Highlights

- 88 Energy has completed a placement to raise AU$17.5 million (before costs) at an issue price of AU$0.0095 per share.

- The company has secured the Permit to Drill for the Hickory-1 exploration well.

- Construction of the Hickory-1 ice-pad commenced with mobilisation of Nordic Calista Rig-2 expected to commence mid-February.

- The planned spudding of the Hickory-1 well remains on track for early March 2023.

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) has made significant progress towards its planned drilling of the Hickory-1 exploration well in early March 2023.

The company recently announced they have secured the Permit to Drill (PTD) for the Hickory-1 exploration well located in Project Phoenix on the North Slope of Alaska.

Also, the company has recently successfully completed a bookbuild to raise AU$17.5 million before costs.

Permit to Drill for the Hickory-1 exploration well, spudding in early March

The Permit to Drill (PTD) for the Hickory-1 well has been awarded by the Alaska Oil and Gas Conservation Commission (AOGCC).

Construction of the Hickory-1 ice-pad commenced ahead of the mobilisation of the Nordic Calista Rig-2 scheduled for around mid-February that is currently at the Alkaid-2 well location of Pantheon Resources.

Data source: 88E update

Hickory-1 is permitted to a total depth of 12,500 feet. The drilling cost of the well has been estimated at US$13.5 million gross with ~US$10 million net for 88E. The modest drilling cost is thanks to the proximity of Project Phoenix and the Hickory-1 well to key infrastructure including the Dalton Highway, highlights the company update.

Subject to well results, the company plans to undertake flow testing of the Hickory-1 well in the 2023/24 winter season.

Oversubscribed Placement to raise AU$17.5 million

Under the placement to domestic and international institutional and sophisticated investors, the company plans to issue 1,842,105,263 fully paid ordinary shares at an issue price of AU$0.0095 per new ordinary share. The settlement of the new shares is scheduled for 13 February 2023.

The issue price represents a discount of 20.2% to the ASX volume weighted average price for the ten calendar days prior to 1 February 2023 and a discount of 20.8% to the closing price of AU$0.012 on 1 February 2023.

In addition, the company will issue 75 million unlisted options with an exercisable price of AU$0.02 on or before the date which is three years from the date of issue.

With the placement proceeds and its existing cash reserves of AU$14.1 million, the company expects to have a strengthened balance sheet. 88E says that it will have sufficient capital to fund ongoing working capital requirements and general and administrative overheads for at least 12 months.

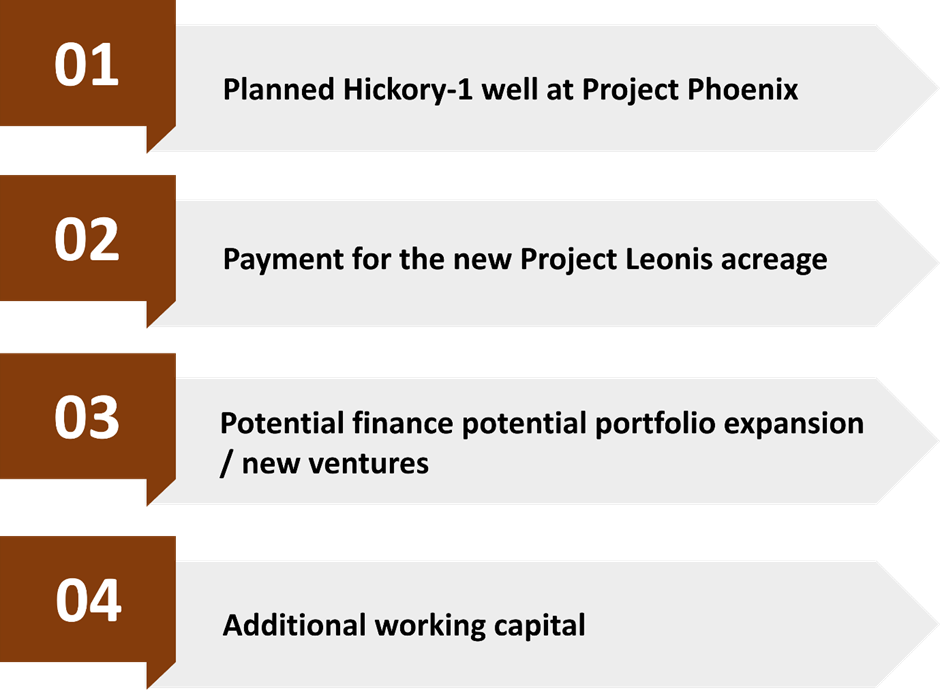

The funds raised are planned to be directed towards:

Data source: 88E update

88E shares were trading at AU$0.011 midday on 14 Feb 2023.