Definition

Related Definitions

Franked Dividend

What is a franked dividend?

Franked dividends were created to halt the double taxation of corporate profits. The concept was first introduced in Australia back in 1987.

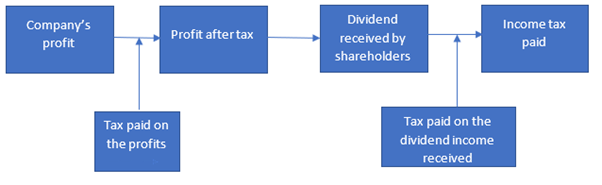

Before 1987, the company’s income was taxed, and the dividend was distributed from the after-tax profit. The dividend received by the shareholders was categorised as other income and was taxed while calculating income tax. It resulted in double taxation of dividend income.

Source: © Rummess| Megapixl.com

For example, companies, including those listed on the ASX (Australia Stock exchange), pay ~30% tax on their profit. The dividend is distributed to the shareholders from the remaining profit. When shareholders file their personal income tax, dividend income is taxed again as it is seen as other income.

The dividend income coming from already-taxed profits is termed as a fully franked dividend.

To know about upcoming dividends, click here.

Summary

- Franked dividend was introduced in 1987 in Australia to avoid double taxation on dividend income and the company’s profit.

- Franking credit is associated with franked dividends to eliminate double taxation issue.

- While filling income tax return, a shareholder submits information regarding credit rating and dividend income received.

- Dividend Can be fully franked, partially franked, or unfranked.

Frequently Asked Questions (FAQs)

How franked dividends avoid double taxation?

Double taxation is eliminated by giving shareholders tax credit, generally known as franking credit. It is also termed as imputation credits. It represents the tax amount which is already paid by the company that is distributing dividend. While paying income tax, shareholders share the information about the dividend income along with the franking credits.

In general, a company’s tax rate is a fixed 30%, while a shareholder’s personal tax rate, which is also considered, could be higher or lower. If a shareholder’s maximum tax rate is under 30%, the difference in the paid tax will be refunded by the Australian Tax Office.

Source: Copyright © 2021 Kalkine Media Pty Ltd

How do franked dividends work?

Franked dividends come into the picture when an Australian firm pays dividends to their shareholders after paying tax on their total earnings. It works in the following manner:

- When a company distributes a dividend, a dividend notice is received in which “franking credits” is mentioned. It is the amount of tax that the company has paid on the dividend.

- While shareholder is paying their personal tax, they must include both credit rating and dividend income.

- Against the franking credit, the tax credit is given to the shareholders. The tax credit is considered against other income of shareholders. Since the flat tax rate is 30% and the personal tax rate is generally low, it results in tax-free franked dividends.

- After 2000, the difference between the tax paid by the company and personal tax paid by the shareholders is also adjusted.

How is franked dividend calculated?

To calculate franked dividend, firstly, the franking credits are calculated by using the following formula:

Franking Credit = ](Dividend / (1-Corporate Tax Rate) – Dividend]

For example, suppose a shareholder received AU$140 as a dividend (fully franked) from a corporation that pays 30% in tax. The franking credit will be calculated as:

Franking Credit = [(AU$140/(1-0.30)-AU$140] = AU$60

Now the franking credit is added with franked dividend, i.e., AU$140 + AU$60 = AU$200. Thus, AU$200 is the gross dividend which is the taxable income. If the dividends are not franked, then the shareholder has to pay tax on AU$200. Since the franking credit is highlighted in the dividend statement, only AU$140 will be seen as taxable income.

What is the holding period rule?

To avoid or control investors from exploiting franked dividend for personal benefits, the Australian taxation department introduced a rule required to be fulfilled before using franking credits.

The holding period rule states that shares of the franked dividend firm must be held for 45 days minimum. These 45 days do not include the day of purchase or sale of shares.

What are unfranked or partially franked dividends?

Unfranked dividends: There is a possibility that the dividend distributed is not a part of the company’s profit which is taxed. For example, a company sells their asset, and it might be exempted from taxes.

Franking credits are not attached to the unfranked dividends, and shareholders have to pay tax on the dividend received.

Partially franked dividends: Whether the dividend received is considered fully or partially franked depends on the tax paid by the firm. The dividend is categorised as fully franked if the tax has been paid before distributing the dividend. A dividend is categorised as partially franked when tax is paid on only a part of the dividend before distribution.

Percentage form is utilised to indicate partially franked dividends. For example, a partially franked 60% dividend indicates that the organisation has paid taxes on 60% of the dividend and still has to pay tax on the remaining 40%.

What are the advantages of franked dividends?

The tax advantage is apparent for the shareholders. Additionally, franked dividend regime leverages the investment in companies that distribute dividend income. Double taxation impacts investment choices and also results in reduced income and economic inefficiency.

The introduction of franked dividends has allowed organisations to manage their capital efficiently and attract investors as these companies become a good investment prospect.

How can franked dividends be utilised to assess an investment opportunity?

While investing in a dividend-paying Australian firm, the franked dividend should be carefully compared with the unfranked dividend. The return needs to be calculated while making a comparison before investing.

An unfranked dividend of 10% means that the stakeholder will have to pay tax on it. Assuming 30% tax, the net return is only 7%.

Similarly, a franked dividend of 10% is equivalent to 14.286% of an unfranked dividend.

DO READ: Top 25 ASX Stocks By Dividend Yield