Definition

Related Definitions

Short-Term Debt

What are short-term debts?

Short-term debts or current liabilities refer to the money borrowed by a company that should be paid back to the lender within a year. A company’s balance sheet shows short-term liabilities below the current liabilities portion of the total liabilities section.

Image Source: © Raquelsfranca | Megapixl.com

Summary

- Short-term debts or current liabilities refers to the money borrowed by a company.

- A company is said to be in a poor financial position if its short-term debt account is greater than its cash and cash equivalents.

- Lease payments, due taxes, stock dividends, salaries and wages are some examples of short-term debts.

Frequently Asked Questions (FAQs)

What are the two most common types of debt?

Usually, a company accumulates two kinds of debts, i.e., financing debt and operating debt.

Financing debt results from efforts made to raise capital to grow the business whereas debt from operations is the result of obligations arising from regular business operations. Debt from operations is naturally occurring and includes accounts payable and taxes due.

Operational debt is relevant because business partners like customers, lenders and suppliers often measure a company's short-term economic robustness by calculating operational debt levels.

Financial debt is typically long-term since it has a maturity of more than one year, which implies that the obligations are extended for more than twelve months. Financial debt is listed in a company’s balance sheet after the current liabilities portion under the total liability section.

Operating debt stems from the primary activities required to run a business. This debt is expected to be resolved within twelve months. Mostly, Operating debt consist of short-term bank loans or commercial paper issued by a company.

What does a firm’s short-term debt account indicate?

The value of the short-term debt account gives a clear picture of a company's financial health and growth. Furthermore, the debt-to-equity ratio helps us calculate the amount of debt a company has with respect to its capital. This indicates that the greater the debt-to-equity ratio, the more is the concern about company liquidity.

A company is in a poor financial position if its short-term debt account exceeds its cash and cash equivalents. This will also indicate that the company does not have adequate funds to meet its impending obligations.

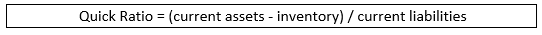

Noticeably, quick ratio is the most popular indicator of short-term liquidity. It helps determine a company’s capability to pay back the short-term liabilities based on how quickly the company can convert its liquid assets into cash. A higher quick ratio result would mean that a company is in a good financial position, whereas a lower quick ratio will indicate that a company is finding it difficult to pay off its debts. It must be remembered that quick ratio is relevant in gauging a firm’s credit rating.

Formula for Quick Ratio

What are some common types of short-term debts?

Image Source: © Photoking | Megapixl.com

- Short-term bank loan: The most common type of short-term debt for a company is its short-term bank loan. Short-term bank loans are mentioned on a company’s balance sheet when a business needs funds to finance the working capital needs.

- Accounts Payable: Yet another type of short-term debt is a firm’s accounts payable. This liabilities account keeps a record of all outstanding payments which is to be paid to the suppliers, outside vendors and other stakeholders. For example, a firm buys a machine for US$50,000 on short-term credit and promises to pay this amount within 30 days. Then this amount of US$50,000 is included in the accounts payable section.

- Commercial paper: Instead of availing a bank loan, some companies opt to issue commercial paper, an unsecured debt instrument, to meet liabilities such as payroll or to finance accounts receivable. Maturities on commercial paper come due in nine months or less.

Mostly, Commercial paper is issued at a discounted face value which is almost equal to the current market interest rates. One major advantage of commercial paper is that it does not need to be registered with the Securities and Exchange Commission (SEC). - Stock Dividends – Dividends payable are mostly considered as short-term liabilities. This is primarily because the company’s intention in those cases is to pay dividends within a year. Thus, dividends that are yet to be paid to the stockholders can also be classified as short-term debts.

- Salaries and Wages: It depends on an organisation the way it pays salaries to its employees. Several times the salaries which are due to be paid to the employees may also be considered as short-term debts. Say, for instance, if a company pays previous month’s salaries to its employees on the 17th of next month, this will create a short-term debt account for the wages which are due unless they are paid on 17th.

- Lease payments: Companies mostly prefer to lease than to purchase. The payments on such leases are sometimes booked as short-term debts. Though maximum leases are categorised as long-term debt, however, in cases where the leases are expected to be paid off within the next 12 months, they are considered a component of the company’s short-term debt.

- Due Taxes: Taxes are considered a short-term liability and categorised as short-term debt when a company owes quarterly taxes yet to be paid.

What are the characteristics of a short-term debt?

- Borrowing amount is relatively low: In the case of short-term debts, the borrowed amount is lower compared to other types of loans.

- Higher Interest Rate: Since the amount is very small in short-term debts, the annual percentage rate or APR is high for these loans.

- Short-term debts are unsecured: Considering the fact that in short-term debts the repayment period and the loan amount are less, the significance of collateral

What are the advantages of short-term debts?

- Easy and quick approval: Short term loans do not require a cumbersome approval process compared to other types of loans.

- Greater accessibility: Short-term debts are generally accessible to everyone ranging from small size businesses to individuals.

- Enhances a borrower's creditworthiness: If an individual avails these loans and pays back on time, it enhances a borrower’s creditworthiness.

- Unsecured: Since short term debts are unsecured, it is not mandatory for a borrower who needs the loan to possess collateral.