Definition

Related Definitions

Legal entity

The legal entity is a term used to underline a separate legal person. A legal entity is an organisation that has separate legal rights and responsibilities from its owners. It is often a body recognised under law, which enters contracts and can sue or be sued in a court of law. The concept came into existence to do away with the personal liability of owners towards a business. With a separate legal entitlement, parties can directly hold the organisation responsible and accountable for its actions. It can also take up obligations and be liable for them. In Australia, specifically, every legal entity possesses a legal entity identifier code. It is a code used to identify any financial documentation related to the entity. It enables easier judicial actions and identification.

Highlights

- A legal entity is an organisation that has separate legal rights and responsibilities from its owners.

- A legal entity is usually eligible to perform all activities allowed in common parlance to a human being.

- There is a limited personal liability as owners and managerial roles and responsibilities are different for the entity.

Frequently Asked Questions (FAQ)

What are the features of a legal entity?

Source: © Outchill | Megapixl.com

- The key features of a legal entity are as follows:

- It has a separate identity from its owners.

- It can buy, sell, and own any assets in its name.

- It can enter legally binding contracts and sue or be sued in its name.

- The liability of its owners is separate from its owners.

- It is identified as a different entity for the statutory obligation.

A legal entity can perform all activities allowed in common parlance to a human being in law. However, it has a separate legal personality and existence. Its features are described and recognised by laws.

What are the types of legal entities?

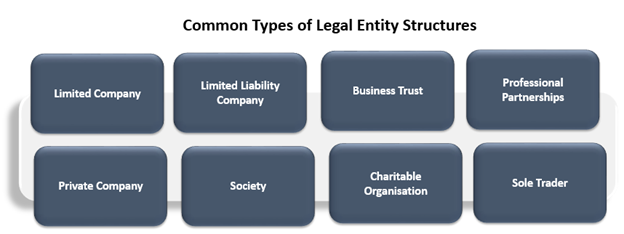

There are various forms in which a legal entity can exist. However, the common types of legal entity structures are:

Source: Copyright © 2021 Kalkine Media

In different countries, different types of organisational structures have been recognised as legal entities.

In the US only, sole proprietorship, partnership, corporation, limited liability companies (LLC) are the more commonly found legal entities.

To have a separate legal entitlement in the UK, an organisation can choose to be a limited company, a limited liability partnership (LLP), an incorporated charitable organisation, and an industrial society or one formed as a provident society.

In Australia, the four more common types of legal entity structures are a sole trader (unincorporated), a partnership, a trust, and a company.

In Dubai, this differs even more. Compared to other Emirate countries, it includes companies registered by category as – company, partnership, branch office or free zone company, as a separate entity. Even an organisation registered as a limited liability company, a civil company, a joint-venture, a private shareholding or a public shareholding company is included by law.

If one considers forming a legal entity in South Africa, they may form a public (Ltd) or private (Pty Ltd) company; incorporation or a personal liability company; a partnership firm or otherwise. They may also create a business trust, sole proprietorship, or an external company, a foreign branch in South Africa.

While the meaning of a legal entity and its characteristics do not change much, different jurisdictions allow different legal entity forms and types as per their laws. Therefore, the governing compliances and regulations also change from region to region.

What is the impact of legal entity on personal liability?

If a legal entity is formed for running a business or other purposes, the owners or promoters are freed from any personal obligations. It means the organisation’s obligations are separated from that of the entity. In cases of unpaid debts or other contingent obligations, only the entity is liable. Creditors cannot access the personal funds of the owners for it.

Example

Consider a professional fashion designer Ms Suave; she recently got her professional degree. Earlier she used to design clothes for her family and own use. But now, she wants to set up a professional design studio as a business project. She plans to employ workers under her and open a chain of stores in future. Now she registers this professional project as a separate entity under the law, namely, The Suave Studio. She needs a lot of equipment and tools for workers and a rental space. Thus, she applies for a loan in the name of The Suave Studio. Being a legally established business, she gets the loan for setting up the business, but repayment liability is on the legal entity. If the studio is not successful and it becomes difficult to repay the loan, only business assets can be sold to recover the loan. Ms Suave, personal assets remain with her and are not attached for loan repayment.

Why is legal entity identifier (LEI) important?

A legal entity identifier (LEI) is a unique ID, or a code associated with a legal entity. It is a term used specifically in Australia. No universal LEI-ID or a convention is stating its requirement. It was created because of the numerous problems faced by a lack of a uniquely identifiable code.

An LEI is a 20-character code used as a reference to identify the financial details of a legally distinct entity. It serves the dual purpose of-

Inimitability –Two legal entities cannot have the same LEI code. There is no replication.

Uniqueness – Once assigned, it is used uniquely for identifying one legal entity.

What are the advantages of a legal entity?

A legal entity generates its revenues, incurs expenses, and attracts separate legal liabilities. As a separate legal person, it offers the following advantages to its creators-

- limited personal liability.

- Ability to make separate legal binding contracts,

- Have a principal and agent relationship with the entity.

- Separate roles and responsibilities as owners and managers of the entity.

How is a legal entity different from an accounting entity?

An accounting entity is created for accounting classification purposes, while a legal entity is created to establish a separate legal identity. In accounting, the entity and its assets are distinct, whereas a legal entity may own certain assets and be liable for certain obligations in law.