Definition

Related Definitions

Free-Float Methodology

What is free float methodology?

Free-float is a method used for calculating the market capitalization of stocks that are included in a stock market index. In a standard method, the market capitalization includes outstanding shares (both privately and publicly owned are taken into consideration), however, in the free – float methodology, the market cap is calculated only on the basis of the publicly held outstanding shares.

The outstanding share values are then multiplied by the share price. The calculations completely ignore the shares held by the government bodies, promoters and trusts. This implies that the free-float market cap value will be lower than the actual market cap of a company.

Float adjusted capitalization is another term used for free-float market capitalization.

Summary

- Free - float is a method used for calculating the market capitalization of stocks included in an index.

- In the free – float methodology, the market cap is calculated only on the basis of the publicly held outstanding shares.

- The free-float market cap value will be lower than the actual market cap of a company.

- Float adjusted capitalization is term another term used for free-float market capitalization.

Frequently asked Questions (FAQs)

Which shares are not included in the calculation of the free-float methodology?

While calculating market cap by employing the free-float methodology, only those shares are taken into consideration that are actively traded in the market and not owned by the company’s promoters. ‘Free shares’ refers to those shares which are readily available in the open market for the purpose of trading and issue by the company.

Following shareholders are excluded from the calculation –

- Shares held by the founders, partners, promoters or directors of the company.

- Controlling interest.

- Shares owned by hedge funds or private equity funds or any type of funds.

- Shares that are locked-in by nature.

- Equity owned by the cross-holdings.

- Equity owned by the trustees.

- Other shares which are not actively traded in the market.

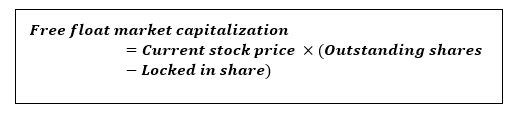

How free float market capitalization is calculated?

What is the difference between the market cap weighted methodology and price-weighted methodology?

Indexes are either weighted by market capitalization or price. The returns on the listed stocks are weighted by both the methodologies, however, market capitalization methodology is used by the majority of the indexes. For example, the S&P 500 index of the United States employs market cap weighted methodology.

The choice of the methodology is crucial as it affects the overall returns of an index significantly. The return is calculated in the price-weighted index by weighting the returns of a stock in relation to their price levels. Stocks that have a higher price will achieve higher weightage and ultimately affect the overall return on the index. The price-weighted methodology gives no consideration to market capitalization.

Dow Jones industrial average is one of the examples of price-weighted indexes in the trading market.

How can investors utilize free float methodology?

From the perspective of a risk averse investor, the aim would be to invest in the shares that have large free float as it results in less price volatility. The free-float shares are actively traded along with the high volume of shares, allowing the investor to exit the market in case of losses. The holdings of the promoters are generally less and give the retail investors more power to participate in the company’s decision making along with higher voting rights.

What is the relationship between market volatility and free float?

There is an inverse and significant relationship between free float and market volatility. Higher free float means that shares are bought and sold rapidly. When the free float is low, then the volatility is high and traders can easily affect the market prices.

The traders cannot affect the prices of the shares that have high free-float, and therefore, the majority of the traders prefers the shares which have low volatility and higher free float. The shares can be sold and bought easily, and the price of the index is not questioned.

How is the free float value adjusted?

The value of the free-float is affected by the amount of the outstanding shares and a company can change the free-float value by either increasing or decreasing the outstanding shares through management decisions. For example, a company can increase the value of free float by undertaking stock split or selling the shares.

Moreover, the increase in the volume of outstanding shares can take place when the restricted shares are converted into the unrestricted shares. Furthermore, the free float value can be decreased by performing reverse stock split or buybacks of the company’s shares.

What are the advantages of free float methodology?

- The market sentiments are accurately depicted by the free-float methodology as only the actively traded shares are considered in the calculations. The influence of the promoters or the trustee is reduced significantly.

- The index’s bases become broader with free float methodology as the concentration of the top companies is reduced in the index.

- The index’s scope becomes wider as both low free floating shares and large market capitalization shares are given consideration while composing the index. Since only the free-float capitalization is considered, these companies also find a place in the index and the trading playground increases.

- Free-float shares which are large have less volatility as they are traded actively, and limited people have the power to affect the share prices. The shares with less free float are highly volatile and are affected by few trades only.

- The free-float methodology is considered as the best practice in the industry and utilized by all the largest indices in the globe such as S&P, FTSE and so on. The exchange traded funds QQQ of NASDAQ – 100 are also weighed on the basis of the free float methodology.

What are free float factors?

The free float methodology can also be utilized in ascertaining the float factors. The free-float factors are assigned to each share and it highlights the shares which are open for trading and which are closed (cannot be traded).