Highlights:

- Arcadia has received assay results for the first hole at Madube Pan, with lithium grades similar to that of the holes drilled at Eden Pan.

- The company expects the current JORC Mineral Resource defined over Eden Lithium Pan, which is of 286,909t Li2CO3 (LCE), to increase from Madube drilling.

- The clay units hit thus far at Madube Pan are 44% thicker than those intersected at Eden Pan.

- The company plans further nine drill holes on a 500m grid over Madube Pan, with drilling expected to be completed in December 2022.

Arcadia Minerals Ltd (ASX:AM7) has announced assay results for the first hole drilled at Madube Pan. The results highlight grades similar to those of Eden Pan, where a lithium JORC Mineral Resource was previously defined. The Madube Pan is one of 14 exposed pans situated at the Bitterwasser lithium-in-clay project.

The exploration company with a diverse portfolio has a host of projects focused on tantalum, lithium (clays and brines), copper, nickel and gold in Namibia.

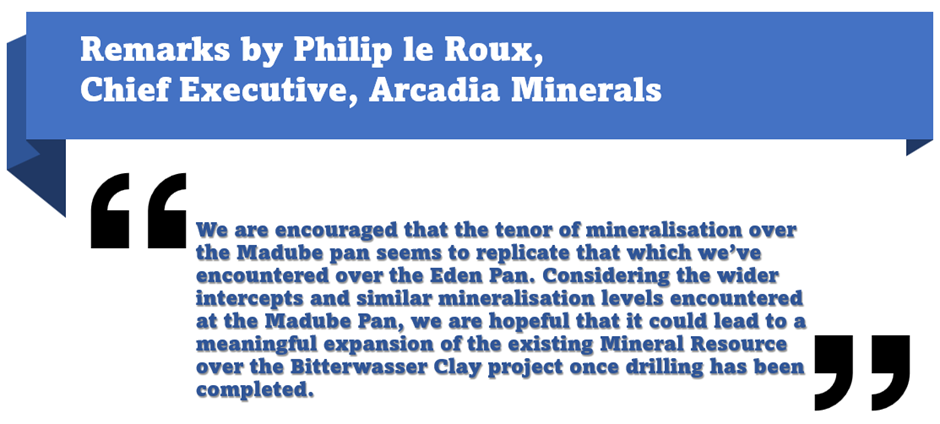

Commenting on the latest development, AM7 CEO Philip le Roux said:

© 2022 Kalkine Media®, data source: Company update dated 22 November 2022

Lithium grades at Madube Pan: similar to those of Eden Pan with 44% more thickness

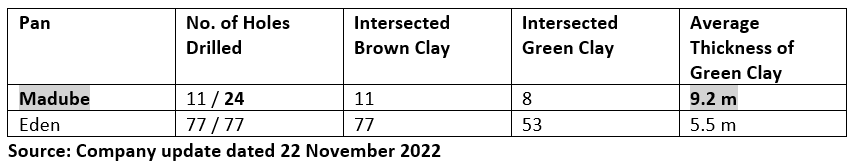

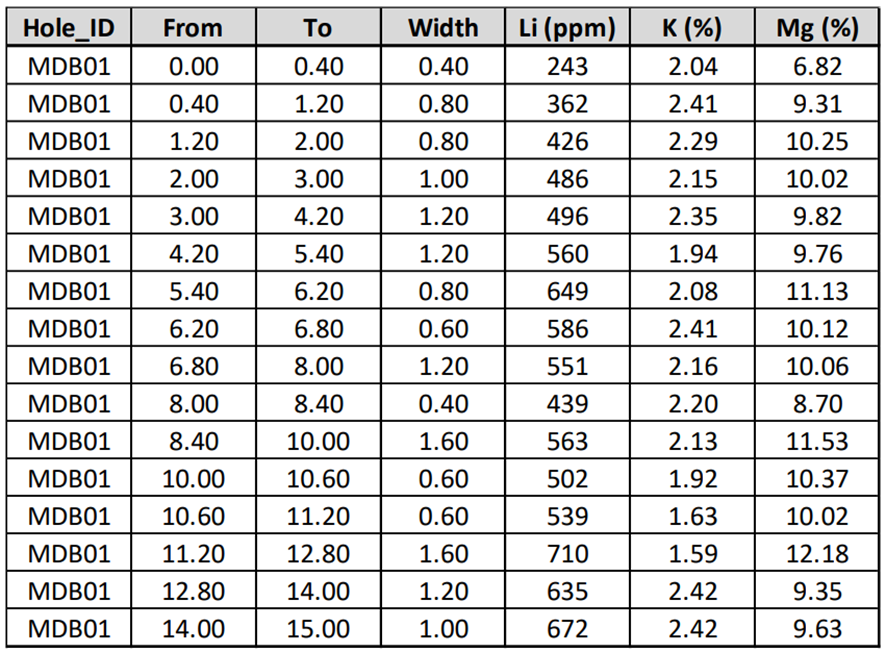

The assay results have come for the first hole drilled at Madube Pan, MDB01. The results indicate that the grades within the green clay units intersected are similar to those at Eden Pan.

Past drilling over Eden Pan resulted in an Inferred JORC Mineral Resource for the green clays of 85.2 million tons at 633 ppm Li for 286,909 ton lithium carbonate (Li2CO3) using a 500 ppm Li cut-off.

Using a similar cut-off at Madube Pan too, a 9.6m mineralised intersection with an average grade of 605 ppm Li was resulted from drill hole MDB01.

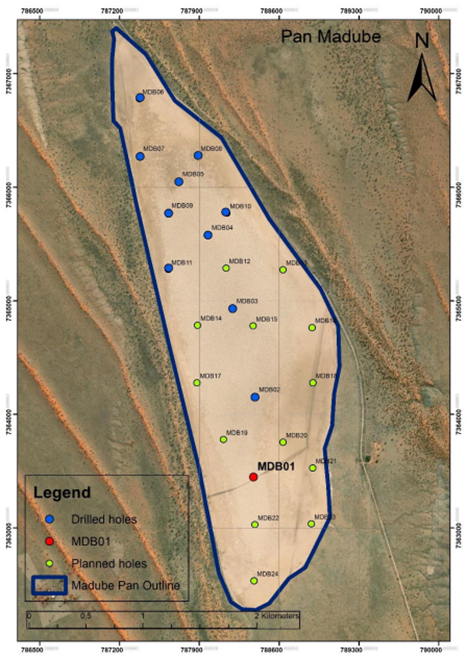

Out of the total of eleven drill holes (MDB01 - MDB11), eight intersected the green mineralised clay unit. It is to be noted that the holes that did not intersect the green clay unit were drilled on the pan’s edge.

The company says that the green clay unit is located in the centre of the pan, as was in the case with Eden Lithium Pan.

Holes drilled and planned at Madube Pan (Source: Company update dated 22 November 2022)

Thicker green units than Eden Pan: Upon analysing the thickness of the clay units from the 8 holes drilled at Madube Pan thus far, it is suggested that the green clay unit is 44% thicker than those of Eden Pan.

Out of the earlier planned 15 auger holes over Madube Pan (of which the pan is 517 hectares in extent), 11 have been drilled thus far.

AM7 doubles down at Madube Pan with increased number of holes

Upon confirming lithium mineralisation at Madube Pan, the company has now ramped up the planned drill program from the earlier 15 to now 24 holes.

Assay results pertaining to hole MDB01:

Source: Company update dated 22 November 2022

The way ahead - Additional drill holes and resource update

The drilling at Madube Pan is expected to be completed by the month of December 2022, with assay results expected by the first quarter of 2023 followed by an updated resource statement by the second quarter.

AM7 shares traded at AU$0.255 on 24 November 2022.