Definition

Related Definitions

Unconstrained Investing

What is unconstrained investing?

Unconstrained investing is an investment approach that seeks a variety of sources of return to manage volatility. It is a flexible and adaptable approach to seeking opportunities across a wide variety of investment assets across markets. Unconstrained investing is neither undisciplined nor ignores the risk/return tradeoff. Instead, it works to choose risks carefully. It invests in the best sources to get a risk-adjusted return. Funds or portfolio managers adopting this approach do not need to adhere to a specific benchmark.

Summary

- Unconstrained investing is a flexible and adaptive style of investment adopted by fund/portfolio managers.

- It gives the fund managers the ability to benefit from market fluctuations in an appropriate manner.

- It is a risky investment approach, and poor decision making may drain portfolio gains. Thus, investment managers must assess asset risks properly before investing.

Frequently Asked Questions (FAQ)

What makes unconstrained investing different?

Investment professionals habitually use benchmarks to determine performance of portfolios being managed by them. They often restrict themselves to obtain the performance results like the fixed benchmarks. This inflexibility doesn’t allow them to take gain from market ups and downs in a suitable manner. Unconstrained Investing is a type of investing that places a premium on portfolio performance over time. It shuns away any constraints that arise from benchmark tracking. Though it increases the risk exposure in portfolios if adopted with a good understanding of different asset classes and sectors, it significantly improves portfolio performance. The approach adopts internal metrics and controls to measure performance and control risks.

How did unconstrained investing become popular?

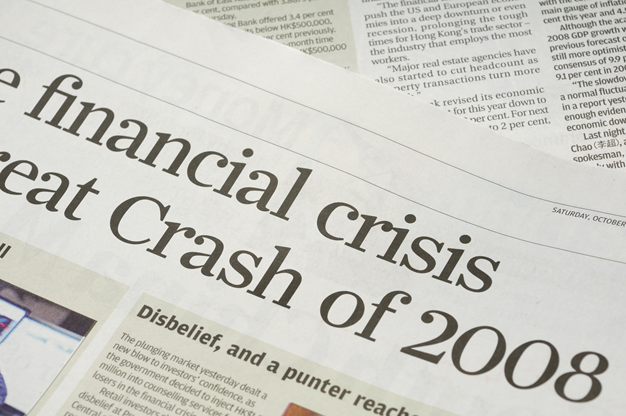

Source: © Bedo | Megapixl.com

The unconstrained investment strategies became popular post the ‘2008 Financial Crisis’. During the financial crisis, most global markets and investment asset classes saw a significant decline in returns. Even diversification failed to sustain returns and protect from losses. Investors realised that indexes do not always meet portfolio aims. It is when investment managers realised that more flexibility was the only way to avoid such a risk. Without the flexibility to adapt to changing market conditions, investment managers could not avoid significant declines or capitalise on significant market movements.

How can investors access unconstrain investing?

A lot of Investment funds and portfolio management companies have their own unconstrained investing styles. Managers from big investment management firms pursue unconstrained investing strategies after deep research. They develop investment ideas across a wide range of markets, sectors and asset classes or security types. They typically go for a multi-sector, multi-asset, a global tactic to tap maximum returns while avoiding risks. Managing the incumbent levels of uncertainty and risk is not possible for unprofessional or less knowledgeable investors. Therefore, high-net-worth individuals (HNI) or any other accredited investors can utilise the services of professional investment management houses to access the benefits of unconstrained investing strategies.

What are the essential elements for unconstrained investing?

Unconstrained investing entails these elements -

Dissociating from Benchmarks- Unconstrained investing requires dissociation from the traditional performance measurement using benchmark based on relative return. Since in the traditional benchmarking approach, it is more likely that portfolios get invested similarly to the benchmark. Even risks are measured about the benchmark. This makes the portfolio rigid in a way, investing roughly along index lines. The alternative, unconstrained strategy thus has two benefits. First, there is no pressure on the investment manager to stick to a particular market segment and develop a benchmark-relative position. Second, the manager gets the freedom to invest in multiple assets across markets to maximise total portfolio return.