Definition

Related Definitions

Recession

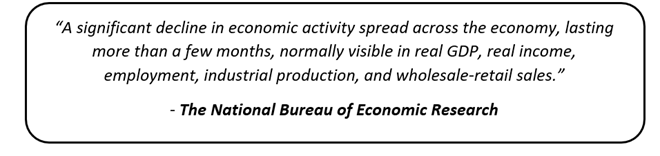

What is Recession?

Simply put, Recession is a macro-economic phenomenon characterised by a dip in economic activity, fall in aggregate demand and soaring unemployment levels for an extended period of time. Some experts define the onset of recession with the negative economic growth rate for two consecutive quarters, as Technical Recession.

COVID-19 Pandemic Rang Bells of a Technical Recession Across the Globe in 2020

During a recession, the economy faces sluggish retail sales, crushed consumer confidence, dip in business sentiments, job losses, reduced manufacturing output and sales¸ with a decline in the nation’s overall GDP.

What are the Leading Indicators of an Economic Recession?

Economic monitoring agencies such as the National Bureau's Business Cycle Dating Committee maintains a chronology of U.S. business cycles in the forms of peaks and troughs. While the peak is defined as the month in which several macroeconomic indicators reach their highest level, a trough is identified as a month in which economic activity reaches a low point and begins to rise again for a sustained period. The period between a peak and a trough is a contraction or a recession, and the period between the trough and the peak is an expansion.

Predicting future recessions is not an easy economic phenomenon, given a lot of uncertain factors involved in economic forecasting. However, economists monitor macroeconomic fundamentals to gauge the recession scenario. Below are some of the leading indicators of looming threats of economic recession:

- Negative Economic Growth Rate

- Yield-Curve Inversion

- Sharp Stock Market Declines

- Dip in Unemployment

- Asset Bubble

- Sudden Economic Shock

- Excessive Debt

- High Inflation Levels

What were Chief Triggers Behind Previous Episodes of Recession?

Because the US is the largest economy of the world and has robust financial and trade linkages with several other economies, most of these internationally synchronized recession outbreaks also coincide with the US’ recessions.

- Global Virus Crisis (February 2020 Beginning) - The NBER officially declared a U.S. recession due to coronavirus in June 2020, noting that the U.S. economy fell into contraction starting in February 2020. According to the World Bank, the COVID-19 recession seems to be worse than twice the depth of 2007-09 Global Financial Crisis and the deepest since 1945-46.

Good Read: Three Unique Investment Tips to Build Recession-Proof Portfolio in COVID-19 Crisis

- Global Financial Crisis (2007-2009)- Following the unsustainable housing bubble and credit boom, a downturn in the US housing market proved to be a catalyst for the financial crisis that spread from the US to the rest of the world through financial system linkages. Excessive risk-taking in a favourable macroeconomic environment, increased borrowing by banks & investors and regulation and policy errors were considered as the key factors behind one of the deepest recessions post 1930s Great Depression.

- The Dot-Com Recession (March 2001 to November 2001): A rampant excitement and investment into tech stocks terminated with a bang 20 years ago, when the dot-com bubble busted officially.

With the easy and common access to world wide web in the mid to late 1990s, reckless fad investments were made by investors in technology stocks and internet-based companies, fuelling NASDAQ to record high levels of ~5,000 in the year 2000 from ~1,000 in the year 1995. While, the good times didn’t last, with NASDAQ crashing to ~1,100 by October 2002, wiping off 75 per cent of market value from the equity market.

Consequently, the US economy suffered a dot-com bubble recession, which induced massive job losses in the tech sector, triggering repetitive rate cuts by the Federal Reserve.

- The Gulf War Recession (July 1990 to March 1991): A steep increase in oil prices can be an indication of a recession, as evident during 1990 oil price shock when energy became expensive in response to the Iraqi invasion of Kuwait on August 2, 1990, pushing up the overall price level with a significant dip in aggregate demand.

- Great Depression 1930s: Recognised as the only economic depression of the modern era, the Great Depression hit the world in 1930s, lasting from 1929 to 1939. The Great Depression initiated in the US, resulting in around 30 per cent fall in the nation’s real GDP and more than 24 per cent rise in the unemployment rate. The severity of this depression was evident from acute deflation, remarkable falls in output and terrible unemployment rates in almost every single country of the world.

What are the Economic and Social Impacts of Recession?

Previous episodes of recession have been seen to be giving a dent to social and economic considerations of the nations as outlined below:

Economic Blow

- Weak Output Levels

- Rising Unemployment Rates

- Fall in income

- Lower levels of household spending and investment by businesses

- Fall in asset prices (e.g. fall in house prices/stock market)

- Higher government borrowings (less tax revenue)

- Financial and banking sector instability

Social Blow

- Mental Stress amidst bankruptcies and business losses

- Sustainability fight amidst a rise in poverty, an increase in inequality

- Health problems and social issues such as suicides

- Impact on education affordability

What are the Types of Recession and Recovery?

While there is no specific classification system to define recession shapes, economists tend to refer to four key shapes of recession and the resultant economic recovery:

- V-Shaped Recession: Recessions that start with a sharp fall in economic growth but then discover a bottom and rebound strongly, are categorised under V-shaped recessions.

- U-shaped Recession: Recessions that commence with a relatively slower fall in economic growth but then stay at the bottom for multiple quarters before turning around and reviving are classified under U-shaped recession.

- W-Shaped Recession: Recessions which initially start like V-shaped recession but turn back down again after exhibiting false signs of recovery, demonstrating a ‘down up down dip’ shape akin to W are deemed to be W-Shaped Recessions.

- L-shaped Recession: Recessions in which economic growth quickly falls and fails to stand back are termed as L-shaped recessions.

Though V-shaped recessions are considered to be a best-case scenario for an economy, L-shaped recessions, that offer no hope of economic revitalisation, are believed to be the worst case scenario.

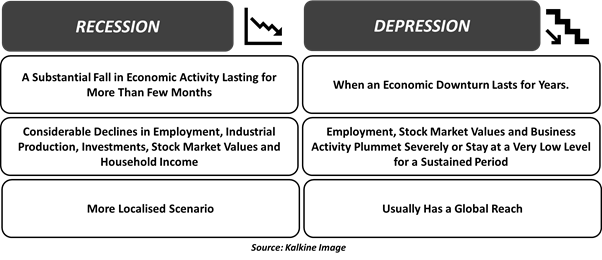

What is the Difference Between Recession and Depression?

The key difference between recession and depression is usually marked by the duration and depth of an economic downturn. While a recession is characterized by a considerable dip in economic activity lasting for more than a few months in a more localized scenario, a depression is noted when an economic dip lasts for years, usually with a global reach.

What are Feasible Responses to an Economic Recession?

While recession casts a heavy blow to the nation/world’s economic, financial and social aspects, efficient policy responses play a crucial role in containing the downturn and charting out gradual recovery prospects. Some of the key policy responses are listed below:

- Monetary Push- Monetary authorities, in a bid to contain recession and aid dysfunctional markets, engage in Quantitative Easing i.e. purchasing long term securities in Open Market Operations, reduce interest rates, and lend money to the financial institution, thereby increasing the money supply.

- Fiscal Initiatives- Governments undertake key changes in tax norms, infrastructural investment and increased spending to support employment and aggregate demand.

- Robust Oversight of Financial Firms- In the face of crisis, regulators are often seen to be strengthening their supervision of banking and financial space in an attempt to prevent the risk spread.

Read Through Some Investment Strategies to Build Recession-Proof Stocks