Definition

Related Definitions

Portfolio Investment

What is a Portfolio Investment?

It is a set of investments comprising various financial assets like stocks, funds, bonds, currencies, cash and liquid instruments, and other commodities owned by an investor to earn profit. Portfolio consists a set of financial assets in which investment is made with the aim of earning profit.

Summary Points

- Portfolio Investment consists of different financial assets such as bonds, stocks, funds, etc.

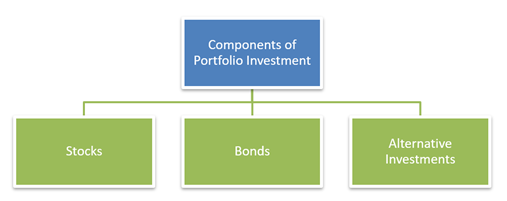

- Stock, bonds, and alternative investments are three components of Portfolio Investment.

- A diversified portfolio reduces risk for the investors.

Frequently Asked Questions (FAQs)

How to understand a Portfolio Investment?

Portfolio investment features different asset classes such as corporate bonds, real estate investment trusts, mutual funds, government bonds, stocks, exchange-traded funds, and bank certificates of deposit.

A portfolio investment is a direct investment; includes a variety of assets purchased with a motive that it will give good returns or appreciation in value.

Risk bearing and time boundaries are main factors while selecting any portfolio investment. Portfolio Investment also includes investments in real estate, commodities, timber, and even art.

Portfolio Investment can be divided into two categories - strategic and tactical.

Strategic investment defines purchasing of financial assets for a long time. Tactical approach of investment refers to purchasing and selling activity in short time.

What are the Components of an Portfolio Investment?

The assets of a Portfolio is referred to as an asset class. The purpose is to make sure that there is a proper balance of assets, which is good for capital growth or in controlling risk. It includes the following:

Source: Copyright © 2021 Kalkine Media Pty Ltd

- Stocks

Stocks are one of the main components of a portfolio investment. They refer to a part or portion of a company. It signifies that the owner of the stocks is the owner of the company and the ownership in the company depends on the percentage of shares he/she owns.

Stocks are also called as shares. A stock is the source of income of a company because it makes profit out of it.

- Bonds

A bond is an instrument that refers to a loan that is given to a borrower. The issuer of bonds can be a company, a government, or an agency. Bonds are not considered as risky as stocks but they also churn out lower rewards. Bonds are issued on a specific date. When bonds are matured, principal amount is to be returned along with interest.

- Alternative Investments

Portfolio Investments also include the alternative instrument. These investments include gold, oil, and real estate. Alternative Investments refer to those assets whose value can increase by time. Alternative Investments are mostly less traded as compared to stocks and bonds.

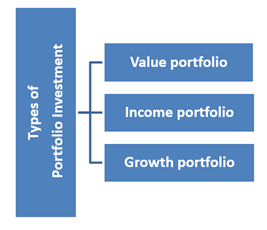

What are the types of Portfolio Investment?

Portfolios are of various types, according to their investment.

Source: Copyright © 2021 Kalkine Media Pty Ltd

- Growth portfolio

Growth portfolio focuses on promoting growth by taking high risks. In this portfolio, investors or financial managers mostly invest in growing industries, younger industries that have more potential for growth. In growth portfolio, investor’s emphasis is on investments that typically bestow higher potential rewards and higher potential risk.

- Income portfolio

Income portfolio, as the name itself suggests, shows that it is based on constant returns from investments as other portfolios depend upon possible capital gains. It aims to have regular income from investments.

- Value portfolio

Value portfolio focuses on valuation of assets, and as per this asset valuation, the investment is done. Investors often buy cheap assets after valuation and churn out profits out of it.

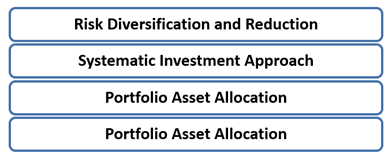

What is the significance of Portfolio Investment?

Portfolio investment is important for asset allocation and diversification in order to reduce the risk of incurring maximum loss.

Source: Copyright © 2021 Kalkine Media Pty Ltd

- Risk Diversification and Reduction: Portfolio investment helps in reducing risk rather than increasing income. One of the biggest challenges in investing is the uncertainty of an investment's future performance and thus the risk of investment losses.

- Systematic Investment Approach: Portfolio investment is a systematic way of investment, which is likely to benefit the investor in the long run. In order to get return in long term, one has to set portfolio objectives with formulating a strategy that garners positive result after an investment.

- Portfolio Asset Allocation: It is the most important part of portfolio investment to minimise the chances of risk. An investor can have hundred different financial assets in his portfolio, even so if they all are invested in one sector, investor can face risk of that sector. To avoid the risk, investors allocate their portfolio to different portions and invest in various sectors and asset classes.

- Minimal Security Analysis: In the past, security selection required a three-step analysis of economy, industry, and company. Although portfolio investment involves assembling a collection of individual securities, the focus is less on the merits of each security standing alone, and more on how they may fit with the expected overall performance of the portfolio.

What are the steps in building a good Portfolio Investment?

An investor or financial manager should take note of the following steps to create a good Portfolio Investment.

- Determine the objective: For a good Portfolio Investment, Investors have to know what exactly the portfolio is for and start pondering over and researching on what kind of investment needs to be made.

- Reduce investment turnover: Some investors use tactical approach - purchasing and then selling stocks within short time. This increases transaction costs. In order to minimise investment turnover, investor should go for long-term investment.

- Don’t spend more on an asset: The higher price for buying an asset, the higher chance of having total is equal revenue. So, by spending low on an asset, the chances of profit will be high.

- Diversification of investment: For a good portfolio, investors should diversify their investments. When some investments are in decline or in loss, others may be on the rise. Holding different assets of investments helps to lower the overall risk for an investor.