Highlights

- Copper plays a prominent role in connecting and delivering to the world a clean and efficient energy.

- Globally, refined copper use is forecast to grow 3.7% to 26 million tonnes in 2023 and to 27 million tonnes in 2024, as per a government report.

- Cyprium Metals is growing its strength in the industry with its strategy of developing major copper projects in Australia.

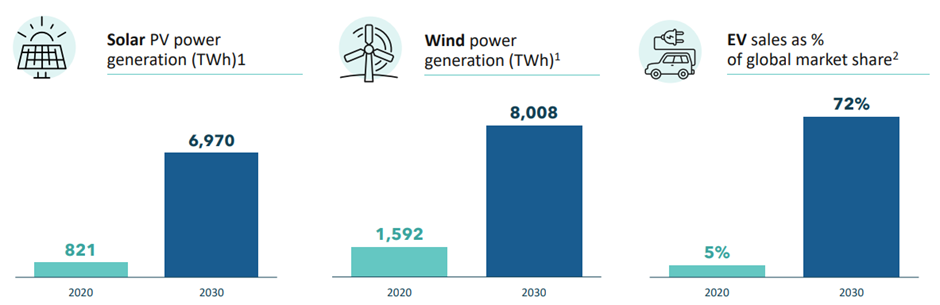

One of the world’s most versatile and useful metals, copper is a critical material finding application in heat exchange, power generation, and electricity transmission. The highly conductive properties make copper a critical material for energy storage, wind and solar technology, as well as electric vehicles.

Copper plays a prominent role in connecting and providing clean and efficient energy to the world.

Mineral-intensive wind, solar, and the associated battery technologies use several base and niche metals, entailing copper use that is approximately 4-6 times more than fossil fuels. Copper is utilised in a range of products, such as building construction, infrastructure, electronic devices, manufacturing, transport, electrical wiring, and plumbing, health, and consumer products.

Use of Cu in solar, wind and EV production

Image Source: Company Announcement

The blooming market of the versatile metal has brought with it a hoard of opportunities for the industry players to grow and prosper with the growing demand. Among several copper-focused exploration company, we have Cyprium Metals Limited (ASX:CYM), which is growing its strength in this industry with its strategy of developing major copper projects in Australia.

Global copper mine production and end use segment

Due to energy transition and modernisation, refined copper use is forecast to grow 3.7% to 26 million tonnes in 2023 and to 27 million tonnes in 2024, as per the Department of Industry, Science, Energy and Resources, Commonwealth of Australia Resources and Energy Quarterly September 2022.

Electric vehicles (EVs) and battery storage technologies have increased briskly in the last 10 years, taking EV sales to 6.8 million units in the year 2021, more than double the number of sales in the previous year, as per the report.

The report highlights that global mine production is expected to reach 22 million tonnes in 2022, representing a year-on-year increase of 5.4%. The report projects this figure to hit 23 million tonnes in 2023 and 24 million tonnes in 2024.

Cyprium Metals’ Australian projects in upbeat copper market

Established in June 2019, Cyprium Metals (ASX:CYM) has a rich copper portfolio including the Nifty copper project, Paterson exploration project, Murchison copper project, and the Maroochydore copper project.

The company highlights that in Australia, Nifty is placed at the sixth position in copper development project by copper metal and the highest grade of the top group, while Maroochydore is at the eighth rank.

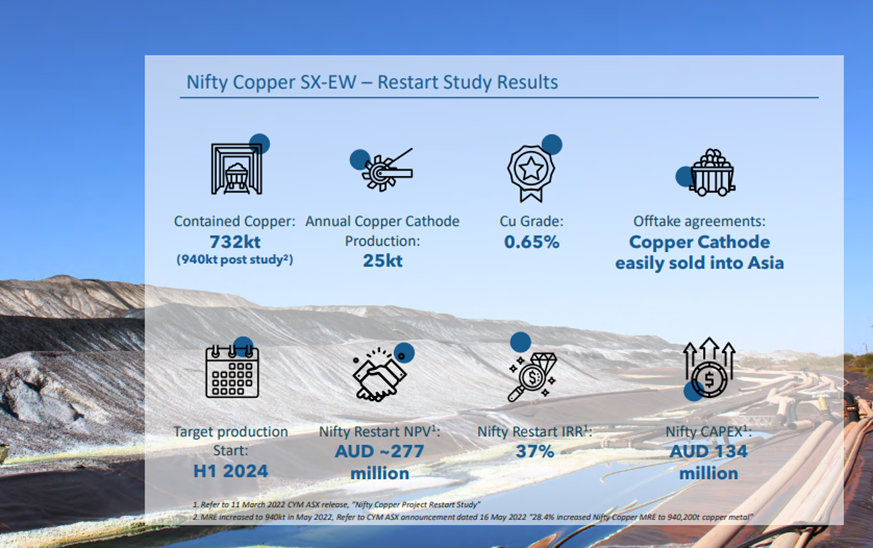

- Nifty Copper Mine

Initially, Nifty was as an open pit, oxide heap leach SX-EW operation; however, oxide open pit was suspended later.

Cyprium plans to restart the open pit oxide mine and re-treat the existing heap leach pads in the first stage of the commencement of Nifty. The second stage would focus on the development of the open pit into the sulphide portion of the orebody for mine life of more than two decades.

Image Source: Company Announcement

The mineral resource endowment at Nifty has witnessed an increase of nearly 40%, and the west and east of the orebody has not closed off as of now. The revised mineral resource estimates will be mentioned in Phase 1 of the Nifty Restart Project optimisation. This development will bring in more copper tonnes, mine life as well as cashflow, says the company.

The company is currently in advanced discussions with debt financiers, aimed at finalising the finance process for the restart of the operation.

- Maroochydore Copper Project

The company has completed metallurgical test work for diamond drilling at the Maroochydore Copper Project. There is a substantial shallow oxide and sulphide mineral resource of ~480,000 tonnes of copper. Mineralisation remains open along strike >3km and down-dip.

Mineralogy of Maroochydore is similar to that of Nifty. This is because it is based in the shales of the Broadhurst Formation.

- Murchison Copper Project

A resource development opportunity, the Murchison Copper Project includes complementary deposits, Hollandaire and Nanadie Well. The encouraging drilling outcomes from Nanadie Well is likely to be part of maiden Mineral Resource Estimate as per JORC 2012. This estimate would then be a part of the scoping study on the project.

The Hollandaire Mineral Resource (JORC 2012) stands at 2.8Mt @ 1.9% copper contained metal of 51.5kt of copper, 28Koz gold and 0.5Moz silver. The Nanadie Well Mineral Resource (JORC 2012) is 40.4Mt @ 0.4% copper contained metal of 162kt of copper, 130Koz gold and 1.4Moz silver.

Broad anomalous zones copper–nickel-PGE mineralisation 1.6km north of the Nanadie Well resource was identified during the most recent RC drilling assays. To know more about this development, read here.

Also, at the Cue project, Cyprium’s joint venture with Musgrave Minerals Limited (ASX:MGV), the company recently reported encouraging RC drilling results.

CYM shares traded at AU$0.089 on 29 November 2022.