Definition

Related Definitions

Market Index

What is a Market Index?

A market index could be defined as a representation of a security market, market segment, or asset class of freely tradable market instruments. A market index is primarily made up of constituent marketable securities and is re-calculated on a daily basis.

There are basically two forms or variations of the same market index, i.e., one version based upon the price return known as a price return index, and one version based upon total return know as a total return index.

Why Do We Need A market Index?

Ideally, a large number of market participants including investors and institutional funds gather and analyse vast amounts of information about security markets; however, doing so could be a very troublesome and tiring task as the work is both time consuming and data-intensive.

Thus, a large number of market participants prefer to use a single measure that could represent and consolidate a plethora of information while reflecting the performance of an entire security market of interest.

This is where market indexes play a major role as they are often a simple measure to reflect the performance of any underlying market of interest. For example, S&P500, NASDAQ, are believed to reflect the true performance and picture of the U.S. stock market in particular and U.S. economy in general.

Likewise, many indexes such as S&P/ASX 200 is believed to reflect the performance of the Australian stock market and so on.

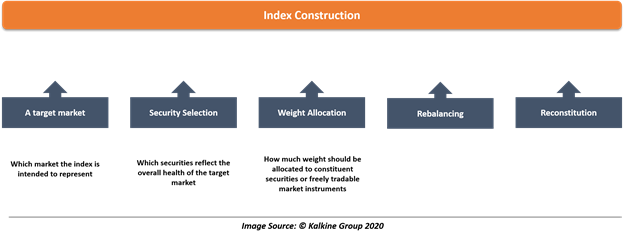

Index Construction

Constructing a market index is almost similar to constructing a portfolio of securities as the construction of an index requires:

Target Market and Security Selection

The first and the primary decision in constructing an index is to identify the target market and select financial instruments which reflect the true nature of the underlying market.

The target market, which determines the investment universe and securities available for inclusion, could be based on any asset class, i.e., equities, fixed income, commodities, real estates or on any geographic region.

Once the target market is identified, the next step is to select securities which represent the true nature of the target market and decide on the number of securities to be included in the index.

Ideally, a market index could be of all securities in the target market or a representative sample of the target market.

For example, some indexes such as FTSE 100, S&P 500, S&P/ASX 200, fix the number of stocks to be included in the index while indexes like Tokyo Stock Price Index (or TOPIX) select and represents all of the largest stocks, known as the First Selection.

For such indexes, the included securities must meet some basic parameters like pre-decided market capitalisation, the number of shares outstanding, to remain in the index.

Weight Allocation

The weight allocation varies considerably among indexes depending upon the method of weight allocation, and it basically decides on how much weight each security in an index carry.

The method of weight allocation is one of the most important parts that investors need to understand thoroughly as it has a substantial impact on the value of an index.

Some of the most widely-used weight allocation methods are as below:

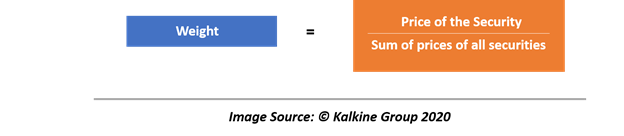

- Price Weighting

This method was originally used by Charles Dow to construct the Dow Jones Industrial Average (or DJIA) and is one of the simplest methods.

The price weight method determines the weight of each individual security of an index by dividing the price of the security by the sum of prices of all securities. In simple terms, each security gets the weight of its price in proportional to the total price of the index.

The primary advantage of this method is its simplicity; however, the method leads to arbitrary weights for each security as the method is highly sensitive to some market actions such as stock split.

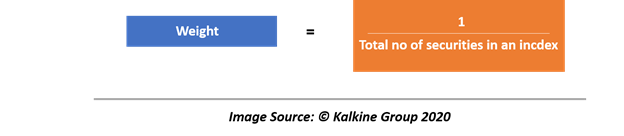

- Equal Weighting

As the name suggests, this method assigns equal weight to all securities in an index.

Just like equal weighting, the major advantage of this method is its simplicity; however, this method tends to underrepresent the value of large securities and overrepresent the value of smaller securities.

- Market-Capitalisation Weighting

Market-Capitalisation method weight each constituent by dividing its market capitalisation with the total market capitalisation of the index, i.e., the sum of the market capitalisation of each constituent.

The market capitalisation could be determined by multiplying the number of outstanding shares of the security with its market price per share.

Rebalancing and Reconstitution

Rebalancing of a market index could be defined as the adjustment to the weights of the constituent securities. Depending upon the method of weighting an index, the weight of each individual security tends to change due to market actions or price appreciation and deprecation, in similar fashion to a stock portfolio requires scheduled rebalancing.

A majority of market indexes are rebalanced on a daily basis as price tends to often change regularly.

On the other hand, reconstitution could be ideally defined as the process to change the constituent of a market index.

As suggested above, many market indexes such as TOPIX require each constituent security to meet some parameters for the inclusion; however, due to market dynamics, various securities tend to get added or removed from an index time to time.

Uses of Market Index

Originally, market indexes were created to provide a sense to investors on how a security market performed on a given day. However, with the development of the modern finance theory and growing numbers of indexes in the market, uses of market indexes have been expanded significantly.

Some of the major uses of market indexes are as below:

- To Gauge the market sentiment

A market index is usually a collection of the opinion of market participants; thus, they reflect the attitude and behaviour of the market participants, making them one of most widely used tool to gauge the market sentiment.

- To measure and model the risk and return profile of a market

Market indexes could serve as a proxy for systematic risk in many popular models such as the Capital Asset Pricing Model (or CAPM). The market portfolio, which represents the systematic risk of the market often uses a market index, as a proxy of the market portfolio as including the whole population or all stocks in the model could lead to wrong output, and it could be very costly and cost consuming.

- Serves as a Performance Benchmark

Market indexes often serve as a performance benchmark for individual investors and especially large investors such as mutual funds, ETFs, pension funds, and large banks.