Definition

Related Definitions

Fundamental Analysis

What is Fundamental Analysis?

Fundamental Analysis is a method to evaluate the intrinsic value of a business through evaluating the financial, economic, qualitative and quantitative factors. It is usually applied when investors seek to invest in a business for a long-term. However, special situation investing, such as buy backs, rights issue, merger and acquisition, etc. also call for using knowledge of fundamental analysis to make profit in the short-term.

Just like groceries don’t come with a fixed price, equities are similar. Fundamental Analysis helps an investor to mute the short-term noises around the company and emphasise on the long-term prospects.

A person who is practising fundamental analysis has various sources of information, including historical data of the company, announcements released by the company, industry insights, economic projections related to the economy, in short both microeconomic and macroeconomic understating.

While daily information flows may affect the share prices, not everyone in the market is a trader because many believe in long term investing as well. The process of fundamental analysis requires understanding of accounting, business, and mathematics.

One should also understand the business models and how the business makes money and how the business is impacted by the underlying changes in the industry as well as in economy.

Do Read: Understanding Different Kinds of Fintech Businesses

Consider you know onions are sold around $2 a kilogram, but when buying the seller asks you $4 for a kilogram. Either you will not buy from that seller, or there must be a reason behind the price hike like shortage of onion supply. Fundamental Analysis will help find such reasons with respect to share prices.

Since the fair value of bonds and equities is the discounted value of expected future cash flows, the cash flows of bonds are predetermined but not in equities, where cash flows fluctuate over the course of investment period.

To know more on bonds read: Fixed Income Securities – A look Into Bonds

Equity is a perpetual investment and non-redeemable, therefore, the emphasis of Fundamental Analysis remains on future earnings and estimates of growth in future earnings. There is a wide perception around fundamental investors that share price should reflect intrinsic value over the long-term despite mispricing in the short-term.

Moreover, returns on stock not only reaped from picking good stocks but also investing at the right price. Just like when buying groceries, you ask how much, it is also favourable to ask when investing in stocks. Readers should understand that, shares are a right to a part of business and not just a piece of paper. Fundamental Analysis contradicts the Efficient Market Hypothesis, which argues that share prices incorporate all relevant information.

More on buying cheap stocks: Investment Strategy Of Picking Undervalued Stocks

Top-down approach: It includes analysing macroeconomic indicators such as GDP growth rates, interest-rates, inflation, unemployment, currency exchange rates etc. One usually looks at industries that are in a favourable position based on macroeconomic indicators.

For more on this approach read: A lens over Top-Down Investing Strategy

Bottom-up approach: Industry analysis further requires research into the state of the industry like growth rates, competition, regulatory development, new entrants, disruptive technology, structural change. But more attention is given to individual businesses and potential effects as a result of underlying changes.

Good read: Which Parameters Should Be Looked at While Selecting Stocks?

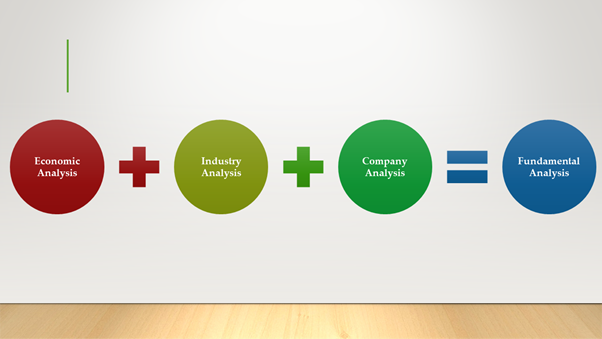

What is Economic, Industry and Company (EIC) analysis?

Economic Analysis: In this analysis, the investor seeks to evaluate microeconomic as well as macroeconomic factors. Within microeconomic factors, the emphasis is on behaviour of individuals and their spending decisions at given price levels. Consumer demand is also analysed while microeconomic also includes study of firm, including costs, profits, competition.

To Understand behaviour of individuals understanding Behaviourial economics is paramount.

Under macroeconomic study, the analyses of the trend in unemployment rates, growth rates, inflation, investment rates, savings rate, consumption, income and other major macroeconomic variables that could impact the potential investments is undertaken.

Here in this article, global energy consumption is discussed: EIA Anticipates 50 per cent Surge in Global Energy Consumption

It also includes study of fiscal policies developed by the Government as well as monetary policy by the Central Bank. And, the analysis also extends to international trade, exchange rates, trade deficits, geopolitical environment, global economy, especially nations with close relations.

More on this read: Monetary Policy vs. Fiscal Policy

Industry Analysis: Under this analysis, the investor emphasises on the trends in a particular industry and their impacts on individual companies. Industry analysis allows to gain valuable insights about the industry and understand the position of an individual company compared to its peers.

Read: Birds Eye View on Australian Transport Industry

Michael Porter’s five forces model is a widely used template to study an industry. These five forces include: threat of new entrants, threat of established rivals, bargaining power of buyers, threat of substitutes, bargaining power of sellers.

Political, Economic, Socio-cultural, Technological, Legal and Environmental (PESTLE) Analysis is also widely used when evaluating an industry from an investing perspective. As the name suggests, this analysis is related to the study of all those areas that could affect the business.

Read: How Are Market Analysts Eyeing The Impact Of Election Over Equity Market?

Investors also monitor the regulatory developments in an industry because it is crucial to know the rules of the game. Also, there remains a possibility that change to regulatory environment can have a material impact on companies.

On the topic of regulation: Banking regulator tightens dividend paying capability, Fitch downgrades Banks

Company Analysis: In the analysis, the investor conducts research on an individual company and emphasises on specific details like business models, strength, competitive advantages, risks, opportunities etc.

Read: Why Competitive Market Strategy Brings A Tough Time For Certain Players - Credit Corp Faces The Heat

It is important to know the cash-generation intensity of the business as well as how the company makes profit or what are margins of the business. What are the products or services of the company and who are the customers of the business.

Further, it also include research on the quantitative aspects of the company, including net income, operating expenses, assets, debt, liabilities, cash flows, earnings as well as growth history of the business.

On ROE: Interpreting ROE: A Quick look at Dupont Analysis

Some basic valuation techniques

Dividend yield: Dividend yield is one of the basic valuation techniques to express, in percentages, the amount of dividends paid by a company in a given annual year relative to its current price. Dividends are paid by companies after meeting their necessary obligations, including taxes, interest costs, suppliers etc.

Good Read: Tips For Scanning Attractive Dividend Stocks Amidst The Current Volatile Market

Also Read: 5 Tips for finding sustainable dividend yield stocks

Earning yield: Expressed in percentages, it is the earning of a company in a given annual year in relative to its current price. Earnings or net income of the business is the amount of money the business has made as per accounting principles since actual cash realised could be otherwise.

Price-to-earnings ratio: P/E ratio is one of the widely used valuation techniques to indicate the premium given by the market to the company based on its earning potential. It is calculated as the current price of the stock/earnings per share.

Good read: Understanding Price-Earnings Ratio

Price-to-book ratio: P/B ratio is calculated by dividing the price of the stock by the book value per share of the company. It is primarily used to evaluated stocks based on their premium over the book value or discount over the book value.

Good fundamental analysis entails reading and synthesising lot of material and using a balanced approach to come to an investment decision. Seasoned investors read a lot of material including Annual reports, industry reports, newspapers, business journals, conference call transcripts, to name a few. Having a circle of competence is essential and for building a solid circle of competence one should also consider learning ideas from other domains to become a rounded thinker which is essential for good long-term fundamental analysis.

Read: An Annual Report a Day Keeps the Losses Away; Get the Most from Reading an AR

Read: Understanding Darwin Theory; Analogy with Businesses and Investors