Definition

Related Definitions

Retained Earnings

What are retained earnings?

Retained earnings is the amount of net profits left with the business after paying dividends. It is reported on the balance sheet and is the cumulative net income minus the cumulative dividends since the inception of the firm.

In the balance sheet, the retained earnings of the enterprise are reported within the shareholder’s equity. However, the number sitting on the balance sheet as retained earnings does not necessarily mean hard cash, but the funds used to pay liabilities or acquiring assets.

Income statement accounts for revenues, gains, expenses and losses of the firm, therefore net income is derived when revenue and gains exceed expenses and losses. Now the net income of the firm is transferred to retained earnings.

When the firm records net income, it increases the retained earnings. However, net loss reduces the retained earnings. Net loss occurs when the firms' expenses and losses exceed revenue and gains in an accounting period.

Dividends are also paid out of the retained earnings. When an enterprise declares a dividend, it reduces the retained earnings on the balance sheet.

Depending on the stage of the business, the retained earnings can have a credit balance or debit balance. A credit balance means positive retained earnings, while debit balance means negative retained earnings.

A positive balance of the retained earnings shows accumulated profits of the firm, whereas a negative balance of the retained earnings means accumulated losses. A firm that was established recently, such as start-ups, could incur losses during the initial years, leading to debit balance in the retained earnings.

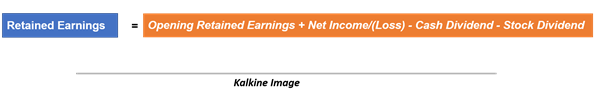

Retained earnings formula:

What are the uses of retained earnings?

Dividends: Companies with limited investing and working capital needs often pay dividends to the shareholders. When the growth opportunities for the firm are exhausted and is growing consistently with the industry, the firm can pay dividends since capital expenditure needs are limited.

Dividends remain one of the main return drivers in a portfolio over the long term. Even if the business has suffered net loss, it can pay dividends because of positive cash balance and reserves in retained earnings.

Working capital: Working capital management is crucial in a business and also depicts the short term needs of the business. Working capital is the liquidity of the business to manage its day-to-day operations.

Working capital requirements of a firm can be fulfilled by equity or debt. Funding working capital needs through retained earnings is an equity type of financing. In addition, a firm’s current assets like cash, inventory and receivables, are used to fund working capital needs.

Fixed investments: Fixed investments primarily means investments in large scale assets to improve production. Retained earnings are also used to fund capital expenditure plans of the firm. Capital expenditure can include purchasing assets like furniture, equipment, plant etc.

It can also include funds used to improve the quality and utility of the assets.

Other needs: A firm also has other needs that can be fulfilled through retained earnings. Other applications of retained earnings can include shares buyback, repayment of the loan, R&D investments, expansion etc.

Why companies prefer to retain earnings instead of disbursing dividends?

A company would retain earnings primarily because of the above uses. However, when the company does not have retained earnings, the funding source for the above uses will likely be either an equity raise or debt.

Both the funding sources also come at a cost. In equity, the shareholders of the company would face dilution of interest or ownership. In debt, the expenses increase because the company has to bear the interest costs and also repay the principal at maturity.

In comparison, the equity funding route is mostly preferred by the companies, depending on the scale of requirement. Large funding requirements are likely to be funded with debt capital given the risks of large dilution.

Companies may also elect to refrain from paying dividends, specifically when the management believes that better shareholder value can be created by using retained earnings to fulfil needs of the business.

Mostly growing firms are likely to refrain from paying dividends or pay a lower amount of dividends primarily because growth and investment opportunities for growing companies are relatively higher than matured companies or blue-chip companies.

Revenue vs Retained Earnings

Revenue is recorded on the income statement and is referred to as the top line of the company. It is the amount of total income earned by the company by selling its goods and services. All the expenses incurred by the company during the financial period are deducted from revenue to arrive at net income.

Retained earnings of a company are the funds that were left with the firm after paying dividends out of the net income. A company utilise retained earnings for the future benefits for the business and to meet the current need of the business.

Warren Buffet on Retained Earnings

Warren Buffet in his 2019 Annual Letter acknowledged the importance of retained earnings. He noted that great American businessmen like Carnegie, Ford and Rockefeller had retained a large portion of earnings to fund future growth of the business.

He and Berkshire’s second-in-command, Charlie Munger, have extensively focused on retained earnings. The firm’s priority is to reinvest in operational assets, which are productive.

Mr Buffet reckoned that Berkshire’s portfolio companies, where Berkshire hold over 50% interest, have retained earnings but that those retained earnings do not factor in Berkshire reported earnings.