Definition

Related Definitions

World Gold Council (WGC)

What is World Gold Council?

The World Gold Council (WGC) is a not-for-profit association of leading gold producers around the world. It is a set-up designed to develop markets for the gold industry. The World Gold Council consists of 33 members, and it works along with other gold mining companies. It is headquartered in London, UK, and covers markets that contribute about a third-fourth of the world’s annual gold consumption. It was established to facilitate industry leadership and arouse global demand for gold.

Highlights

- The World Gold Council (WGC) is a not-for-profit association of leading gold producers around the world.

- WGC aims to monitor and defend the existing demand for gold consumption. It has developed globally recognised standards for clarity and consistency to reinforce trust across the gold value chain.

- The WGC also supports and advises central banks with respect to gold. It helps the governments’ asset managers, officials, and sovereign wealth funds globally.

Frequently Asked Questions (FAQ)-

What is the aim of the World Gold Council (WGC)?

Source: © Alexiv84 | Megapixl.com

The World Gold Council (WGC) was established with the motive of promoting gold consumption. It aims to make the most of the industry's potential for growth. In addition, WGC aims to monitor and defend the existing gold consumption.

Besides the above-mentioned primary objective, it also works as a co-sponsor for various research undertaken to understand new uses of gold or any other new products containing substantial gold.

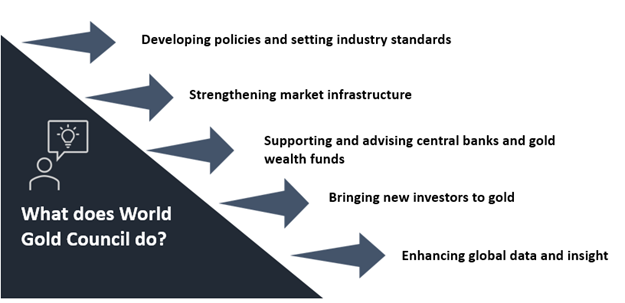

What does World Gold Council do?

Source: Copyright © 2021 Kalkine Media

- The WGC works for developing policies and industry standards. It collaborates with governments and other international agencies to reduce barriers to the gold industry. It has developed globally recognised standards for clarity and consistency to reinforce trust across the gold value chain.

- Recently it has introduced the Internet Investment Gold Investor Guidance, the Guidance for Monetary Authorities on the recommended practice in accounting for monetary gold, the Conflict-Free Gold Standard. It has also been major effort maker in developing hallmarking standards in India.

- World Gold Council facilitates market infrastructure strengthening. It works to make pricing, trading and settlement of gold transparent and provide market access. It is a prerequisite for making gold a mainstream investment asset globally. It has helped establish and advance the Shanghai Gold Exchange and many other global gold trading ecosystems.

- The WGC, with its innovative ways, has always tried to bring new investors to gold markets. It targets key investor segments like pension funds, insurers, gold wealth funds and others to increase the number of long-term investors in the gold industry. It makes them understand the importance of gold as a hedge for their portfolios.

- The WGC also supports and advises central banks with respect to gold. It helps the governments’ asset managers, officials, and sovereign wealth funds globally. The advises it gives is based on WGC’s authoritative research and key market statistics. It also offers education and training programs on the gold market based on recent changes. It works to provide insights for decisions about using gold as a reserve. WGC’s work is valued and trusted globally.

- It works towards enhancing global data availability and insight on gold. It is working towards a global repository of gold market data which will be made accessible worldwide. It does provide a lot of information, but it is not centrally collected at a particular location. Its access is also rarely available on a timely basis.

What is the Importance of WGC for the gold industry?

Gold is a valuable investment option and has various other non-monetary uses. It can be moulded into jewellery items; it is used in electronic chips and teeth filling in dentistry. Thus, there always remains a minimal level of demand, and it is impossible to counterfeit it perfectly.

- The World Gold Council helps stimulate and sustain this demand and provide leadership to the fragmented industry participants. It is also the authority of gold markets globally.

- The WGC works to define a market structure to develop a fair trade practice. It wants to make the gold market effective, transparent and accessible and engaging to the global investor, governments and policymakers.

- It also works to resolve all industry-related issues, including ESG. This way, it reinforces reliability, clearness and belief across the gold industry's value chain.

- It has a significant contribution in promoting gold as a mainstream asset class amongst investors, institutional and retail and has helped spread the importance of gold as an investment asset to balance portfolios. The WGC also created the world's first gold ETF (exchange-traded fund).

- The WGC is a lobbying organisation that always is bullish on gold. Therefore it focuses on the balance between annual demand and supply of gold globally. It acts as the authority for global gold markets and producers.

- With its large and diverse partner group, it creates access and drives innovation for global gold demand. It acts as a microphone for the collective voice of gold producers. Most of the global gold industry insights are also provided by WGC.

- The World Gold Council is filled with tremendous experience and deep insights about the gold market drivers. It thus resolves industry issues and streamlines pro-gold policies.

- The global gold markets have changed significantly over the past few decades. They have become wider and stronger. The World Gold Council has played a key role in this. It has driven many of the initiatives for change, like liberalising gold markets in China.

- Though it is based in the UK, its' operations are in India, China, Singapore, and the US. It has still led the change for the global gold industry.

Who acts as an audience to World Gold Council?

- The data and insights from WGC's research programs are heard and followed by Institutions from the public and private sectors.

- Any corporation managing investments on behalf of clients may also be interested in it.

- Big business houses that guide and influence investors rely on WGC's insights.

- It partners with central banks and sovereign wealth funds to deliver educational training on gold markets.

- Pension funds, insurance companies, asset managers, wealth managers, investment consultants, and index providers worldwide seek data from WGC.

- Affluent and high-net-worth markets are specially targeted in the developed and developing world.

- The entire gold value chain looks forward to insights from the World Gold Council.

The WGC thus targets a broad population with tailor-made approaches in various dominions worldwide. Moreover, it develops deep relationships and investor ecosystems while developing robust standards to ensure responsible gold trading.