Definition

Related Definitions

Hedge Funds

What is meant by hedge?

A hedge refers to a position taken by an investor to reduce risk related to the price movements of an asset. An investor hedges against risk by taking an offsetting position in the market for related securities. Since it is impossible to eliminate the risk completely associated with security, investors can only try to lessen it by taking opposing positions in the market.

The offsetting position taken by an investor can be in the market of existing securities or in the market of related securities.

How does a hedge work?

Investors use derivatives to hedge against uncertainties in the market. Derivatives are contracts that hold an underlying real asset like a stock. To better understand the working of a hedge, an example would be helpful.

Consider the case when an investor wants to buy a stock. However, there is a possibility that prices could decrease in the future, meaning the investor will face a loss if he sells in a bearish market. Thus, he wants to protect himself from reducing prices in the future. The current position held by the investor is that of a buyer of the security, therefore, an offsetting position for him would mean being the seller of the same security or related security.

The most common and efficient method that helps protect from a price decline are options. In the above scenario, a put option can be bought alongside the security. Buying either a call or put option gives the right but not the obligation to buy or sell the underlying asset, respectively.

Another way to hedge against risk is to diversify one’s portfolio by buying additional securities. This includes securities that do not rise or fall together so that if the investor faces loss in one security then the other securities, bring him a profit.

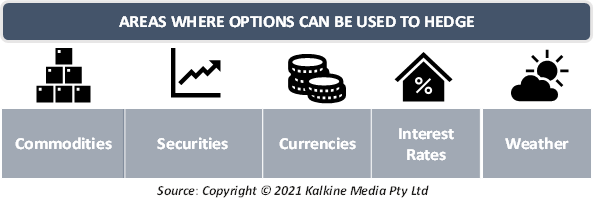

What are the areas where options can be used to hedge?

Investors can use hedging using options to protect against price volatility of various securities, including the following:

- Commodities: Commodity trading is one important area where investors want to hedge against changing commodity prices. For a commodity buyer, the risk would be that of increasing prices in the future. Thus, to secure himself, he/she can buy a call option.

If the physical market prices do not increase, then the buyer can simply purchase the commodity from there. However, suppose the prices in the physical markets increase. In that case, the buyer can simply exercise the call option and buy the commodity at the previously fixed strike price lower than the market price.

- Securities: The same is true for securities like shares, equities, indices, etc. The risk linked to these securities is called security risk or equity risk. Consider an investor who is short selling shares of a stock at $10 per share and is unsure whether the prices of the share would increase or fall in the future.

To hedge against the risk of increasing share prices, the investor can buy a call option with a strike price of $7 per share. If the market prices rise higher than $7 per share, the investor can simply exercise the call option and buy at a lower strike price than the market, giving him a profit.

- Currencies: These include foreign currencies, which have various types of risks, including exchange rate risk and volatility risk. Consider an Australian company with its operations in the US. Now, the US operations' profits would have to be exchanged at the existing AUD/USD rate

However, the company can hedge against an exchange rate decline by buying a put option to sell USD. In this case the strike price would again act as the lowest threshold below which the company would not have to pay to get AUD. However, if the exchange rate does not decline and stays above the strike price then the company can simply buy AUD from the market and not exercise the option.

- Interest Rates: Interest rate hedging can be done using interest rate options. An interest rate call option gives the owner the right but not the obligation to benefit from rising interest rates. If the market interest rate is higher than the strike price, then the owner of the option can exercise the call option.

On the contrary, an interest rate put option gives the holder the right but not the obligation to benefit from decreasing interest rates. Just like regular options, interest rate options also have a premium associated with them.

- Weather: Hedging can also be done against changing weather conditions. Weather derivatives may be used to hedge in such a scenario. For instance, firms that require a certain temperature to be maintained use something called “Heating Degree Days” or HDD as an index to trade in weather derivatives. Other indices may also be used, such as the number of cooling days, the number of days with rainfall, etc.

What is meant by a natural hedge?

A natural hedge refers to a hedge taken by an organization by adopting risk reducing operational methods. For example, a company that has operations in the US would be susceptible to exchange rate risk. However, if the company shifts its expenses to the US, then it could reduce its risk by minimizing exchange rate risk.

A natural hedge does not require investment into any additional funds. Rather it is a hedge that can be attained by cutting down on existing operations or by adopting less risky methods. A natural hedge may occur in those instances too, when equity or any other security is not involved and only the business operations of a company are being hedged against risk.

Why is hedging important?

Hedging offers various benefits apart from minimizing investors’ risk. Hedging provides a fixed range under which the investor would incur a loss. This means that with unpredictable market price movements, an investor would not be able to calculate how much loss he would incur if the market contrary to his expectations. However, with hedging, this potential loss becomes known, and the investor can prepare himself for a loss within an expected limit.

Investors can invest in various assets which provide greater liquidity to the market. Additionally, profits remain locked in for the investors through hedging.