Highlights

- Allup started FY22 with a successful listing on the ASX in May.

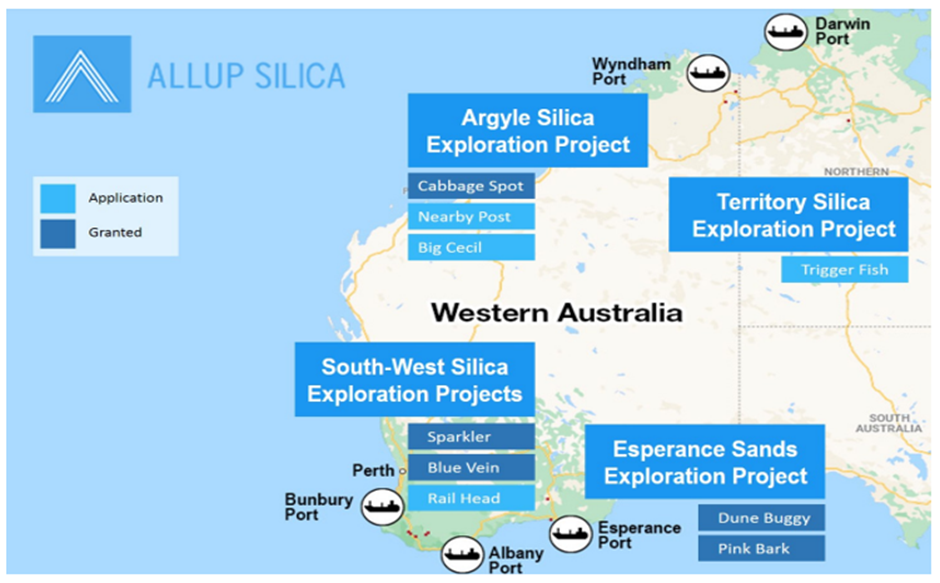

- The company has a diversified portfolio of exploration assets.

- The Sparkler Silica Sand Project delivered excellent metallurgical results with high-purity SiO2

- For the Sparkler Silica Sand Project, the company completed updated JORC Inferred MRE with 37 million tonnes (0.106mm-0.6mm).

- Allup has applied for new tenements to expand its project portfolio.

ASX-listed silica sand exploration firm Allup Silica (ASX:APS) witnessed a busy period throughout FY22, after a successful listing on the ASX in May 2022.

The company is committed to becoming a first-class global supplier of high-purity silica sands with the development of its diversified portfolio of exploration assets. The recently released annual report for the financial year 2022 too resonates a similar dynamism.

During the reported period, the company commenced exploration programs at several of its key West Australian based tenements. Moreover, subsequent to the end of the financial year, APS applied for new tenements to expand its project portfolio.

Image source: APS update

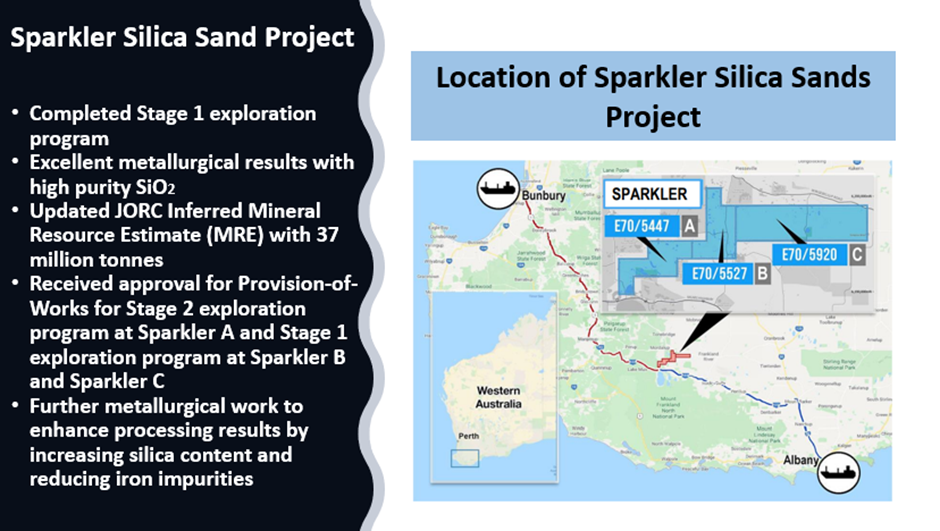

Exploration at Sparkler Project advancing well

The Sparkler Silica Sand Exploration Project covers three granted exploration licences E70/5447 (Sparkler A), E70/5527 (Sparkler B) and E70/5920 (Sparkler C). The project is located nearby the Albany Port and has access to well-established infrastructure.

As of now, the project has witnessed surface sampling and an initial drill program. Moreover, the initial chemical analysis and metallurgical studies have been completed.

Key highlights from the independent, JORC compliant Inferred Minerals Resource Estimate for the Sparkler A Project are:

- 37 million inferred tonnes at 99.66% SiO2 and 0.02% (200 ppm) Fe2O3 in sand fraction (0.106mm – 0.6mm). (Note: 0.106mm – 0.6mm suitable for high quality glass manufacturing).

- 25 million inferred tonnes at 99.67% SiO2 and 0.03% (300 ppm) Fe2O3 in coarse sand fraction (+ 0.6mm).

The Sparkler Silica Sand Project Data and image source: APS update

Allup makes headway at Pink Bark, Cabbage Spot and Dune Buggy projects

During the reported period, the company remained focused on activities related to the permitting and approvals required for the future exploration of these silica sand projects.

Pink Bark Silica Sand Project

- Received encouraging results from initial surface samples.

- Identified 6 km strike length with nearly 29 sq. km target area.

- Received approval for provision-of-works stage 1 exploration program.

Dune Buggy Silica Sand Project

- Submitted heritage impact assessment notice.

- Submitted provision of works for stage 1 exploration program.

- Undertaking test work to study potential processing techniques for the type of sand found at the sites.

Cabbage Spot Silica Sand Project

- Submitted heritage impact assessment notice.

- Received approval for provision of works for stage 1 exploration program.

Allup eyes expanded project portfolio with new tenements

Subsequent to the financial year, the company made an application and was subsequently granted tenement EL 70/6170 located in the South-Western region of Western Australia.

Moreover, the company has applied for tenement ELA 70/6208 located in the South-Western region of Western Australia and tenement ELA 33298 located in the Northern Territory.

For further details, read here

Commercial strategy of the company

Allup’s commercial strategy is based on the investigation of multiple project areas having their own logistics and port options. Currently, the company has projects close to four Western Australian port locations: Bunbury, Wyndham, Esperance, and Albany. A further port location is also available at Darwin in the Northern Territory. Allup believes the strategy will help it in the following ways.

- Risk reduction:

If effective, this model of many projects/several ports has the potential to lower the risks related to the myriad variables and regulatory permissions necessary to move from exploration to commercial production.

- Scaling up using several projects:

The company believes that another benefit the many projects/several ports strategy will provide is the opportunity to scale up production by having several operations in different project areas, with each area having access to its own logistics and ports, which would allow the company to sell more to its customers.

- Project variability:

Every project location for the company is unique and depends on a distinct form of transportation. The unique dynamics of an individual project eventually define whether it is economically viable or appealing.

Words from Allup Chairman Andrew Haythorpe

There is a highly encouraging demand for technology-focused minerals such as silica. This year, the Government of Australia has included silica in its list of critical minerals. Many leading economies have started recognising silica as an essential mineral for current and future technologies. The mineral is used to manufacture fibre optics, solar panels, mobile phones, tablet glass screens, etc. However, the supply outlook of this mineral remains constrained.

“Hence, the board of Allup see the importance of advancing our key silica projects towards development,” said Allup Executive Chairman Andrew Haythorpe.

APS shares were trading at AU$0.099 midday on 12 October 2022, up 10% from the last close.