Highlights

- Invictus Energy has released its report for the March 2023 quarter.

- The preparations for the Mukuyu-2 appraisal well and Phase 2 exploration program at Cabora Bassa is underway.

- IVZ has started the process of tendering for some long leads and services for the Mukuyu-2 well.

- During the quarter, the company signed a contract amendment with Exalo Drilling S.A for Rig 202 for 12 months.

- The appraisal well will be drilled using the Exalo Rig 202, which has been warm stacked at the Mukuyu-1 wellsite.

- Invictus successfully raised AU$10 million upon successful completion of a AU$10 million placement to sophisticated and institutional investors.

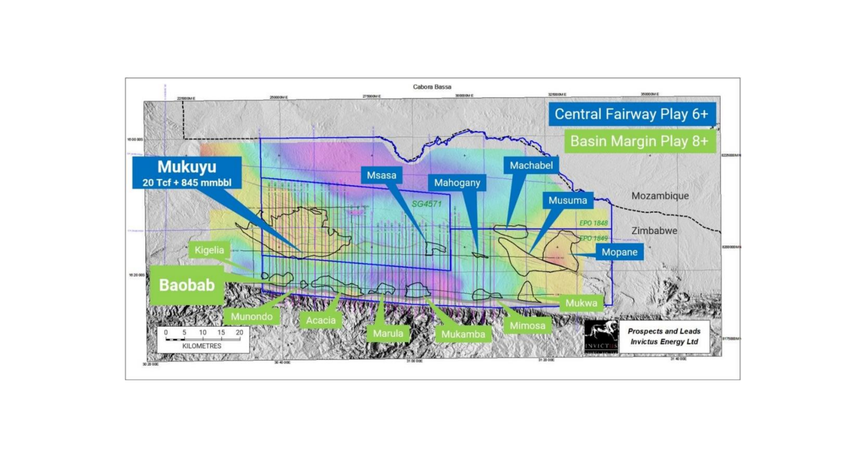

Invictus Energy Limited (ASX:IVZ) continues to make progress as it works towards its mission of opening one of the last untested large frontier rift basins in onshore Africa – the Cabora Bassa Basin – in northern Zimbabwe through a high impact exploration programme.

In its recently released report for the three-month period ended 31 March 2023, the Company has listed out the key updates relating to the project. Have a read!

Updates on Mukuyu-2 appraisal well

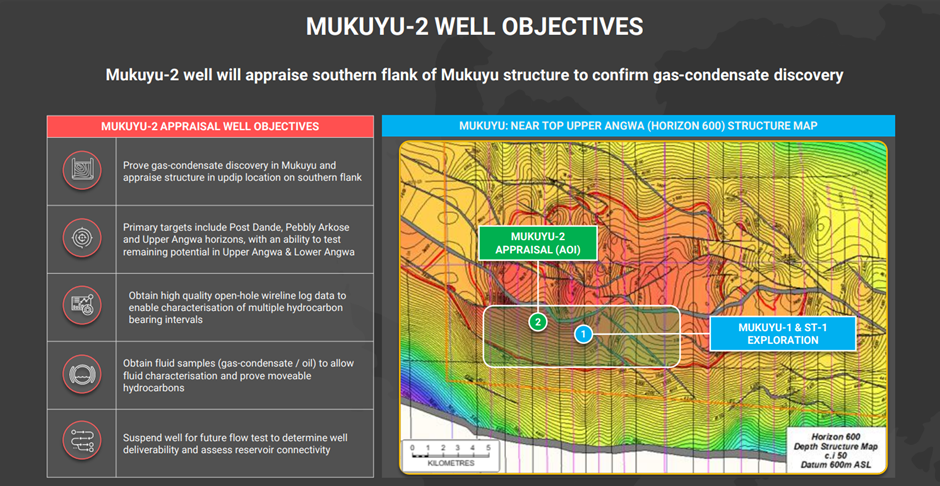

The Company is moving ahead with its preparations for the Mukuyu-2 appraisal well and the second phase of the exploration program at Cabora Bassa.

During the quarter, Invictus initiated the process of tendering for some long leads as well as services for the Mukuyu-2 well. The Company is expecting to spud in the third quarter of the year (Q3 CY2023).

Multiple hydrocarbon bearing intervals found in the Mukuyu-1/ST1 well in the Upper Angwa and Pebbly Arkose formations will be targeted by the Mukuyu-2 well. It’s done with the main purpose of confirming a gas-condensate discovery.

The additional prospectivity in the deeper Upper Angwa and undrilled Lower Angwa that did not get penetrated in the Mukuyu-1/ST1 program, will also be tested by Mukuyu-2. The Company believes this will offer further upside potential. Mukuyu-2 will also test the Post Dande horizon away from the major eastwest fault on the southern flank.

Image source: Company presentation

The design of Mukuyu-2 will allow for flow testing to confirm reservoir deliverability and connectivity following a successful discovery. The appraisal well will be drilled using the Exalo Rig 202, which remained warm stacked at the Mukuyu-1 wellsite following the completion of operations at the start of the quarter.

The Mukuyu-2 has been designed in a way that will allow for flow testing, confirming reservoir deliverability and connectivity following a successful discovery.

The Exalo Rig 202 will be used to drill the appraisal well. During the quarter, the Company inked a contract amendment with Exalo Drilling S.A for Rig 202 to be present in the basin for another year.

Before mobilisation to the Mukuyu-2 wellsite to commence drilling, certain activities for planned upgrades and maintenance of the rig will be done.

IVZ set to start seismic campaign

The preparations are on for a 2D seismic campaign. Invictus is expecting to begin the campaign next month soon after it secures the seismic contract.

The 2D seismic program will be performed with prime focus on numerous leads along the proven play on trend and to the east of Mukuyu, and additional leads along the highly prospective Basin Margin play.

With the acquisition of modern 2D seismic, Invictus will be able to mature several leads, which have been previously detected on vintage seismic data, to drillable prospects.

The ongoing Mukuyu-1 and ST1 analysis

After drilling of the Mukukuy-1 well concluded successfully, it was confirmed that there lies a working hydrocarbon system in the Cabora Bassa basin. This led to the beginning of the exploration and appraisal campaign at the site.

A total of 13 potential hydrocarbon bearing zones have been identified at the Mukuyu-1 ST1 well, with a combined 225m of gross potential hydrocarbon bearing zones detected in the primary target Upper Angwa.

A porosity of up to 15% and gas saturation of up to 90% in selected potential pay zones was calculated through wireline log interpretation in the Upper Angwa.

Invictus’ pre-drill basin model has been validated by the results to date from Mukuyu-1 (This suggests the presence of organic rich source, numerous phases of oil and gas generation and hydrocarbon charged reservoirs at different horizons).

Indications for potential significant gas columns

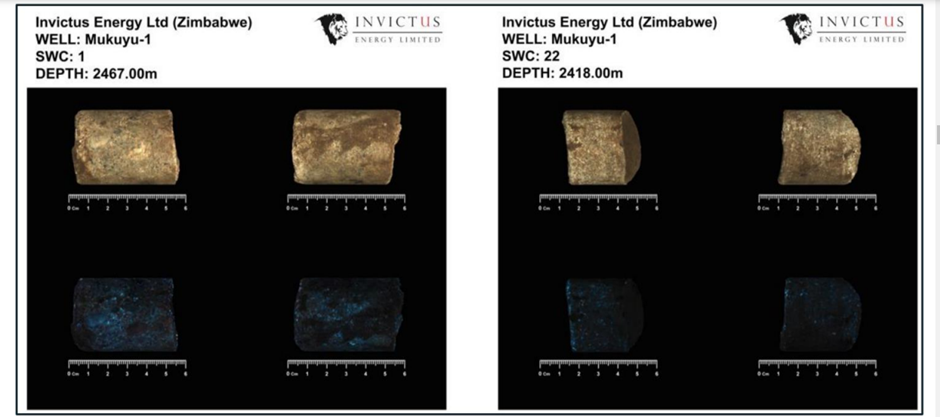

Mukuyu-1 Side Wall Cores from upper Pebbly Arkose showing strong fluorescence under ultraviolet light.

The Company is analysing the sidewall cores obtained in Mukuyu-1. So far, during the initial processing, the Company has noted strong fluorescence in-side wall cores obtained from ~2,407m Measured Depth in the upper Pebbly Arkose reservoir sections.

Consequently, the gross interval with hydrocarbon charge has risen across the Pebbly Arkose and Upper Angwa to 1,500m and substantially stretches the play interval in the Cabora Bassa Basin.

Also, significant filter cake build-up on the wellbore identified during post well analysis has hindered formation pressure pre-tests that could check hydrocarbon gradients as well as the ability to obtain fluid samples in reservoir zones interpreted from wireline data to contain hydrocarbons.

However, valid formation pressure pre-tests from the upper Pebbly Arkose and Upper Angwa reservoirs have been relatively higher than hydrostatic pressure and suggest a major gas column in these formations. Any modifications if required in the drilling mud design or drilling fluid composition for future wells will be determined from the ongoing analysis of this data.

Other developments during Mar’23 quarter

During the quarter, John Bentley took over as a Non-Executive Chairman, while Robin Sutherland has been hired to serve the role of a Non-Executive Director.

Invictus successfully raised AU$10 million upon successful completion of a AU$10 million placement to sophisticated and institutional investors.