Highlights

- King River Resources has shared a conceptual development plan for its wholly owned Speewah Vanadium Project in Western Australia.

- The company has outlined an open-cut mining operation scaled at 5Mtpa of feed to an on-site processing plant to produce a high-grade magnetite concentrate.

- KRR plans to export the concentrate to produce vanadium pentoxide, titanium dioxide and iron co-products.

King River Resources Limited (ASX:KRR) has been consistent in advancing its 100%-owned Speewah Vanadium Project, Australia’s largest vanadium-in-magnetite deposit in terms of tonnes and V2O5 content.

In the latest development, KRR has drafted a conceptual development plan for a potentially long mine life, supported by the large deposit size of Speewah.

The company is also a participant in the Future Battery Industries Cooperative Research Centre (FBI-CRC) Vanadium Redox Flow Batteries (VRFB) Project.

With the development of its Speewah project, KRR is targeting the expansion of its specialty metals focus to become a high purity vanadium pentoxide and titanium dioxide producer.

The company intends to tap opportunities in the vanadium flow battery energy storage, Al-Ti-V super alloy and TiO2 pigment markets.

Read more about King River Resources’ projects

Open-cut mining at Speewah Vanadium Project

Located in the Kimberley region of Western Australia, the Speewah deposit comprises a Measured, Indicated and Inferred Mineral Resource of 4,712 million tonnes at 0.3% V2O5, 3.3% TiO2 and 14.7% Fe (reported at a 0.23% V2O5 cut-off grade from the Central, Buckman and Red Hill deposits).

The ASX-listed firm’s conceptual development plan is an open-cut mining operation on the Central Vanadium deposit, which outcrops, is fresh rock from near the surface and has shallow dipping geometry with a low strip ratio of 0.4.

The operation is scaled at 5Mtpa of feed to an on-site processing plant, aiming production of a high-grade magnetite concentrate for export. The exported concentrates could then be refined overseas by salt and reduction roast methodology to target V2O5, TiO2 and iron co-products.

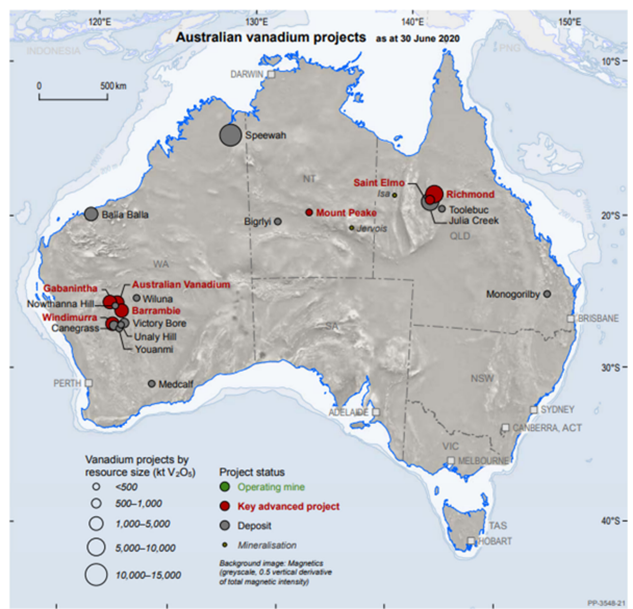

Vanadium deposits in Australia, including KRR’s very-large Speewah deposit

(Source: Australian Critical Minerals Prospectus 2020, Geoscience Australia, page 152)

An outline of the process

As per the conceptual development plan, a high-grade vanadium-bearing magnetite concentrate will be produced from the high grade (HG) zone of the Central Vanadium deposit. This will be done through crushing, grinding and magnetic separation.

Also, a magnetite concentrate with grades of 2.15-2.64% V2O5 will be produced using the beneficiation process. Notably, the grades are higher than other Australian vanadium deposits. It is mainly because of very high V concentration in the magnetite crystal that reduces gradually upwards in the deposit. As a result, a smaller mass of concentrate could be processed to deliver the targeted V2O5 product.

The low insitu grade of 0.3-0.4% V2O5 and the disseminated nature of the mineralisation (ranging from 10% to 19% titanomagnetite and ilmenite) leads to a relatively low mass yield of around 13% into a magnetite concentrate. Thus, a greater mass of disseminated magnetite gabbro feed is required to be beneficiated to produce a magnetite concentrate. Staged crushing-grinding and magnetic separation optimisation tests on drill core samples are in process for generating a magnetite concentrate of high V grade, low in contaminants, and higher mass yield and vanadium deportment.

Tests underway for optimised process flow sheet

Murdoch University Hydrometallurgy Research Group is carrying out metallurgical investigations for developing an optimised process flow sheet for producing high purity V2O5, TiO2 and iron metal. This is being done using trialing oxidative and reductive roast techniques, such as the use of hydrogen as a reductant.

During the already completed salt roast tests, the company has got vanadium extractions of up to 92% from high-grade vanadium bearing magnetite concentrate.

Further testwork is underway for trialling mixed salts, salt dosage optimisation, and V2O5 product precipitation via ammonium metavanadate (AMV) process.

KRR shares were trading at AU$0.014 midday on 23 September 2022.