Highlights

- First Au has announced its progress report for the September quarter including a placement raising AU$900,000 before costs.

- The results from diamond drilling at Dogwood Project showed extensive copper mineralisation.

- FAU started a systematic and geophysical review of its Mabel Creek project.

- The ASX-listed firm has declared positive results from metallurgical testwork at the Gimlet project.

Gold and base metals exploration company First Au Limited (ASX:FAU) recently released its quarterly activities report for the three months ended 30 September 2022. The ASX-listed firm advanced the pace of activities at its Victorian Gold projects during the quarter to achieve its business goals.

FAU is engaged in exploration across its projects including

- Victorian Goldfields Project in East Gippsland

- Gimlet Gold project near Kalgoorlie

- Mabel Creek Project in South Australia

Keep reading to know about all the major developments and activities undertaken at the firm’s major projects across regions during the quarter.

Drilling hits extensive copper mineralisation at Dogwood Project

During the quarter, FAU declared the initial assay results of a maiden diamond drilling program at the Dogwood Porphyry Copper Gold project. The results from two holes showed wide mineralisation zones with a maximum copper grade of more than 0.8% and gold of 5.62 g/t.

- Hole 1 - 72.7m zone of broadly disseminated Cu mineralisation from 41m to 113.7m

- Hole 3 - a 32m zone of broadly disseminated Cu mineralisation from 180.1m to 212.1m

Moreover, drilling intersected high-grade results of 0.5m @ 0.807% copper from 100.7m in hole 1 and 0.3m @ 0.262% Cu, 5.62 g/t Au and 9.3 g/t Ag from 210.8m in hole 3.

With maiden drilling at the project, the company has introduced a variety of geological units that have never been mapped in this region earlier. To establish the relevance, relationship, and timing of these units within the district, further work is needed.

The results of further assays are yet to be declared.

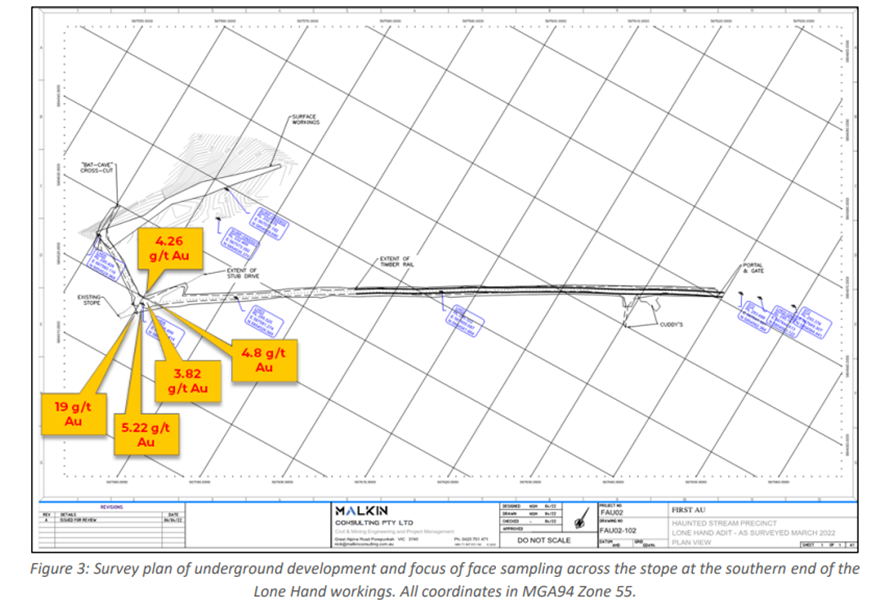

Haunted Stream Project indicates potential for high-grade gold mineralisation

The quarter saw results from a focused face-sampling and surface sampling program in conjunction with structural mapping across underground development at Haunted Stream to refine its drill targets.

Gold assays up to 135g/t Au from Screen Fire Assaying have been yielded from high-grade face samples of the Ernestine and Lone Hand underground drives and open pits. The company is counting them as highly encouraging in supporting the pursuit of testing the depth potential of the system down plunge and beyond the historic shallow mining depths (~100m depth). Also, sampling has produced assays up to 19 g/t Au.

Data source: FAU update

The ongoing underground rehabilitation at Haunted Stream is expected to allow the company to drill from optimal locations and offer an opportunity to hit identified targets. FAU is expecting the work to complete in the last quarter of 2022.

FAU proposes underground bulk sampling at Snowstorm Project

FAU is looking forward to the next stage of exploration at its Snowstorm project, including a bulk sampling program. Previously, two drill programs at the project site have yielded consisted results. Using drill intersections, preliminary polygonal mineralised 3D blocks have been defined along the targeted shear zone which were worked previously within the adit.

The quarter saw FAU advancing on its application for the proposed bulk sample program. It has reached the final stages of collecting the relevant data and reports that are needed to submit its work plan to Earth Resources and Regulation.

The underground bulk sampling program is expected to deliver a better understanding of the geological controls, framework, and metallurgical characteristics of the ore. This will help in having a better evaluation of the project’s economic potential.

During the quarter, FAU also announced sampling results – returning gold assays up to 74.54 g/t Au - from a sub-cropping quartz-sulphide reef taken during the previous drill.

Studies indicate high-priority targets at Mabel Creek Project

The company began a further systematic and geophysical review of its Mabel Creek project, South Australia, during the September quarter. Additionally, the company commenced an XRF multi-element program on drill cuttings present in the South Australia core library.

FAU geologists have identified drillholes in the South Australian Core Library, for which scanning is underway by XRF (x-ray fluorescence) for pathfinder elements. The initial results have been highly encouraging for FAU geologists who are now evaluating and assessing the potential for IOCG & other style deposits at the Mabel Creek project site.

A series of high-priority targets were highlighted in the new studies which will be further assessed and evaluated by FAU geologists.

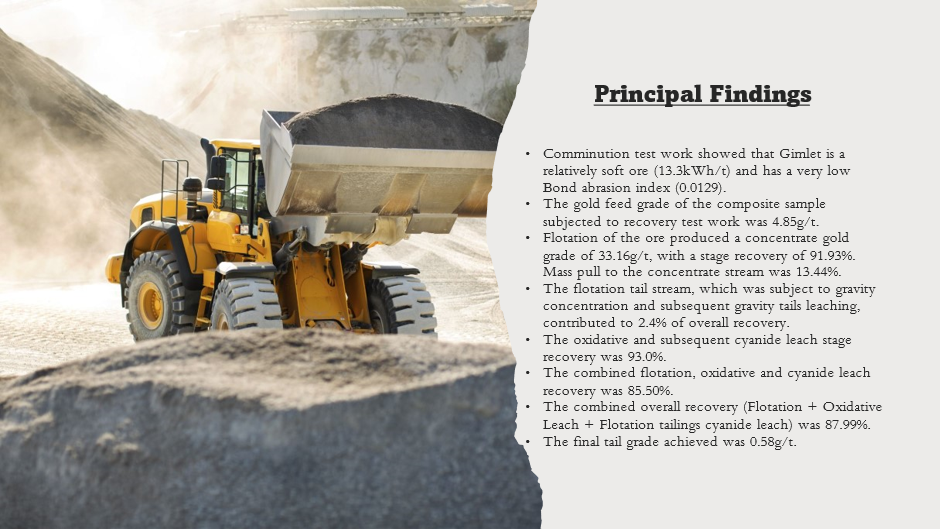

Positive outcomes from metallurgical testwork at Gimlet Gold Project

Positive results were announced from the metallurgical test work during the quarter. This work was being undertaken on the Gimlet project to demonstrate high recovery rates from the treatment and processing of gold bearing materials from Gimlet.

The testing that has been completed to date has demonstrated gold recovery rates of 87.99%.

Data source: FAU update

East Pilbara – Talga Project and Tambina Project

The company revealed in September month that it has satisfied all conditions precedent for the Talga Joint Venture and Farm-in agreement with Octava Minerals Limited. Following which, Octava began trading on the Australian Securities Exchange on 16 September 2022.

Upon commencement of the agreement, FAU maintains a free carried interest in the Talga project. Moreover, the company has no commitments towards expenses, enabling retaining upside to any exploration success at the project.

Stock information: FAU shares last traded at AU$0.004 apiece on 1 November 2022.