Definition

Related Definitions

National Securities Clearing Corporation (NSCC)

What is a National Securities Clearing Corporation?

National Securities Clearing Corporation (NSCC), a subsidiary of Depository Trust & Clearing Corporation (DTCC), was formed in 1976 and offers centralised clearing, settlement, information, and risk management to the financial industry. It also functions as a central clearing counterparty (CCP) for corporate debt, foreign exchange, shares, and other investments.

The NSCC provides:

- Multilateral netting.

- Allowing brokers to combine sell and buy positions into a single payment obligation.

- Lowering financial risk and capital needs.

The US Securities and Exchange Commission (SEC) monitors the National Securities Clearing Corporation, which was formed as a commercial entity in 1976. Thus, NSCC must adhere to the SEC's standards, which are enshrined in the Exchange Act.

Moreover, the Securities and Exchange Commission (SEC) is a federal government agency that enforces federal securities laws and develops securities rules. It is also liable for stock and options exchanges, the securities industry, and the regulation of electronic securities markets and other national events. The SEC's mission is to safeguard investors and guarantee that markets are efficient, fair, and orderly. Apart from that, it attempts to create a market environment in which individuals can have faith.

According to the Exchange Act, the NSCC wants to keep credible risk management procedures in place and meet statutory requirements. Therefore, the requirements are written as "Covered Clearing Agency" guidelines to strengthen the legal foundation for clearing agency oversight.

In addition, the Depository Trust and Clearing Corporation (DTCC), the NSCC's parent business, functions as a counterparty to securities exchanges and as a central depository for securities.

NSCC, on the other hand, nets trades and payments among its members, lowering the value of payments that must be transacted by 98% daily. Thus, t+2 is how NSCC usually settles and clears deals.

Summary

- National Securities Clearing Corporation (NSCC) was formed in 1976 as a subsidiary of Depository Trust & Clearing Corporation (DTCC).

- The organisation offers centralised clearing, settlement, information, and risk management to the financial industry.

- The NSCC wants to keep credible risk management procedures in place and meet statutory requirements.

Frequently Asked Questions (FAQs)

What is the Depository Trust & Clearing Corporation (DTCC)?

DTCC was established in 1973 and has since grown as one of the world's largest securities depositories and a global financial services business dealing in post-trade transactions.

The National Securities Clearing Corporation (NSCC) manages one depository and four clearing organisations with the Depository Trust & Clearing Corporation (DTCC). The ultimate focus of DTCC is to combine DTC (another subsidiary of the DTCC) and NSCC, streamlining clearing and depository transactions to lower costs and boost financing efficiency.

Source: © Kdrs32 | Megapixl.com

Furthermore, the corporation is structured as a limited-purpose trust firm that offers electronic safeguarding of securities balances and serves as a clearinghouse for the settlement and processing trades in municipal and corporate securities.

DTCC has offsetting positions with clients in every transaction to guarantee that the transactions are executed efficiently and speedily. Clearing brokers affiliated with the DTCC are exchange members who aid in properly settling trades and completing transactions. Furthermore, the paperwork associated with the clearing and implementing a transaction is kept by these clearing brokers.

What is the National Securities Clearing Corporation's purpose?

Source: © Djbobus | Megapixl.com

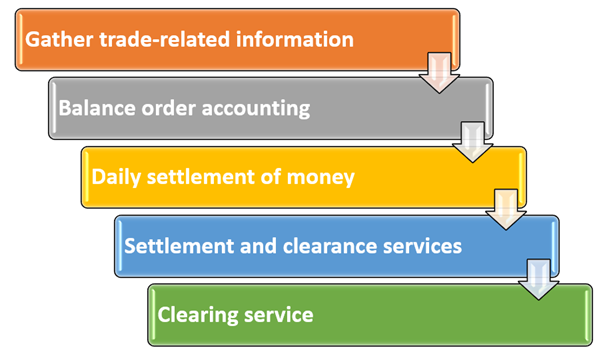

Gather trade-related information

The NSCC employs the Universal Trade Capture (UTC) system to gather trade-related information from 50 trading venues around the United States daily. The data is subsequently checked, the sales and purchases are completed, and the trade comparison findings are communicated to the members.

Moreover, 90% of the trade information has already been compared in the marketplace. The NSCC employs the UTC system to assess and store the information and present it among the members.

Settlement and clearance services

The NSCC uses its Continuous Net Settlement (CNS) System for clearance and settlement services. By netting all the recorded and confirmed transactions, the CNS system offers every member a net long (buy), one short (sell), or flat position for a specific settlement date.

The NSCC is responsible for procuring, compensating, and distributing securities for settlement purposes on behalf of its members. The CNS netted method decreases the quantity of securities that must be transferred to settle transactions, cutting the expense. In addition, the NSCC is responsible for processing transactions for securities qualified for book-entry transfer on the books of the Depository Trust Corporation (DTC).

Balance order accounting

For securities that do not qualify for CNS processing, the NSCC offers a Balance Accounting System. The system sends NSCC members instructions for receipt and delivery of allotted and netted positions.

The "clearance cash adjustment," which offers a modification to mark-to-market pricing to process the netted and allotted balance orders, is the balance order portion addressed by the NSCC.

The NSCC does not engage in balance order transactions. Still, it provides a trade guarantee to deliver and receive valid parties until the close of business on the specific settlement date.

Source: Copyright © 2021 Kalkine Media

A daily settlement of money

Money is settled with the NSCC at day's end. The method is centralised with the money settlement of the Depository Trust Company so that common participants can acquire consolidated reports and a single point of access to settlement data. The NSCC encapsulates and nets the money credit and debit transaction information captured during the day, producing an aggregate money debit or credit for every participant. DTC participants' transactions are likewise netted and recorded.

Clearing service

The NSCC permits other members to serve as an executing broker, referred to as a special representative, to settle and clear transactions for members.

In the case of an original purchase order, the special representative would be considered a seller. The member would be considered a buyer, effectively netting out the original trade transaction's executing broker. The Universal Trade Capture System handles the correspondent clearing services.