Definition

Related Definitions

open-end funds

What are open-end funds?

A diversified portfolio that is created from the pool of investors that can issue an unlimited quantity of shares is known as an open-end fund. The sponsor directly sells shares to the investors and redeems them also. Based on the net asset value, the pricing of these shares is done daily. There are many types of open-end funds such as exchange-traded funds, hedge funds and mutual funds.

Closed-end funds are the counterpart of the open-end funds and are less popular. Open-end funds are the safeguard on the investment alternatives offered in the company-sponsored retirement plans.

Summary

- A diversified portfolio that is created from the pool of investors that can issue an unlimited quantity of shares is known as an open-end fund.

- The sponsor directly sells shares to the investors and redeems them also.

- Based on the net asset value, the pricing of these shares is done daily.

-

There are many types of open-end funds such as exchange-traded funds, hedge funds and mutual funds.

Frequently Asked Questions (FAQs)

What is the working of open-end funds?

Shares are issued by an open-end fund in accordance with the demand of the buyers. These funds are always open for investment, and are therefore, termed open-end funds. With the purchase of the shares, new replacement shares are created by the fund, while the sale of the shares results in taking shares out of circulation. NAV determines the price at which shares are bought or sold. The calculation of the value is done at the end of the trading day on the underlying security’s value. In case a large quantity of shares is redeemed, then the sponsor can sell its investment to pay the investors.

An open-end fund extends a low-cost and easy way to pool the money and buy a portfolio in accordance with the investment objective. The investment objective can be grown in the investment, generation of income and so on. The investment can also have a specific target such as large, mid or small companies, specific countries, industry to name a few. The open-end funds can be accessed by all type of investors as the investment does not require a large sum of money.

It happens occasionally that funds are closed for new investors. It happens when the fund managers feel that the open-end fund has become too large and is not fulfilling the objective. In some cases, the fund can be closed for the existing shareholders also.

The open-end funds are like mutual funds virtually, and many investors might even be unaware of their investment type.

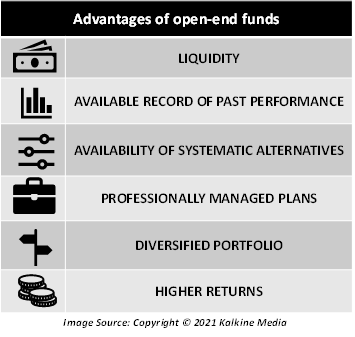

What are the advantages of open-end funds?

An investor can take the following advantages by making an investment in the open-end funds –

- Liquidity – The investor has access to the liquidity as there are no restrictions on the units which can be redeemed in open-end funds. The advantage of liquidity can be taken at any time. The redemption of the funds is done on the net asset value on the day of redemption.

- Past performance – The historical data of the open-end fund is available through which investors can easily track the past performance of the fund and make the investment decision accordingly.

- Availability of systematic alternatives – The investors can utilize systematic plans in the open-end fund while investing funds and withdrawing funds. An investor can choose from systematic transfer plans, SWPs and SIPs.

- The plans are managed professionally – The open-end funds are managed by experienced fund managers. These people are responsible for making investment decisions by making use of their resources, experience, and expertise in the field.

- Diversified portfolio – The funds pooled for open-end funds are invested in various assets. The stocks belong to a range of companies, industries, and countries. With diversification in the investment, the risk associated with the investment is minimized considerably.

- Higher returns – The returns through open-end funds are better in comparison to other types of schemes. Those investors should invest in the open-end fund whose investment horizon is short.

What are the disadvantages of open-end funds?

A lot of advantages are associated with the open-end funds; however, they also carry a few risks and disadvantages with them.

- The open-end funds are exposed to a large volume of inflow and outflow, unlike the closed-end funds. In case, the fund is facing sudden outflow (increase in the redemption), then the fund manager will be forced to sell the current holding at lower prices, as a result, the loss will be encountered by all the unitholders.

- A considerable amount of market risk is instilled in the open-end funds. The net asset value of the funds fluctuates on daily basis because of the volatility in the underlying asset. Thus, investors should take into consideration the market risk component while making an investment decision.

- The liquidity should not be viewed only from the positive perspective only as it adds disadvantages in the case of open-end funds. Lock-in case is not available in the open-end fund; therefore, an investor can make investments during the bull period and redeem their holding during the volatile period because of the fear of losing the money.

- The exit load is present in the open-end funds. Exit load is a charge which is paid by the investor in case they exit the fund in a predefined time which is usually 1 year. Therefore, the overall earnings are reduced in case it attracts capital gains tax.

How to invest in open-end funds?

An investor can get in touch with the distributors and agents of the mutual funds and gain the necessary information and forms in relation to the investments in open-end funds. The investor should make sure that the agent is a registered distributor.

In case the investor wishes to invest through the direct plan, then the financial advisor should be contacted and save the fee of commission to the distributor. In comparison to the closed-ended funds, the returns are maximized by this procedure.

When investment is done through a distributor, the distributor will enclose all the commission amount which must be paid to them in exchange for providing a range of schemes.

Moreover, direct investment can be done in mutual funds through online mutual funds websites or branches of mutual funds. Agents can help with depositing the documents or the forms. It is recommended that investors should assess the track record of the funds they are making investments in. The investor should refer to the schemes of the funds as issued by the regulatory authorities.