Highlights

- Jindalee Resources has reported that it received excellent shallow intercepts from holes MDD022 and MDD023 at the McDermitt Project.

- JRL has concluded 21 holes out of the 28 planned holes under the drilling program, with drilling currently paused.

- The drilling program is intended to boost confidence in the Inferred Mineral Resource and translate it to Indicated status.

In its latest key update, Jindalee Resources Limited (ASX:JRL) has reported the assay results from holes MDD022 and MDD023, which were part of the drilling at its 100% owned McDermitt Lithium Project. This project is located in SE Oregon, USA.

The 2022 drilling program comprises a total of 28 approved holes and is aimed at infilling and extending the recently announced Mineral Resource Estimate (MRE) for the project. The MRE currently stands at 1.82 Bt @ 1,370 ppm lithium for 13.3 Mt LCE (lithium carbonate equivalent) at 1,000 ppm Li cut-off.

Impressive intercepts from drilling

JRL had finalised 10 diamond holes at McDermitt, as reported by the company on 23 August 2022. Subsequently, JRL declared significant intercepts from two diamond holes, MDD020 and MDD021, on 19 September 2022.

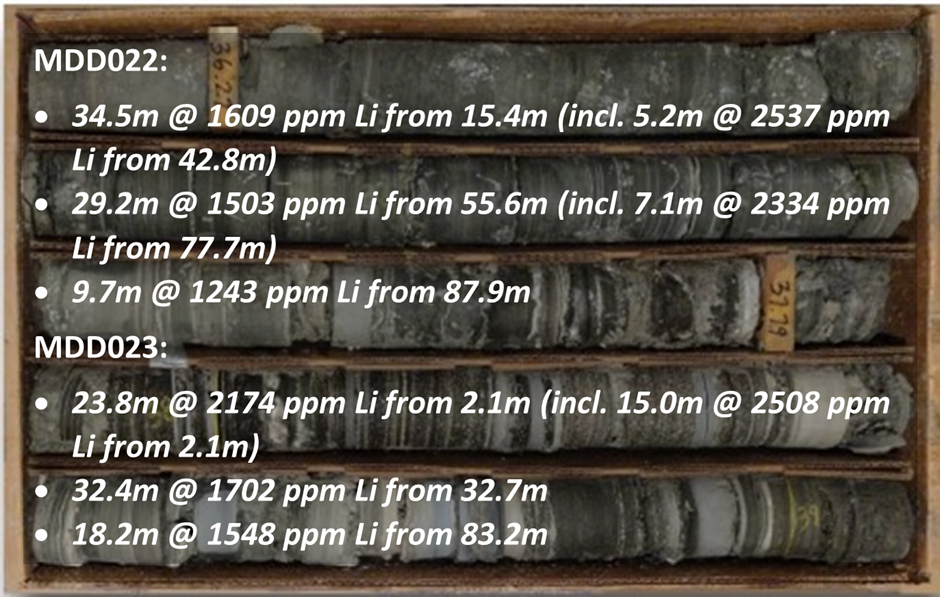

The significant intercepts delivered as part of the current results include the following –

© 2022 Kalkine Media® | Data Source: JRL | Image Source: JRL

The company has now finalised 21 holes, including 10 diamond and 11 reverse circulation, at McDermitt. Drilling has been paused to enable the drill sites for the 21 holes completed to date to be rehabilitated. JRL has already received results from holes MDD020 to MDD023, and results from the remaining completed holes are yet to be received.

Plan going forward

JRL remains confident that the present drilling program will help in further increasing confidence in the Inferred Mineral Resource and convert it to Indicated status, as well as determining the extent of lithium mineralisation across this lithium asset.

Moving forward, JRL anticipates a steady flow of assay results through to December and looks forward to announcing further results as soon as they become available.

JRL shares were trading at AU$2.310 midday on 26 October 2022.