Definition

Related Definitions

Zero-Based Budgeting (ZBB)

What is zero-based budgeting?

In management accounting, if a budget is prepared by re-evaluating each cash flow item, that budget is termed a zero-based budget (ZBB). It does not work on past trends instead assumes no balances or pre-committed expenses. The emphasis is on identifying a task and then funding it irrespective of the existing expenditure structure. All the costs for the new period are computed based on actual expenses incurred and not on the differential by just changing the costs incurred based on a change in operational activity.

Highlights

- In a wholly owned subsidiary, 100% of the ownership rights are with the parent company. There is no minority group of investors.

- In this method of budgeting, justification for every expense is provided by management. It thus reduces unnecessary costs.

- It requires cross-functional engagement and expertise from management and is oriented towards increasing profits and long-term growth.

Frequently Asked Questions (FAQ)-

How is a zero-based budget prepared?

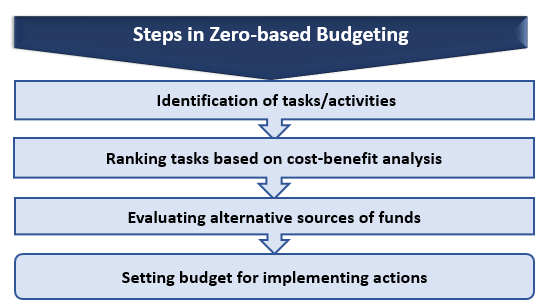

Following are the steps for preparing a zero-based budget-

Source: Copyright © 2021 Kalkine Media

Firstly, all the tasks and activities required to achieve a target are Identified; a justification for every action for which expenditure is to be incurred in the budget is laid out. Then, these activities are ranked according to cost-benefit analysis. After this, alternative sources of funds are identified for optimising the allocation. Finally, funds are allocated in the budget to implement actions and ensuring profitable results.

What are the uses of zero-based budgeting?

- It challenges traditional budgeting and alters the funding and operation standards of practice.

- It supports efficient processes and provides explanations for each change in operations.

- ZBB improves cost visibility and enhances the transparency of the costing process.

- It assigns accountability on cost managers to link costs to business drivers.

- ZBB enables management to build efficient budgets for financial sustainability.

- It is a good process for startups that do not have previous budgets.

- ZBB helps save money and improve profits each year by eliminating unnecessary business expenses.

What are the pros & cons of zero-based budgeting (ZBB)?

ZBB has the following benefits-

- It is more accurate than traditional budgeting as arbitrary changes are made to the previous year’s budget. Each function or activity is relooked for computing operation costs.

- ZBB efficiently allocates resources as it is based on cost-benefit analysis. It does encourage the use of historical numbers rather than seeks estimation of actual numbers.

- It helps reduce redundant activities by identifying cost-effective ways for each activity and therefore removes all unproductive activities.

- It does not result in an unnecessarily inflated budget as explanations for every line item is required for resource allocation under it.

- ZBB enhances cross-functional coordination for efficient decision-making.

ZBB has the following shortcomings-

- It is a little more time-consuming method of budgeting as compared to incremental budgeting.

- There is the involvement of more manpower in making the entire budget from the start.

- Justifying each item of the budget may need expertise which is usually a difficult task for managers.

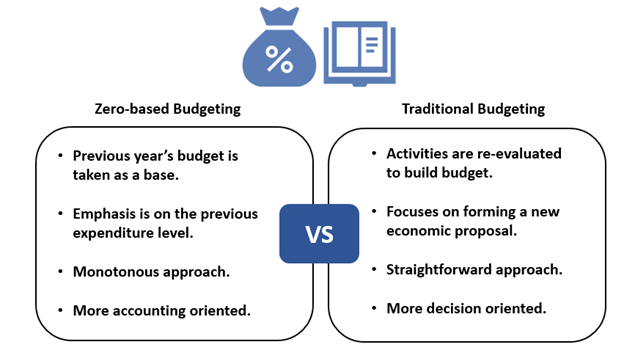

How is zero-based budgeting different from traditional budgeting?

Source: Copyright © 2021 Kalkine Media

Zero-based budgeting provides better clarity to management on costs and benefits from them as compared to traditional budgeting. It involves more involvement and expertise of management and assigns more responsibility to them for profits, thus driving long-term growth.

Example-

Source: © Designer491 | Megapixl.com

Suppose the manufacturing department of Miser Ltd. spent AU$20 million the previous year. How will this be helpful to prepare the current year budget of production activities?

In the traditional budgeting method, management may take AU$20 million as a base for computation and build a budget around it. Then, all costs that were a part are tweaked as per current targets, and the new budget figure is obtained.

But using the zero-based budgeting approach, management will not just look at last year’s AU$20 million but relook at all activities involved in production. It will assess costs and benefits for each activity from the start. Managers will compare various sources for getting the funds needed for manufacturing the product. They will choose the optimal options, and management will then develop a new budget from scratch. All redundant costs from the previous year will be eliminated in this method, and additional expenses to increase production or profitability will be included.

All costing priorities will be changed as per the current years’ requirements and management expertise on it. Thus, the zero-based budgeting will align management’s budgeting focus with the overall profitability targets of the current period.

All costing priorities will be changed as per the current years’ requirements and management expertise on it. Thus, the zero-based budgeting will align management’s budgeting focus with the overall profitability targets of the current period.

What are the five misbeliefs for zero-based budgeting (ZBB)?

- It is the same as building a budget from zero- this is not true; it is much more. ZBB uses a structured approach for cost governance aligning to earnings. It is the step-by-step approach of cost management.

- ZBB requires under-sizing costs- in reality, the cost-cutting is based on targets. The aggressiveness of cost-cutting is based on justifications and expertise and not just fanciful.

- ZBB utilises a lot of business time and manpower focus- but it is a complete cross-functional exercise that offers multiple benefits to an organisation. It requires dedicated focus and coordination for better cost visibility and savings.

- It only focuses on selling general & admin expenses- it is applied to all types of cost, including capital expenditures and operating expenses. It is a comprehensive cost-management tool.

- ZBB is not beneficial to growth-oriented firms- whereas it is very successful when used by growth-oriented corporations as it redirects unproductive costs and drives growth. Cost management is very crucial to any organisation’s success, and ZBB offers deep visibility on it.