Highlights

- Cooper Metals Limited (ASX:CPM) has announced the results for FY22 with details of ground exploration activities conducted at its projects.

- During the year, CPM intersected significant copper-gold (Cu-Au) mineralisation at its flagship Mount Isa East Copper-Gold Project.

- Highly encouraging shallow Cu-Au mineralisation was intersected at the King Solomon prospect after CPM completed the maiden reverse circulation drilling program in FY22.

Australia -based mineral exploration company Cooper Metals Limited (ASX:CPM) has released its annual report for FY22 with details of ground exploration activities conducted at its flagship Mt Isa East Copper-Gold Project in Queensland. The company made a significant discovery of copper-gold (Cu-Au) mineralisation at its flagship project during the year, post its listing on the ASX in November 2021. Notably, major progress was also made at the company’s other project sites.

Cooper is developing a pipeline of quality Cu-Au targets. Recently, CPM concluded a large detailed versatile time domain electromagnetic (VTEM) survey over a large part of its tenure that led to the identification of many conductors. It is in the process of ground truthing and working up to drill testing these conductors.

Image Source: Company presentation

Below we enumerate the key activities undertaken and results obtained by Cooper across projects in FY22. Have a look!

Mt Isa East Copper-Gold Project

Spread over nearly 1,575 sq. km of tenure, the Mt Isa East Copper-Gold Project includes several historical copper-gold workings and prospects that have been identified for immediate follow-up exploration. The priority areas have been identified on the basis of historical exploration results as well as conceptual targeting of favourable host lithologies and structures that have the potential to host key Cu-Au mineralisation, such as iron oxide copper gold, iron sulphide copper gold (ISCG), and shear-hosted Cu-Au mineralisation.

Recently, Carnaby Resources Ltd (ASX:CNB) made Cu-Au discoveries at the Nil Desperandum and Lady Fanny prospects, which lie in close proximity to the south of Coopers existing tenure.

At the King Solomon prospect, major shallow Cu-Au mineralisation was intersected as CPM completed the maiden reverse circulation (RC) drilling program during the financial year. Later, an induced polarisation (IP) survey mapped out mineralisation at the site and identified new targets for drill testing along strike, downdip, and adjacent to known Cu-Au mineralisation.

In addition, CPM completed a large detailed VTEM identifying multiple anomalies prospective for ISCG deposits.

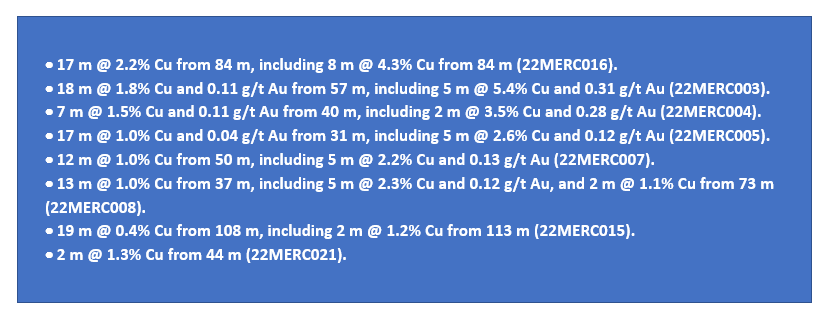

RC drilling results for King Solomon

At the King Solomon Prospect, several old (artisanal) copper workings strike over 1.2 km in a larger mineralised corridor stretching for around 1.5 km within the lower Corella Formation. Historical mining focused on copper oxide and native copper from three main locations along the strike, King Solomon 1, 2, and 3.Cooper completed 21 holes for 1,665 m of RC drilling at the King Solomon prospect in FY22, drilling under historical workings and testing the higher-amplitude FLEM responses along the 1.2 km long mineralised trend.

King Solomon 1 RC drilling results and IP survey

In total 12 RC drill holes were drilled at variable spacing along a NNW-trending strike ~80 m apart, with infill to a depth of 25 m along the strike. In eight of the drill holes, the RC drilling intersected significant shallow copper mineralisation, including:

King Solomon 2 and 3 IP and RC drilling results

Mineralised outcropping rocks disappear under cover at the southern end of King Solomon 1 and reappear some 260 m to the SSE at King Solomon 2. Mineralised outcrops and scattered workings extend for around 400 m at King Solomon 2 and 3. The largest pit is at King Solomon 3, which is ~60 m long by 10 m wide and 15 m deep.

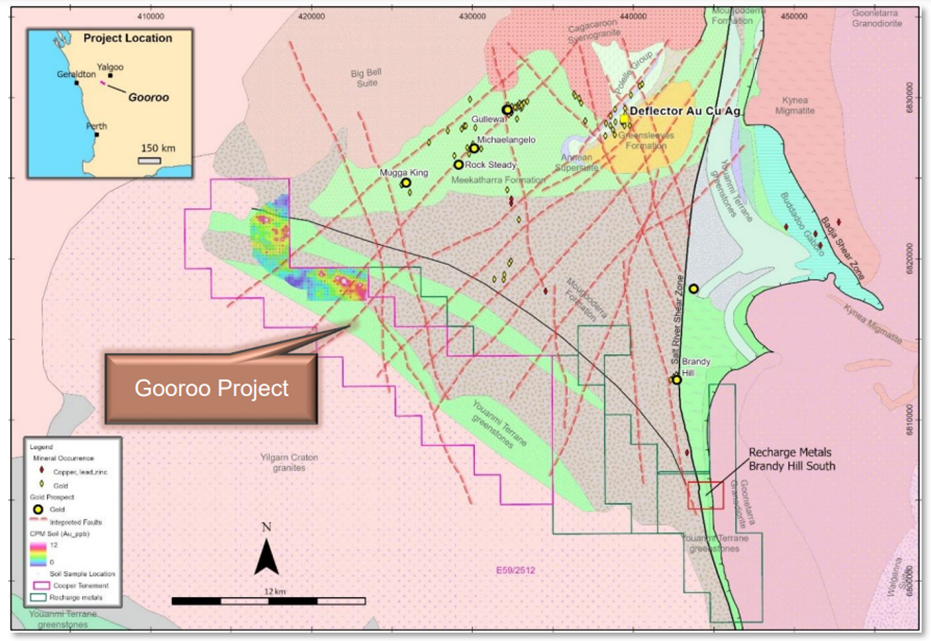

Gooroo Copper-Gold Project, Western Australia

Image Source: Company announcement

Regional soil sampling results on simplified geology (GSWA 2020)

Situated around 413 km northeast of Perth, the Gooroo Copper-Gold Project is adjacent to the Silver Lake Resources Limited (ASX:SLR) Deflector mine and explorer Recharge Metals Ltd’s (ASX:REC) recently discovered major copper mineralisation at the Brandy Hill South Project.

During the financial year, Cooper declared the results of a regional soil sampling program (200 m by 200 m sampling grid) with prime focus on an area of outcropping to thinly covered greenstones in the less explored southern limb of the Gullewa syncline in the northwestern portion of the project area. Assays for the infill samples are pending and follow-up exploration has been planned for the next financial year.

The outlook for the year ahead

Cooper Metals expects FY23 to be busy for the company as it intends to grow its focus on its flagship Mt Isa East Copper-Gold Project. The company in its annual report stated that the field programs have been designed to develop and analyse the quality Cu-Au targets, for creating substantial shareholder wealth via identification of significant gold and copper.

Share price performance during FY22

The share price of CPM has almost doubled since the company’s initial public offer and was trading above 40 cents for most of the first half of 2022. On 12 October 2022, CPM shares were trading at AU$0.325 with a market capitalisation of AU$14.84 million.