Definition

Related Definitions

Zero Capital Gains Rate

What is Zero Capital Gains Rate?

As the name suggests, zero capital gains rate is a 0% tax rate charged on capital gains. It is generally levied on those individuals who sell their properties within the stated enterprise zone. These enterprise zones are earmarked as special geographic areas, which are granted special tax rebates, tax breaks, concessions, regulatory exemptions, and other types of assistance. Basically, these special privileges are provided to encourage economic development and job creation in a particular area, thereby revamping a specific neighbourhood.

Summary

- Zero Capital Gains Rate refers to when no tax is levied on the sale of a property or an asset, which otherwise would be charged with capital gains.

- Capital Gains Rate of 0% is generally linked with enterprise zones, which are specific areas identified by the government to give a boost pertaining to the economic development and employment opportunities in that area.

- To avail the benefit of a zero capital gains rate, there are certain criteria, which must be fulfilled by the taxpayers.

Source: Copyright © 2021 Kalkine Media

Frequently Asked Questions (FAQs):

When were enterprise zones introduced in the United States?

In the 1970s, enterprise zones were established in the United States to encourage the establishment of private companies in suburbs, neighbourhoods, and even in the outskirts of the cities and towns.

In order to infuse the economic development and uplift certain specific regions, the government had created enterprise zones. These zones were not region specific and were not limited to a particular state or municipality. Those investing in these regions were given incentives in form of special tax benefits, concessions, etc.

Criteria to be met for securing Zero Capital Gains Rate

One such enterprise zone which has been granted zero capital gains rate is the D.C. enterprise zone located in the District of Columbia. In order to harvest the said benefit, the following conditions were made mandatory:

- The property or the specific asset to be held for at least a period of five years from the purchase date.

- It should have been significantly improved during the duration of the ownership.

- Minimum 80% of the total gross income obtained from the property must come from the business operations run within the D.C. Enterprise Zone.

- If the said property is for commercial rental purposes, then a minimum of half of the rental income must come from the business activities inside the D.C. enterprise zone.

It is noted that the above criteria apply to all the partnerships, corporations, and real estate businesses based within the district.

Which countries do not impose capital gains tax?

Not many countries impose capital gains tax. Some of them are - New Zealand, Switzerland, Bahrain, Belize, Barbados, The Cayman Islands, Singapore, Monaco, Malaysia, Sri Lanka, Belgium, Isle of Man, Hong Kong.

Is it true that zero percent capital gains tax can be charged?

Since 2020, capital gains tax rates can be charged at different rates, based on a person’s income level, i.e., at 0%, 15%, or 20%. Generally, these are levied on those assets or properties which are held for a period exceeding one year.

However, for those assets which are held for a period of less than a year, the tax would be levied corresponding to the ordinary income tax brackets like 10%, 12%, 22%, 24%, etc.

It is pointed out that long-term capital gains tax is generally lesser than the short-term capital gains tax rates.

When was the 0% capital gains rate implemented in the US?

The 0% long-term capital gains rate came into the picture under President Bush’s major laws pertaining to tax legislation, which was the Jobs Growth and Tax Relief Reconciliation Act of 2003, though was implemented in 2008. It was finally made permanent under the American Taxpayer Relief Act of 2012.

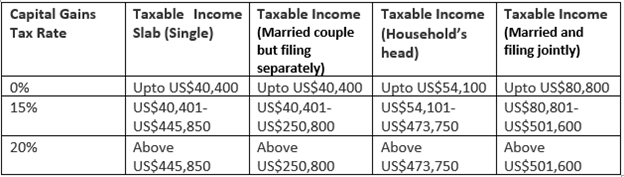

What are the income thresholds for 2021 long-term capital gains tax rates?

Details of Long-term capital gains tax rates, depending upon the income levels for 2021, are given below. It is noted that the more the income levels, the more would be the tax rates.

Source: Copyright © 2021 Kalkine Media

Who benefits from the long-term capital gains tax of 0%?

Taxpayers whose marginal tax bracket is below 25% can take advantage of the long-term capital gain tax rate at 0%. Hence, tax on any long-term capital gains falling within the tax slab of 10% or 15% is zero for the said taxpayers.

In other words, to ascertain if the taxpayer can avail the benefit of the zero percent tax-saving opportunity, one must find out the taxable income and if it is less than the 25% tax bracket or not.

Under which circumstances can the zero capital gains rate be availed by the investors?

If an investor has a high taxable income, then he/she may not harvest the gains arising from zero tax. But there may arise a period when he/she can avail benefits from this strategy. These are as followings:

- When the investor is temporarily unemployed.

- When the investor is self-employed and his/her income differs each year.

- Between the age of 60-72 years, or when the investor is soon going to retire or has already retired.

- Times when the investor deliberately creates a low-tax year to qualify for the zero capital gains rate by delaying social security benefits until the age of 70 years or bonus until next year.