Definition

Related Definitions

Restricted Stocks

What are restricted stocks?

Restricted stocks, also known as restricted securities, refers to those unregistered shares whose ownership cannot be transferred by the shareholder until certain conditions are met. This means a stockholder can exercise the right to transfer a stock only after the fulfilment of certain conditions. These conditions usually include:

- i) Continuous employment for a predetermined period ii) Fulfilment of preplanned performance objectives and earning per share (EPS) goals.

Usually, restricted stocks are awarded to employees of a company as equity compensation. Restricted stocks are profitable for a company in the sense that until these stocks are earned and issued, they do not give any ownership rights to the employees. The employees are granted the shares either on the condition that they will stay in an organisation for a pre-defined number of years or until the organisation achieves a particular milestone.

These conditions are imposed to prevent their premature selling, as this can impact a company negatively. Typically, restricted stocks are subject to a graded vesting schedule, which has a longer duration. Another word for restricted stock is “letter stock.” Restricted stocks are more common in established or reputed organisation to keep their employees motivated.

Summary

- Restricted stocks refer to those unregistered shares whose ownership cannot be transferred by the shareholder until certain conditions are met.

- Restricted stocks are more common in the established organisation to keep their employees motivated.

- Restricted stocks are more common in the established organisation to keep their employees motivated.

Frequently Asked Questions

What are the characteristics of restricted stocks?

- Restricted stocks are more common in established or reputed organisation to keep their employees motivated.

- Restricted shares have their vested date and milestone. The ownership of these shares is non-transferable until certain conditions are met.

- Restricted stocks are often issued to corporate affiliates like directors and senior executives. These shares are not subject to restrictions when another corporation acquires the company, and the executive is laid off in the acquisition

Image Source: © Rummess | Megapixl.com

What are the three conditions for restricted stocks to become transferable?

With restricted shares, an employee gets a claim in the company; however, that is not valuable until an employee vest. Vesting gives an employee the right over the assets provided by the employer and motivates him to stay in the company. The vesting schedule of a company decides when an employee will have complete ownership over an asset. Restricted stocks became more popular when companies were required to pay for stock option grants. This happened in mid the 2000s. The two conditions which must be fulfilled for these stocks to become transferable are i) Continuous employment for a predetermined period ii) Fulfillment of preplanned performance objectives and earning per share (EPS) goals.

These stocks are unrestricted if the company merges with some other corporation or if there is an acquisition. Furthermore, if an executive is laid off during merger/acquisition, he is likely to forfeit the restricted stock. Other reasons for an executive to lose his shares in a public-traded company can be a failure to meet the performance goals and non-compliance with the Securities and Exchange Commission (SEC) regulations. This means that an executive will lose his restricted stock if they fail to meet the performance targets or violate SEC rules in the US.

Discuss the two types of restricted stocks?

1) Restricted stock unit (RSU)

A restricted stock unit or RSU is an assurance or a promise by an employer to an employee to grant a certain number of shares of the company’s stocks at a predetermined future date. Holders of RSUs carry no voting rights because they are not actual stocks. To receive stock, an employee must exercise RSU.

2) Restricted stocks award

Restricted stock awards are more or less similar to restricted stock units. However, the only difference between the restricted stocks unit and the restricted stocks award is that the latter comes with voting rights. Thus, as soon as these stocks are awarded, an employee can exercise voting rights. Besides, in RSU, an employee is allowed to receive the cash value of the restricted stock unit in exchange for a stock award; however, in restricted stock awards, employees are not allowed to redeem the cash value of restricted stock awards.

Are restricted stocks taxable?

Image Source: © Raducomes | Megapixl.com

The Internal Revenue Code (IRC) governs the taxation on restricted stocks. It is usually considered a complex process. Capital gains or loss on restricted stock is equal to the gap between the stock’s price on the date when it is sold and the date when it vests. When it comes to taxation, a restricted stockholder will pay tax on these capital gains or losses. Section 1244 of the IRC regulates the taxation of restricted stock. Besides, restricted stocks are taxed as ordinary income for the year they vest. This is contrary to stock options, as they are not taxed when they are vested.

For taxation purpose, the amount of restricted stock that must be considered is the gap between fair market value of the stock on the vesting date and the initial/original exercise price of the stock.

However, section 83(b) election of the IRC allows the restricted stockholder to recognise the income from the restricted stock on grant date rather than the vesting date to calculate the ordinary income tax.

This is mainly done to minimise income tax liability. However, this is risky because if the restricted stockholder joins another company before the shares vest, then the taxes paid are non-refundable.

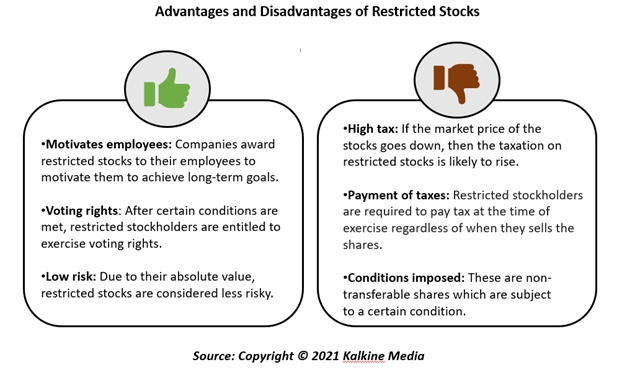

What are the advantages and disadvantages of Restricted Stocks?

Advantages of Restricted Stocks

- Motivates employees: Companies mainly offer restricted stocks to their employees as part of equity compensation. The conditions imposed on these stocks motivate the employees to stay in a particular company and help it achieve new milestones.

- Voting rights: After certain conditions are met, restricted stockholders are entitled to exercise voting rights. Besides, these stocks become regular shares for the employees after the completion of the vesting period.

- Low risk: Due to the absolute value, restricted stocks retain their value even when there is a drop in market prices after the day of grant. Therefore, they are considered less risky.

Disadvantages of Restricted Stocks

- High tax: If the market price of the stocks witnesses a downfall, then the restricted stockholders might be asked to pay extra taxes.

- Payment of taxes: All the employees are bound to pay tax at the time of exercise regardless of when they sell the shares.

- Conditions imposed: These are non-transferable shares which are subject to a certain condition. This means that the employees cannot stake ownership rights over the restricted stocks until certain conditions are met.