Definition

Related Definitions

Gross Profit

What is gross profit?

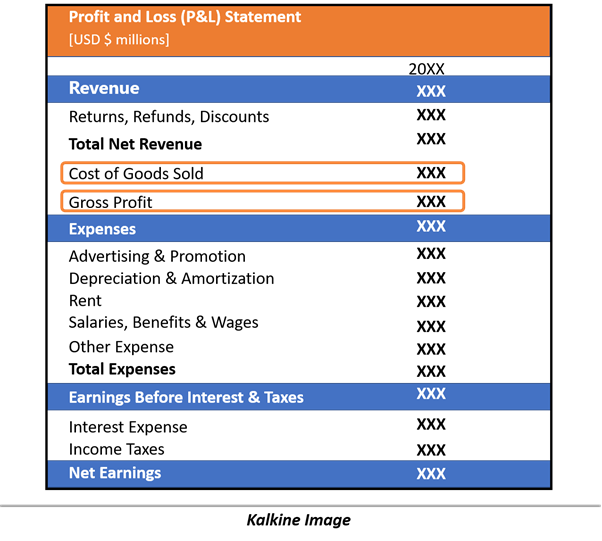

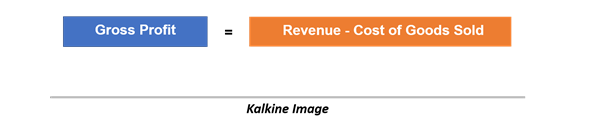

Gross profit is the profit a firm makes after deducting cost of goods sold from the revenue. Since only cost incurred in production of goods or services are deducted from the revenues, it is called gross profit. Also referred to as gross income, it depicts a broader level of profitability of a business.

Some firms would present cost of sales instead of cost of goods sold in the income statement. In such cases, gross profit will be revenue minus cost of sales. Cost of goods sold includes direct expenses incurred in the production of goods and services.

Alternatively, gross profit is calculated after deducting direct costs incurred in the production of goods and service from the sales or revenue. Direct cost for a firm could be direct labour expenses, factory overhead, cost of raw material, storage costs etc.

Under absorption costing used in financial reporting, the manufacturing costs incurred in the production of good or services are assigned to produced units. Because of this, the cost of goods sold also includes direct labour, direct material and factory overhead costs.

Gross profit does not include costs such as selling costs, marketing costs, insurance, salaries. Or it does not include cost that are not directly associated with the production of goods and services.

What is gross profit margin?

Gross profit margin or gross margin is the percentage expression of gross profit relative to the revenue of the company. As a primary indicator of profitability, it is used extensively to assess the broader profitability of a firm.

Gross profit margin of a firm is compared to the gross profit margin of other similar firms to assess the relative performance of companies. But it should not be compared with the companies in different businesses.

Why is gross profit important?

Gross profits exclude the direct costs associated with the production of goods and services; thus such costs largely have a positive relationship with the revenues. When the revenue of the company is increasing, the cost of goods sold would also increase since more cost elements of producing goods increase as more goods are produced to achieve higher revenue or sales.

When cost of goods sold as a percentage of revenue is higher, the gross profits will be lower. Whereas a relatively lower percentage of cost of goods sold relative to revenue will translate into higher gross profits for a firm.

Operating leverage

If a firm has relatively higher gross profit margin compared to its peers, net income will grow faster than the rate of growth in revenue. Likewise, when revenues are falling, net income will fall even faster than the revenues. This is called Operating Leverage.

At the time of recovery in a business cycle, the demand for goods and services picks up, and investors prefer companies with relatively higher gross profit margins and operating leverage to benefit to the increase in revenues, thus earnings.

Similarly, during a contraction in business cycle, the demand for goods and services is likely to fall, and investors try limiting the exposure to the companies with high gross profit margin and operating leverage because proportionate fall earnings would be higher than fall revenues.

Consumer-focused businesses

For consumer goods businesses, the brand image, awareness and customer affection towards the brand are of paramount importance. The level of gross profits of such businesses depicts the ability of the firm to invest in brand and the investment bearing fruit.

Investing in a brand means incurring costs related to marketing, advertising, selling, brand development, reach, marketing personnel, trade shows, sampling, customer surveys, consulting, packaging, discounts and promotions etc.

When a consumer business does not have healthy gross profit margins or gross profits, it shows the inability of the firm to invest in brands to generate excess returns. Even if the company intends to invest in brands with low gross profit margin, the ultimate impact would be lower net income.

Reliable metric for Acquisitions

When large consumer goods companies like Pepsi, Nestle go shopping for companies with emerging products or brands in the market, they are likely to focus on businesses with high gross profit margins.

It is because large consumer goods companies can well take care of expenses after the gross profits by the integrating of the sales and marketing channels of the acquired company with their existing sales and marketing channels that are proven.

Pricing power and cost advantages

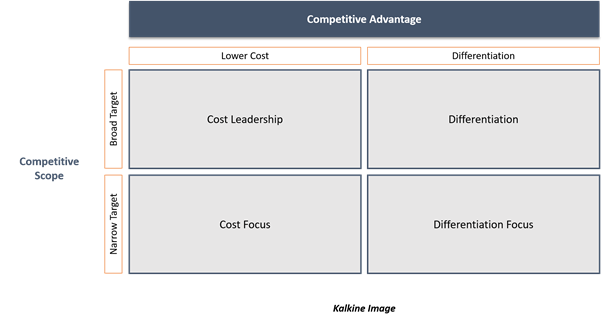

Pricing power and cost advantages of a business depict the competitive advantages of a firm. Companies thrive when they have competitive advantages and continuously seek to achieve and improve competitive advantages.

Gross margins could also depict whether the firm has pricing power or cost advantage. Pricing power means when a business can increase the price of goods and service without losing market share, and this could be seen when the firm has solid brand image and high conviction for the products among customers.

Businesses with pricing power could increase the price of end product, while cost of goods sold may not increase at the same pace, thus there will be higher gross profit margins since costs of goods sold has not risen at a similar intensity compared to revenues.

Similarly, businesses with cost advantages have the ability to keep the cost of production lower irrespective of increase in volumes sold or revenues, therefore improving margins as cost-base is lower while top-line is rising. Such cost advantages could be developed with economies of scale, bargaining power with suppliers, intellectual property, technology, labour productivity etc.

Difference between gross profit and net Profit?

Net profit or net income is the income earned by the businesses after incurring all expenses, including taxes, depreciation and amortisation, marketing and selling, general and administrative expenses.

Whereas gross profit or gross income is the income of the firm after deducting fixed and variable costs incurred in the production from revenues. It depicts a broader level of profitability of a firm.

Net profit of the company also includes non-operating income of a firm such as interest on cash held at bank, gain on sale of assets etc. In contrast, gross profit only includes income of a firm derived from primary operating activity.