Definition

Related Definitions

Undercapitalisation

What do you mean by Undercapitalisation?

Undercapitalisation is when a business does not have enough capital for its day-to-day operations and to make payment to the creditors. Such a situation arises when a company faces a shortage of funds. Undercapitalisation is a warning sign of significant financial trouble for a small business and can trigger bankruptcy.

Undercapitalised companies usually prefer short-term credit over equity or long-term debt. When a company fails to service its debts and finds it difficult to carry out its day-to-day business operations due to cash shortage, investors will become more cautious while investing in that company. This is because in such a scenario, there are more chances that a company will become insolvent. To avoid any future risks, investors are always apprehensive about making investments in companies facing financial troubles.

Summary

- Undercapitalisation is the situation when a business does not have enough capital for its day-to-day operations.

- Undercapitalisation is one of the warning signs of major financial trouble for a small business and can trigger bankruptcy.

- Undercapitalisation is more prominent in young companies that normally fail to anticipate different kinds of costs involved in starting a business and keep it running.

Image Source: Wisconsinart | Megapixl.com

Frequently Asked Questions

What are the factors responsible for Undercapitalisation?

Undercapitalisation is more prominent in young companies which normally fail to anticipate different kinds of costs involved in starting a business and keep it running. It is not that difficult to start a business, but the main challenge comes when there is a need to expand it and maintain a consistent growth. If a company does not have adequate resources required for its expansion, it will eventually lead to the failure of that company. It is to be noted that inadequate access to working capital and other financing options largely contributes to a business's lack of success and ultimate failure. Consistent cash flow is the prerequisite for a business to be successful. Incorrect financial planning and management can often lead to undercapitalisation. When a business runs short of cash and fails to pay salaries to its employees, there are higher chances of going into debt.

Few factors which can lead to undercapitalisation are:

- Lack of proper planning for predictable business risks.

- Unfavorable macroeconomic circumstances.

- Financing growth with short-term funds instead of permanent funds.

- Failure to raise enough capital from financial institutions such as a bank loan or on credit.

- Poor risk management strategies.

Suppose a company which is having adequate cash flows detects undercapitalisation at an early stage. In that case, it can save itself from becoming bankrupt by taking remedial action like issuing debt, selling its shares, and availing a long-term credit facility from financial institutions or private lenders. On the contrary, if a company ignores early signs of undercapitalisation and fails to manage adequate cash flow, there are all the chances to go bankrupt.

How can a proper cash management strategy help young businesses avoid Undercapitalisation?

Image Source: © Info40555 | Megapixl.com

Before starting a new business, it is always better if the entrepreneurs have a fair idea about their financial needs and the expense. For this, a careful assessment of all the aspects of a business is required. Typically, a business incurs expense on – rent, salaries of the employees, inventory, equipment or machinery, licenses, computers, office furniture, marketing, and advertising, etc. Thus, there are numerous factors that determine the financial needs of a business. For initial years it is helpful if companies maintain a cash flow projection for every month. This is because the difference between the funds a business can contribute, the income it generates, and an estimate of expenses incurred by it, gives a clarity about a business's financial needs. To make up for this difference and to ensure adequate capitalisation a business can secure equity from financial institutions like bank loans or private lenders. Since, cash is the lifeblood of a business, proper management of cash flows is paramount for a business to grow and achieve success.

In its cash management strategy, a company should consider factors such as -- i) its level of liquidity, ii) its management of cash balances, iii) short-term investment strategies. Young companies are more vulnerable to undercapitalisation because the initial costs involved in a business pose the most significant challenge for entrepreneurs. A realistic assessment of a business's expenses and financial needs is important before starting an entrepreneurial activity.

What are the different methods to tackle Undercapitalisation?

Image Source: © Michaeldb | Megapixl.com

- One way to overcome undercapitalisation is by increasing the par value of the shares. When this happens, the rate of dividend comes down.

- The other method to solve undercapitalsiation is by issuing bonus shares. Issuance of bonus shares reduces the EPS without affecting the overall earnings of a company.

- Another method to tackle undercapitalsiation is stock split. Through the division of shares, stock split increases the number of shares but reduces the face value of a stock, thus reducing the EPS.

Discuss the effects or consequences of Undercapitalisation?

- Often undercapitalisation is likely to compel a company's management to deliberately manipulate the price of shares by adhering to unethical practices.

- Undercapitalisation can help in enhancing a shares marketing potential.

- Undercapitalisation can increase the financial obligation for a company to pay higher taxes. Since the earnings made by a company increases during this phase, the tax authorities are likely to tax this extra income.

- It can lead to unhealthy competition between different companies/businesses.

- Undercapitalisation can lead to excessive trading.

- Enhances the liquidity of investments: Undercapitalisation can lead to an increase in the liquidity of investments.

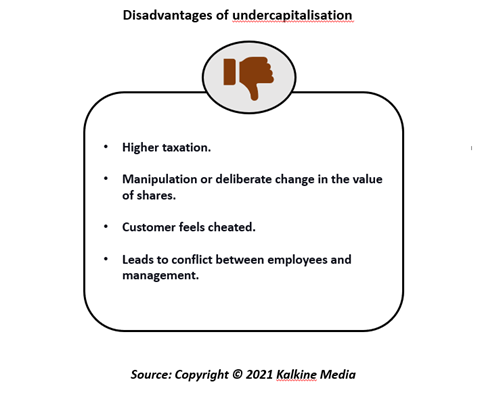

What are the disadvantages of Undercapitalisation?

- Higher taxation: With an increase in the value of shares, there is an increase in the company's earnings. This increased income is subject to higher taxation, as such companies bear the burden of higher tax rate.

- Manipulation or deliberate change in the value of shares: undercapitalisation is likely to compel a company's management to deliberately manipulate the price of shares by adhering to unethical practices.

- Customer feels cheated: When a company announces dividends at higher rates, customers feel that they are being exploited. This is because instead of reducing the commodity price, the company is increasing the dividend rates.

- Undercapitalisation leads to conflict between employees and management: When the employees feel that the company is making more profits, they demand higher wages. The disagreement on this between the management and employees leads to conflict between the two groups.