Highlights

- Manganese is essential to the steel industry and a critical battery mineral, with strong growth forecast.

- Black Canyon is a manganese explorer seeking exposure to the growing battery market with its manganese-focused strategy.

- The company is focused on a downstream strategy to produce HPMSM to facilitate diversification of supply supporting the value-add strategy.

- At BCA’s Flanagan Bore project, there are higher grade zones across LR1 and FB3 comprising 40 Mt @ 13% Mn which is positive for resource optimisation, processing, and mining scenarios.

- BCA is looking forward to continuing its significant exploration programs across the projects in 2023.

The twelfth most abundant element in the Earth's crust, manganese (Mn) is the fourth most consumed metal in the world in terms of tonnage with 20Mt tonnes mined every year. Notably, nearly 90% of Mn in a year is consumed as an alloying agent in making steel.

Besides, manganese is used in the cathodes of Li-ion batteries, in association with lithium, cobalt and nickel that supply rechargeable electric vehicles (EVs).

Till date, there has been no relevant alternative for manganese that is relatively cost-effective as well as offers numerous technical benefits, like the ability to combine with sulphur and a powerful de-oxidation capacity in the production of high quality steel.

Significantly, it has been classified as a critical mineral by numerous countries, such as the United States of America, Australia, Japan and Canada.

Australia-based manganese explorer Black Canyon Limited (ASX: BCA) is forging ahead with its manganese-focused strategy to discover and develop manganese mines and downstream processing to produce high-purity manganese sulphate monohydrate (HPMSM) for battery precursor material.

The company highlights its huge exploration footprint to become the dominant ASX-listed manganese-focused explorer/developer in the Pilbara region with nine tenements totalling 2400km2.

Most recent development: HPMSM Variability Study

Black Canyon has wrapped up manganese concentrate leaching and crystallisation testwork as part of an overall strategy to deliver HPMSM for the booming electric vehicle battery market.

As per initial leach tests, there was an extraction rate of 91% from which high-grade manganese sulphate crystals having 32.3% Mn were produced. These figures are equivalent to > 99% manganese sulphate purity.

According to the Company, this is highly comparable to the typical 32.2% Mn content of battery grade HPMSM. However, more purification testwork is needed to bring down elemental impurities. The Company has planned to conduct a Scoping Study on HPMSM during Q2-Q3 2023.

Under an expanded HPMSM Strategy Black Canyon has decided to conduct variability testwork across various manganese oxide targets to understand the amenability of variable feedstock inputs into a HPMSM flowsheet. The company is aiming at manganese oxide targets that show potentially higher insitu grades, variable impurity levels and proximity to infrastructure.

Under the expanded HPMSM strategy, the Company is looking forward for an opportunity to examine a simple, low-CAPEX small footprint mining facility with mining/stockpiling on a campaign basis to supply a manganese oxide feedstock to a HPMSM facility located elsewhere.

Image source: BCA update

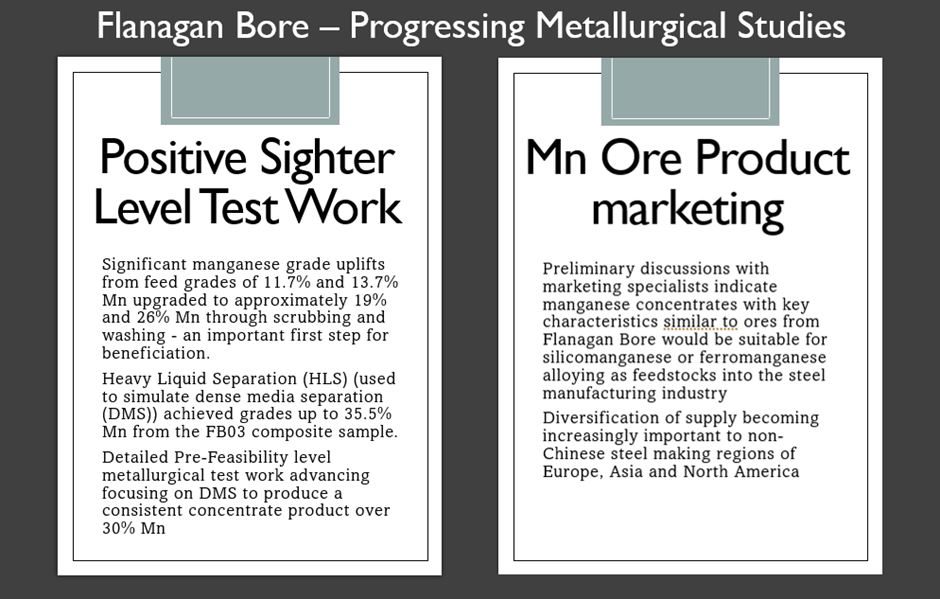

Flanagan Bore project developments

Under a joint venture with Carawine Resources (ASX:CWX), Black Canyon holds eight granted tenements across four project areas spanning over 793km2 in the east Pilbara region.

A part of the JV, the Flanagan Bore Project with 171Mt @ 10.3% Mn for 17.7Mt of contained Mn is the lead project of the Company since its listing. The Company has reported a large-scale, high-quality Measured and Indicated Mineral Resource (JORC) from surface with outcropping higher-grade zones that show impressive geological and grade continuity. Also, there are higher grade zone across LR1 and FB3 comprising 40 Mt @ 13% Mn which is positive for resource optimisation, processing and mining scenarios.

The Company has also completed a positive Scoping Study on the project economics of Flanagan Bore Detailed discussion available here.

BCA shares traded at AU$0.24 on 22 February 2023.