Definition

Related Definitions

Revaluation

What is meant by revaluation?

Revaluation refers to deliberately exerting an upward pressure on the prices of goods, assets and even currencies. In accounts, revaluation may refer to readjustments made to the prices of commodities and assets. For a central bank, revaluation refers to applying an upward pressure to the exchange rate.

Countries that maintain a fixed exchange rate can adjust the value of their currency against a baseline. This baseline can be another currency or the value of a commodity like gold. Revaluation can be understood as the opposite of devaluation, wherein countries deliberately decrease the value of their domestic currency against the baseline.

Revaluation and devaluation cannot occur in a floating exchange rate system where the exchange rate is determined by market forces. In a floating exchange rate system, there is minimal to no intervention by the government or central bank of a country in increasing or decreasing the value of their currency.

How is revaluation carried out?

If the exchange rate of Country A is maintained at 10:1, then the home country can simply announce that the value of the domestic currency will be revalued to 2:1. This would increase the value of the domestic currency. Further, if the central bank announces that the exchange rates are being maintained at 12:1, then this is called devaluation.

Countries may also choose to revalue their currency by changing the supply of foreign currency reserves in their country. Changing the supply of foreign currency affects the exchange rate.

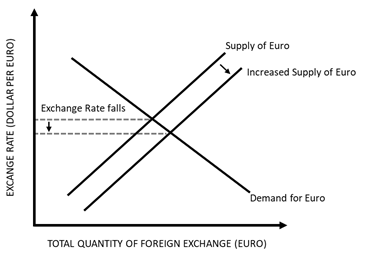

Consider the following example depicting the exchange rate determination of Dollar in terms of Euro. The supply of Euro is the quantity of Euro available as foreign exchange with the US, while the demand for Euro reflects its demand in the US. Here, Dollar is the domestic currency and Euro is the foreign currency.

In the above diagram, the supply of Euro in the economy is increasing, while the demand for Euro remains the same. As more units of Euro are kept as foreign exchange, Euro depreciates while Dollar appreciates. This is how countries can influence the value of the currency by changing the supply of foreign exchange reserves.

What is the effect of a revaluation?

If the exchange rate of country A is maintained at 7:1, then it can be said that 7 units of domestic currency are required to get one unit of foreign currency. However, when the exchange rate is revalued to 5:1 then it means that now only 5 units of domestic currency are required to get one more unit of the foreign currency.

This means that the foreign currency has lost its value as it has become cheaper, while the domestic currency has gained value as it is more expensive. Lesser units of domestic currency must be foregone to get the same amount of foreign currency.

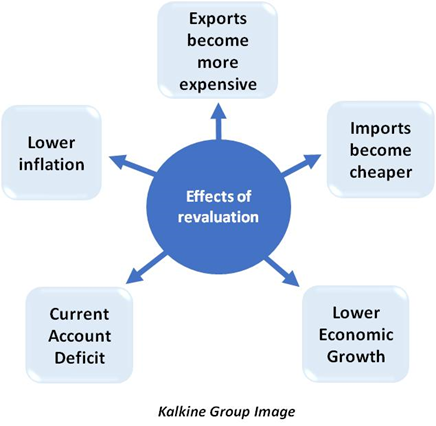

A revaluation would impact the domestic currency in the following ways:

- Exports become more expensive: As the value of domestic currency rises compared to a foreign currency, exports become more expensive. This would end up hurting the country as exports would decline.

- Imports become cheaper: Domestic consumers would prefer cheaper imports over domestic goods because the value of foreign currency is less. Thus, there would be a decline in net exports.

- Lower inflation: Inflation would decline as lesser amount of cash would hold greater value than before. Therefore, purchasing power of domestic currency would increase and lesser units of currency would be required to purchase the same amount of money.

- Lower Economic Growth: As the demand for domestic goods falls domestically as well as internationally, the overall output in the economy would also fall. This could lead to lower productivity and therefore, lower economic growth and lesser number of jobs would be available in the economy.

- Current Account Deficit: As imports increase and exports decline, the current account balance would decrease. This would have a negative impact on the Balance of Payments of the domestic country.

Why do countries revalue their currency?

- Interest Rates: Interest rates are a major factor influencing the demand and supply of foreign exchange reserves with a country. As the interest rates in a country increase, there is greater demand for the currency of that country. This happens because investors would have an incentive to invest in that country rather than in their own. Interest rate changes between countries could lead to one country revaluing its currency to keep it at par.

- Consider the case when interest rates in the UAE are higher than in Saudi Arabia. Then the demand for UAE’s Dirham would increase, thus, Dirham would appreciate, and the Saudi Riyal would depreciate. To increase the value of the Riyal, the Saudi Arabian government, under a fixed exchange rate system, would revalue their currency.

- Current Account Surplus: Countries might look at revaluation when they experience a current account surplus and want to reduce it. A current account surplus could lead to lower domestic employment if it is caused by a recession or a lack of demand.

- Containing Inflation: Currency revaluation can be used to countries to contain inflation. Revaluation reduces the value of currency, thus, leading to a downward pressure on prices.