Definition

Related Definitions

Lien

What is meant by Lien?

Lien is legal claim over the assets that are kept as collateral against a loan or debt. A lien is used to protect the underlying obligation which, as an example, can be the repayment of the loan. A legal claim such as a lien allows the lender to seize the asset in question if the borrower fails to make the repayment.

The lender who holds the lien claims is called the lienholder.

How does a lien work?

In those cases when a borrower fails to pay his mortgage or is not able to repay the loan, a lien can be placed on the underlying property kept as collateral. This is done so that the lender can obtain the amount owed to him.

A line may not only be associated with a loan repayment. A lien can also be applicable when one party is unable to pay fees related to a service, child support, contractor’s bills, rent or a court judgement. Any transaction in which the consumer is unable to pay for the service or good availed by him can lead to the service provider turning towards a lien.

Mutual liens can also be signed between the two parties. This happens when the borrower is unable to make the payment, so he/he offers to sell off the underlying asset in exchange for the services received. When a lien is listed with the concerned authority, it shows that the lender has an interest in the underlying asset before it can be sold off elsewhere.

Once the lienholder gains access to the underlying asset, he/she may resell it for profit.

What is an example of a lien?

Consider a legal case wherein an attorney has been hired to carry out the necessary paperwork. Suppose the case is ongoing, however, the concerned person has failed to make the payment to the attorney for his services.

In such a case, the attorney can file for a lien and seize the paperwork. This would enable the lienholder to not go into a loss. Consequently, the customer would be forced to pay up for the services of the attorney. Thus, the lien would be dropped once the fees is paid.

Similarly, consider the case of a property owner who rents out his property to an individual. If the individual refuses to pay the rental fee, then the property owner can take him to court. Now, the court places a lien on the house owned by the individual. Thus, the individual may be forced to pay the rental fee, upon completion of which, the lien would be dropped.

What types of lien are there?

Lien may be of different types based on who puts a lien for instance financial institutions, governments, and small businesses. The following types of liens are there:

- Bank lien: Here the borrower uses an asset as a collateral on a loan taken by him. Here a lien can be filed by the lender with a governmental institution. The lien is released when the full amount is paid by the borrower.

- Judgement Lien: A judgement lien is placed by a court because of a lawsuit. Here, the defendant can be paid by liquidating the assets of the accused.

- Mechanic’s Lien: Mechanic’s lien is associated with real property. In case of failure of payment to the contractor, the latter can place a lien with the court. The judgement made against the non-paying party would include a lien being placed on an asset owned by him. This is settled by auctioning off the assets of the non-payer to make repayments to the lienholder.

- Real estate lien: A real estate lien allows the lienholder to seize and sell off any property of the property holder does not fulfil his side of the transaction. In mortgage loans, liens may be automatically placed. When a mortgage loan is issued, the bank may automatically place a lien on the underlying house, until the mortgage is completely paid off. Other real-estate liens may be placed in case of non-payment by the borrower. These are non-consensual liens.

- Tax lien: These liens are created by law rather than by a legal proceeding or by defaulting on payment. Authorities can be allowed to put liens on the property of irresponsible taxpayers. Municipalities may place such liens to recover property that has not been paid.

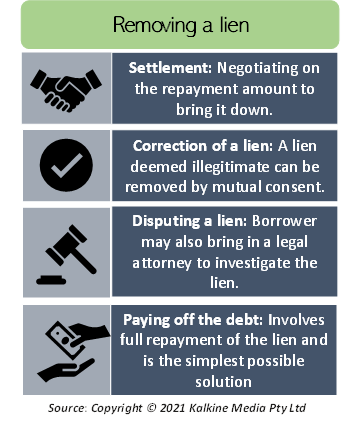

How can a lien be removed?

There are methods other than full repayment that can be availed by the borrower. These include the following:

- Settlement: Negotiating on the repayment can be done when the borrower does not have enough money to repay the original amount. Creditors might sometimes negotiate down to a lower repayment price, provided they get immediate payment.

- Correction of a lien: Sometimes a borrower may not feel that a lien is legitimate, then he/she may contact the lienholder and try to come to a common ground. Here the lienholder can be convinced to remove the lien under the pretext that it has been placed wrongfully.

- Disputing a lien: Juts like the lienholder, the borrower may also bring in a legal attorney to investigate the lien. This is helpful in finding out whether the claim is valid in the current period or not as liens also have an expiry date attached to them.

- Paying off the debt: This is the simplest possible solution to the problem as it involves full repayment of the lien which would automatically remove the lien. This is the borrower’s last resort when all the other methods are not possible, i.e., when the lien is legitimate.