Highlights

- Haranga Resources (ASX:HAR FRA:65E0) is advancing two-stage maiden diamond drilling at the Saraya uranium project in Senegal

- The program aims to test and validate the prospect’s exploration target as established by the review of historical uranium exploration results

- The review has revealed significant equivalent uranium intersections that were not part of any previously reported historical drilling results

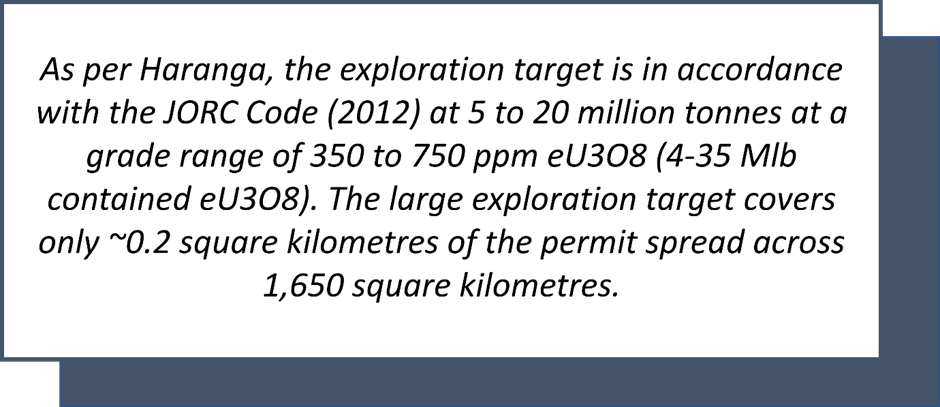

- The Exploration Target stands at 5-20 million tonnes at a grade range of 350-750 ppm eU3O8 (4-35 Mlb contained Eu3o8)

- The project has witnessed historical drilling of approximately 61,500 metres

Haranga Resources Limited (ASX:HAR FRA:65E0), an ASX-listed uranium and gold-focused company, is currently involved in a two-stage maiden diamond drilling campaign at its Saraya Uranium project in Senegal.

This 23-hole, 3,200m drilling program is aimed at validating geological interpretation and verifying historical eU grades while enabling sampling for chemical assays to validate the K-factors used in historical resource estimation.

Data source: HAR update

Historical drill database review indicates significant equivalent uranium intersections

The Saraya Project is believed to hold a strong uranium prospectivity, as indicated by a technical review of historical exploration results.

The review of historical drill database by company consultants, RSC Global Pty Ltd, revealed significant equivalent uranium intersections that were not part of any previously reported historical drilling. It included the following intervals:

- Hole ID SAR327: An interval of 47.8 metres @ 1,630 ppm eU and 1,922 ppm eU3O8 from 72.4 metres onwards.

- Hole ID SAR30: An interval of 46.2 metres @ 1,548 ppm eU and 1,825 ppm eU3O8 from 42.2 meters onwards.

- Hole ID SAR183: An interval of 10.1 metres @ 5,537 ppm eU and 6,528 ppm eU3O8 from 27.7 meters onwards (including a 4.6- metre interval @ 8,669 ppm eU and 10,221 ppm eU3O8 from 28.1 meters onwards).

- Hole ID SARA1007: An interval of 13.3 metres @ 1,194 ppm eU and 1,408 ppm eU3O8 from 88.2 m onwards (including an interval of 7 m @ 1,843 ppm eU and 2,173 ppm eU3O8 from 92.6 meters onwards).

- Hole ID SARA1003: An interval of 37.7 metres @ 797 ppm eU and 940 ppm eU3O8 from 81.2 m onwards (including a 9.1-meter interval @ 1,160 ppm eU and 1,368 ppm eU3O8 from 84.5 meters onwards).

Meanwhile, the Company is flexible with extending its drilling campaign beyond the planned 3,200m. The aim will be to continue to expand on the known mineralisation at the Saraya prospect and/or to test any new targets identified.

Way ahead

Haranga expects receipt of all drill results between November 2022 and January 2023. The next goal will be the exploration target conversion into a maiden mineral resource classified in line with the JORC Code (2012). The Company intends to finalise the conversion by April 2023.

Meanwhile, the Company is waiting for outcomes from a termite mound sampling program carried out on a regional scale. With this sampling, the Company expects to determine the potential for additional targets and trends across its project permit, which covers an area of 1,650 square kilometres. The development is expected to support the Company in boosting any potential resource defined, said Haranga Non-Executive Chairman Michael Davy.

Haranga believes vast opportunities exist for its advanced uranium exploration project as the world prepares for the transition to clean energy.

Data source: HAR update, 29 July 2022

HAR shares were trading at AU$0.140 apiece midday on 24 November 2022.