declared resource tonnage (2.70 million tonnes), which is indicative of the significant replenishing nature of these placer beach deposits where resource blocks are mined more than once per year.

Image source: Company’s update

The Company plans to increase annual production by undertaking advanced studies, exploration and permitting activities. It has planned drilling operations before 2022 year end for the recently granted De Punt prospecting permit to the south of Tormin and plans to expand and extend its Inland Strands resources and reserves.

The Company remains fully funded for the development of a mineral separation plant. MRC is eyeing a transition for Tormin from lower-value concentrate to a higher-value final product,. The Company initially plans to supply finished garnet product to the GMA Group and recently signed an MOU offtake agreement. This, combined with targeting increased production through a proposed capital investment in a third primary concentration plant at Tormin, aims at improving cash flow and profitability.

The Tormin Mineral Sands Operation has a mineral resource of 216.2 Mt @ 9.16% total heavy mineral (THM) and 19.8 Mt in situ THM. The Xolobeni Mineral Sands Project in Eastern Cape, South Africa, has a mineral resource of 346 Mt @ 5% THM and 17.3 Mt in situ THM.

In essence, MRC is focused on delivering critical and industrial minerals essential to modern-day living and the transition to a sustainable world.

MRC shares traded at AU$0.078 on 25 October 2022.

*IEA analysis developed with the IEA Mobility Model (IEA, 2019a)