Definition

Related Definitions

Market Risk

What is a Market Risk?

Market risk reflects the potential of reduction in the investment value due to the interplay of varying market forces in the direction that can lead to losses for the business/ investors.

Significantly, the returns on the investment are often exposed to a range of market forces over which the business/investors do not possess any control. For instance, the financial crisis following the outbreak of coronavirus can be called systematic risk, affecting the overall market. Similarly, a change in the economic policy that can typically impact certain types of companies can also be an illustration of market risk as it can hurt the profitability and share price of such companies.

What do we understand by Market Risk in Stock Markets?

Political upheaval, natural disasters, war, pandemic, and fluctuations in macroeconomic indicators such as inflation, interest rate, fiscal deficit, recession, etc. can also overall impact the market and are thus considered as market risk.

Market risk can be the measure of the volatility of the overall stock markets across different asset types, industries, and sectors.

Such risks are typically associated with the impact of macroeconomic indicators, global factors and geo-political concerns on the financial market rather than being linked up to a company or an industry. Thus, they have the potential to affect a range of investment across different companies and sectors.

The market risk is also called a Systematic risk, which can only be minimised but not eliminated through diversification.

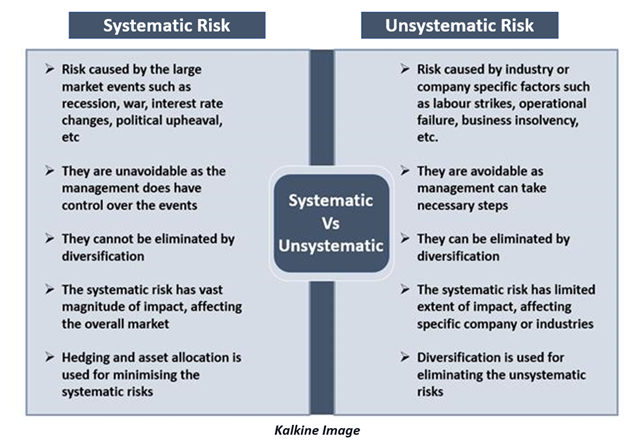

How does Systematic Risk Differs from Unsystematic Risk?

The total risk faced by the business can be categorised into Systematic Risk and Unsystematic Risk.

While Systematic Risk is the risk resulting from various external market variables that are uncontrollable and affect the entire market or segment, the Unsystematic Risk is mainly company or industry-specific and emerge from factors, which can be controlled by the necessary actions of the management.

Let us have a look at the key difference between Systematic and Unsystematic Risks.

- Causes of Risk- Systematic risk is caused by the widely impacting market variables or macroeconomicvariables such as market crashes, currency risks, economic downturns, terrorist attacks, etc. Whereas, Unsystematic risk is directly attributed to a company or industry. They are caused by microeconomic or internal factors, with the familiar risk sources involving business insolvency, labour strikes, disruption in operations, etc.

- Possibility to Avoid- Systematic risks cannot be avoided entirely by the management as it arises due to circumstances over which management does not have any control. The administration can avoid unsystematic risk if they take necessary actions in the right direction.

- Types-Systematic risks experienced by the investment typically include interest rate risk, inflation risk, regulatory risk, currency risk. The types of unsystematic risk include business risk, financial risk, operational risk, and insolvency risk.

- The magnitude of Impact-The extent of the impact of Systematic Risk can be felt across a broad range of organisations and sectors, which eventually impacts the value of the securities present in the market. Unsystematic risk only affects a specific section of the market or a particular company or industry.

- Management-Although systematic risk cannot be eliminated, one can mitigate it by utilising techniques such as hedging and asset allocation. The investors via diversification can dodge off the unsystematic risk.

How to Measure Market Risks?

Market Risk is generally measured using two methods which include Beta Value for the portfolio and value-at-risk (VaR) method.

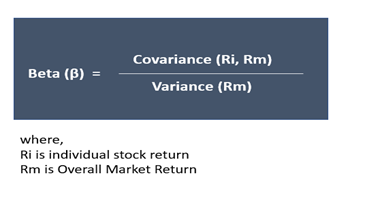

- Beta Measures

Market Risks can be evaluated using Beta, which indicates the volatility of a particular asset/stock/portfolio viz-a-viz the overall market volatility. Beta, also referred to as financial elasticity, is used as a measure of systematic risk of an asset considering the market as a whole. Significantly, the beta value of the market is considered to be 1.

Beta only considers the systematic risk, thereby providing a clearer picture of the market risks attached to the investment portfolio. It is also used in the Capital Asset Pricing Model (CAPM) for measuring the expected return of a stock, considering the risk-free rate plus a premium on the systematic risk attached to the security.

Beta Value Analysis

- If β < 1 => The systematic risk associated with the stock is less than that of the overall market. Thus, if the market index falls by 10%, the share price of the security is likely to drop by less than 10%.

- If β= 1 => The market risk attached to security is the same as that experienced by the market and the security share price will potentially mirror the market movement.

- If β > 1 => The systematic risk of the stock is higher compared to the overall market. Thus, a fall in the market index by 10% would lead to a plunge in the stock price by more than 10%.

- If β < 0 => The negative beta value indicates that the security moves in the opposite direction to the overall market. For example, the price of the gold stocks generally increases with the decrease in the overall stock market returns.

Investors calculate the Beta for the portfolio to gauge the systematic risk of the portfolio in comparison to the overall market risk.

- Value-at-Risk Measure

Value at Risk (VaR) is often used as a simplified technique of calculating the market risk. The measure encapsulates the entire market risk faced by a company. VaR is a statistical method, which answers three significant questions surrounding an investment decision, which are:

- What is the maximum potential loss that the investment can suffer?

- What is the likelihood of the loss to occur?

- What would be the time horizon for the loss?

VaR measures the degree of risk as well as occurrence probability attached to the security over a specific time period. For example, VaR of 2% at the one-month time frame, with 95% confidence level indicates that there is only 5% chance that the value of the security will fall more than 2% in the one month.

Market risk using VaR is calculated through the following methods:

- Historical Method- Using the historical data to calculate VaR.

- Variance-Covariance Method- Creating a normal distribution curve by combining data on average returns and standard deviation.

- Monte Carlo Simulation- Simulations are created for calculating VaR, and then different variables are input each time when running simulation. The graph generated based on the change in the input values provides a measure of market risk.

What are the ways to Hedge Market Risks?

Hedging is a risk management strategy generally undertaken for reducing portfolio exposure to the downside market risks. Hedging technique utilising financial derivatives involves holding offsetting position (long position vs short position) with the purpose to counterbalance losses from one position with profits from the another.

Following strategies can be undertaken to hedge against the market risks, depending on return expectation, financial situation and risk profile:

Futures Contract- It is a legal obligation on the two transacting parties to buy or sell assets and securities at a specific time in the future at a price earlier agreed upon by the parties. It prevents both the sides against the market risk resulting from the unfavourable price movement of the underlying security.

Options- The Options contract provide the buyer of the options an opportunity to buy or sell a security at a specified time at the predetermined and agreed upon price. While the buyer of the option has an alternative whether to execute the transaction or not, the writer (seller) of the option is obligated to sell or buy if the other party chooses to. Significantly, the buyer, therefore, pays an option premium for option rights granted.