Definition

Related Definitions

Market Timing

What is market timing?

Any buying and selling forecasts an investor considering future price movement are referred to as market timing.

Market timing is when an investor predicts that a stock's price will be below or above a specific level on a given day. These predictions might arise from various judgments or thoughts, such as attempting to learn trends or reviewing a price chart from the past.

Any security can be used to time the market. The most prominent example is stocks, but market timing can also lead to gold, bond, or real estate investments. Market timing can be used to trade anything subject to market forces.

Summary

- Market timing is a trading or investment method in which a market participant tries to beat the stock market by anticipating its fluctuations and selling and purchasing in response.

- Buy-and-hold, a passive strategy in which investors acquire securities and hold them for an extended period regardless of market volatility, is the polar opposite of market timing.

- Market timing is possible for portfolio managers, traders, and other financial specialists, but it is challenging for the average investor.

Frequently Asked Questions (FAQs)

How does market timing work?

Market timing is an investment strategy in which a market participant buys or sells a financial asset depending on future price fluctuations. While making trading decisions, the market timing method can be utilised to enter or exit markets and choose between asset classes or different assets.

Market timing is based on what an investor believes will happen in the stock market in the future. For example, if an investor finds a stock trading at AU$100 on Monday and believes it will decline to AU$97 by the end of the week, they may short the stock or purchase a Friday put option. Both of these trades are bearish and rely on the stock price falling to profit. If the stock drops below the investor's expectations, they profit. If the stock goes up, the investor's market timing is deemed unsuccessful, and they lose money.

The opposite, however, is also valid. If an investor believes the stock price will climb, they can buy a call option that expires on the day they believe the stock will rise.

Source: © Mike2focus | Megapixl.com

Additionally, because their price is inextricably related to anything else, options are a sort of derivative security. You get the right, but not the obligation, to sell or buy an underlying asset at a specific price on or before a specific date when you purchase an options contract. A call option allows the holder to acquire stock, whereas a put option allows the holder to sell a stock. A call option is a type of investment that can be used to the down payment on future investment.

Another example of market timing is when an investor sells their stock because they fear a stock market crash, which comes with the high risk and profit that market timing entails.

Even if it's evident that an asset bubble is growing, it's scarce for someone to foresee a catastrophe down to the minute. An asset bubble occurs when the price of assets such as stocks, houses, or gold rises substantially over a short period without being sustained by the product value. During a bubble, investors buy up the price of an asset beyond its actual, long-term value. When demand weakens, or prices plummet, the bubble eventually "bursts."

A systematic or formulaic strategy, on the other hand, is the polar opposite of market timing. Instead of speculating where a stock's price will be on a specific date, systematic investors strive to disregard prices entirely and regularly buy the same amount regardless of price.

When should a market timing strategy be used?

It would be hard to implement a market timing strategy consistently and effectively. Regardless, it appeals to investors because of the ability to make a fortune quickly, as opposed to the long-time horizon needed by most other strategies to value investing or formula acquisition.

Portfolio managers, professional day traders, and other financial professionals who can commit significant time to analyse economic projections and accurately predict market moves with such consistency have found success with market timing. However, it is more beneficial for the average investor to concentrate on long-term investing because daily market monitoring is inconvenient.

Source: © Webking | Megapixl.com

What are the market timing analysis techniques?

Under the market timing method, any selling or purchasing choices are based on one of two types of analysis:

Fundamental analysis

When conducting fundamental analysis, an analyst makes assumptions about variables that influence selling and buying decisions, and market timing is a mathematical function of these variables. It is critical to determine the most precise timing for making a decision. For a mid-to-long-term time horizon, fundamental analysis is used.

Technical analysis

Market timing in technical analysis is determined by the history of investor behaviour and the stock's previous performance. Technical analysis is typically applied to investments with a short- to medium-term horizon.

Source: Copyright © 2021 Kalkine Media

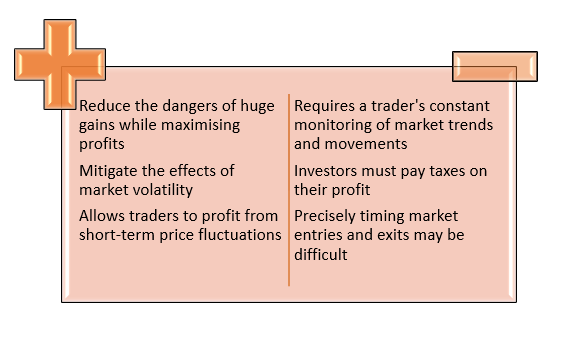

What are the benefits of implementing a market timing strategy?

The following are some of the advantages of using a market timing strategy:

- Market timing is utilised to reduce the dangers of huge gains while maximising profits. In terms of investment, it's the standard risk-reward trade-off: the more significant the risk, the higher the gain.

- Traders might use it to mitigate the effects of market volatility.

- It allows traders to profit from short-term price fluctuations.

What are the drawbacks of implementing a market timing strategy?

Real-life examples and empirical studies reveal that the costs of using a market timing technique usually exceed the potential benefits, as follows:

- It necessitates a trader's constant monitoring of market trends and movements.

- Higher transaction costs and commissions are involved, as well as a significant opportunity cost. Market timers exit the market when there is a lot of volatility. Because most market upswings happen during volatile times, active investors miss out on the chance and receive lower returns than buy-and-hold investors.

- An investor who makes a profit by selling high and buying low must pay taxes on their profit. The profit is taxed at the short-term capital gains rate, that is higher than the long-term capital gains rate if the security was held for less than a year, which is usually the case with market timers.

- It might be not accessible to time market entry and exits precisely.

Source: Copyright © 2021 Kalkine Media