Highlights

- Monger Gold (ASX:MMG) seeks to change its name to Loyal Lithium Limited amid an increasing focus on lithium exploration.

- The proposed name aligns with the company’s transition to a lithium-led battery minerals and technology company.

- MMG has expedited the exploration and development of its lithium asset portfolio, which includes all lithium resource types.

Monger Gold Limited (ASX:MMG) is making serious strides to achieve its goal of becoming a major lithium supplier to the battery metals industry in North America.

Last month, the company announced its intention to change its name to Loyal Lithium Limited (ASX:LLI) in light of the transition to a lithium-led battery minerals and technology company. This pivotal transition of MMG is backed by recent project acquisitions in North America as well as the strengthening of its leadership team.

Recently, MMG acquired a project in Nevada, USA and exercised an option to acquire another project in Quebec, Canada. Besides this, the company has appointed Mr Adam Ritchie as its new CEO, who is a highly experienced lithium and development professional.

MMG seeks shareholder approval for name change

Monger looks to secure shareholder approval at an upcoming EGM for the name change. Moreover, the current ASX code is planned to be changed from MMG to LLI once the proposed name is approved.

The upcoming EGM is slated to be held in October 2022.

Image Source: ©2022 Kalkine Media® | Data Source: MMG Announcement

Based on the strategic review of the exploration results, MMG had also shared its intention in late August 2022 to consider opportunities to divest or joint venture its gold assets.

The company believes that the fundamentals in the lithium market are expected to remain strong in the coming years. This is coupled with the anticipated increase in demand for lithium due to consumer and legislative shifts towards electric vehicles and the electrification of energy grids globally.

Recent work across lithium projects

Monger is also looking to expedite the exploration and development of its lithium asset portfolio, which includes all lithium resource types.

The projects in MMG’s lithium asset portfolio are all located within Tier 1 mining jurisdictions, including the following:

- Hard Rock - Brisk Lithium Project (Québec, Canada)

- Brine and Sediment - Scotty Lithium Project (Nevada, USA)

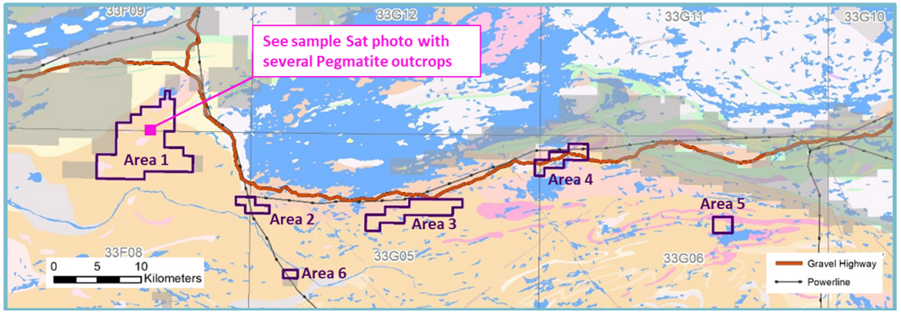

The Brisk Lithium Project with six prospects covering 98.5km2 is host to several known pegmatite outcrops. The company’s in-country geo partner, DG Resource Management, holds a unique perspective on mineral exploration, leading to several grass roots discoveries across multiple commodities.

The company conducted a maiden exploration program across the Brisk Lithium Project in late-September 2022. This maiden program consisted of helicopter-supported surface exploration, prospecting and geochemical sampling.

Areas and location of sample sat photo of location at Brisk Lithium Project (Source: MMG Announcement)

The Scotty Lithium Project is located adjacent to one of North America’s largest lithium deposits. The company has recently wrapped up an extensive auger soil sampling program at the project.

Monger remains optimistic about the advancement of its highly prospective assets and the shift to a lithium-led battery minerals and technology company. The company looks to establish a team of industry professionals and like-minded partners to achieve its objectives.

MMG shares traded at AU$0.400 on 12 October 2022.