Definition

Related Definitions

Sell-Side

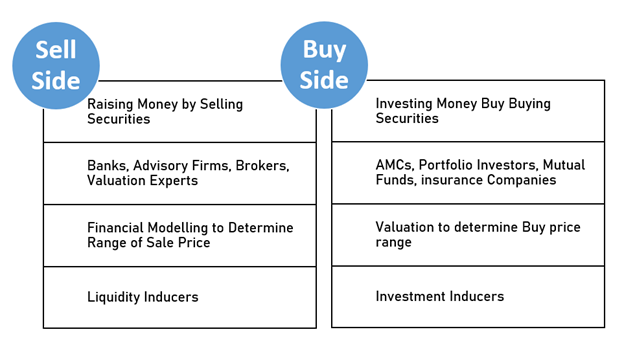

Sell-side in any financial transaction, refers to group of analysts and other finance professionals who are involved in the selling including conception, advertising and dealing of financial instrument ideas, shares, bonds, foreign currency interchange, etc. to the investors in a financial market. The sell-side also involves itself in out of market instruments such as private placements of debentures and shares.

Summary

- The Sell Side of a Financial transaction is the analyst group or entity that helps determine the right sale valuation for any financial instrument.

- They are investment banks, brokerage firm, intermediaries or expert financial analysts.

- Sell Side provides liquidity and pricing for the buy side entities for making investments. decisions.

Frequently Asked Questions (FAQs)

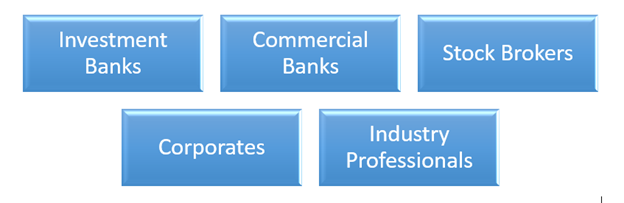

Which Firms Are Involved in Sell Side?

Sell side includes Investment Banks, Brokerage firm, intermediaries, Financial Analysts involved with issuers of securities. They are the market fabricators who induce liquidity for the investors or buy side market entities. They typically make commission money from their clients who undertake such trades. They also get money from the equity and debt offered by companies, which their analysts cover for sale tips.

Copyright © 2021 Kalkine Media

Sell Side Analysts are greater in number as compared to buy side. These analysts are dedicated towards analyzing specific sectors or particular companies. They regularly intermingle with the Buy Side people who are usually Asset Managers of Portfolio funds, Hedge Funds, Insurance Institutions, Institutional and Retail Investors.

What are the functions of Sell Side?

- Keeping a close watch on the Stocks or other Financial Instruments, and their performance.

- Sell side works gives a detailed analysis on the financial results, cash flows and any other published data.

- This exercise is undertaken frequently by them.

- Project forecasted financial statements, based on various analysis & trends.

- Provide recommendations on target sale price, in research reports released by them.

- They actually sell ideas to their clients, and often, these charge a fee or given for free as a part of client service agreement.

- Sell Side provides liquidity and pricing for the buy side entities for making investments. decisions.

How does sell-side function in different markets?

- Foreign Exchange Market- it is the world’s leading financial marketplace. Here, the sell-side is dominated by top multinational investment and commercial banks and financial institutions. There are generally two groups:

- The Interbank traders, who buy and sell large pools of currency on spot and forward markets. They sometimes even take private positions here.

- The sellers of Forex Instruments to buy-side trade groups like mutual funds, and large conglomerates.

- Bond Market - it is the second most active financial marketplace. This space is also donned by Investment banks on the sell-side. Big MNCs that function both as commercial and investment banks also work in this market. They guarantee and manage bond placements. Some of them also work as prime merchants of Treasury bonds, which means they assist government to bring liquidity in the economy.

- Stock Market - Investment banks predominantly work here. They act as underwriters for share issue, take registered positions, and later sell these shares to corporations or individual investors. They perform this high profile activity of underwriting initial public offerings (IPOs) and follow on share issuances. Companies issuing public shares need to enlist themselves for these services with an investment bank. Other underwriters are often brokers, who safeguard companies and the investing public. They also market and sell these shares.

What skills do sell side analysts have?

- Exceptional Analytical & Quantitative skills

- Solid inscription and communication abilities

- Proficiency in tables and charts and presentations.

- Capability to quickly assess & analyze financial statistics & companies

- Ability to rank tasks and multitasking.

- Obligation to finding outstanding results

How is Sell Side different from Buy Side?

- Sell Side advises corporate clients on major transactions, facilitates raising debt and equity, advises on mergers and acquisitions (M&A) and help clients get in and out of positions.

- Buy Side manage their clients’ money for investment decisions and to help them earn the best risk-adjusted return. They help grow assets under management (AUM).

Copyright © 2021 Kalkine Media