Definition

Related Definitions

Earnings Call

What is an Earnings Call?

An Earnings call is a teleconference or video conference amongst the senior management of a public company, and its shareholders, analysts and the media. It is aimed at discussing the company's financial outcomes for a given reporting term. It could be held for each quarter, half-yearly or annually, just after the earnings report's release. The call highlights vital financial information and the management comments on the economic and strategic whereabouts of the company.

Summary

- The earnings call aims to provide a platform to investors and analysts who want to discuss the financial reports.

- It is the teleconference or the video conference amongst the senior management of a public company, and its shareholders, analysts and the media.

- Reasons for the growth or decline in the company's present and future, revenues, assets and liabilities, along with cash flow statement, are discussed here.

Frequently Asked Questions (FAQ)-

Why is an earnings call held?

The earnings call aims to provide a platform to investors and analysts who want to discuss the financial reports. Various laws worldwide mandate publicly listed companies to provide detailed financial results and conduct a qualitative discussion. Almost all listed companies operate earnings-related conference calls to discuss their financial reports. Most companies offer a phone recording, or a media release presentation of the earnings call on their company websites. These stay on the web portal for a few weeks after the actual call date. It provides the investors who could not attend access to the discussion in the earnings call.

Image Source: © Iqoncept | Megapixl.com

What is discussed during the earnings call?

During the earnings call, the company's top management lays out details of its Quarterly annual report. The management discusses and provides qualitative information for further analysis of financial statements. It is a comprehensive discussion covering vital performance metrics. Reasons for the growth or decline in the company's revenues, profits, assets and liabilities, along with changes in the cash flow statement, are discussed. The forum highlights risks faced by investors while extending funds to the company in equity or debt form. Any pending lawsuits or convertible contingencies are also highlighted. Management often outlines future targets and methodologies for new initiatives and any changes in top management or group of key managerial persons.

How do Earnings call Progress?

The details related to holding the earnings call is made available in advance by a company's officials. Media persons are also called to attend the event for coverage. Investors and market analysts are sent the information as well. Investors follow the call to know the company's pursuits and past; market analysts attend to get details for ascertaining values and making forecasts. The structure of the earnings call is as follows

- First, a Disclaimer Statement is issued- that the presentation shall comprise the projected financial statements as well, which may differ from actual results attained. It issued in order to protect the company from any future liabilities. Characteristically earnings call starts with this statement from the management. It is a warning statement to the participants that estimates of results may substantially differ from actual future results, and forward-looking assumptions can drastically differ from the actual future situations.

- Financial Result discussion- next in the earnings call company's top-level management, including the CEO, COO, CFO etc., present the financial results for the current reporting period. Discussions on the corporation's future operational strategies and forecasts take place. The number of executives who will speak depends on the corporate hierarchy and the number of top-level executives attending the meeting. However, the two key executives, chief executive officer (CEO) and chief financial officer (CFO), must be essentially present in the earnings call. The managers talk about the future goals and milestones a company wishes to achieve.

- A session for Question and Answers- After the result discussion, outside members are given an opportunity to question the officials and clear their doubts. The company executive may answer the question or deny or defer the answers for later. This is the final part of the call. Investors, analysts, and media participants question the management regarding the current financial results presented.

- Closing Remarks-The management gives a conclusion of all the discussions held.

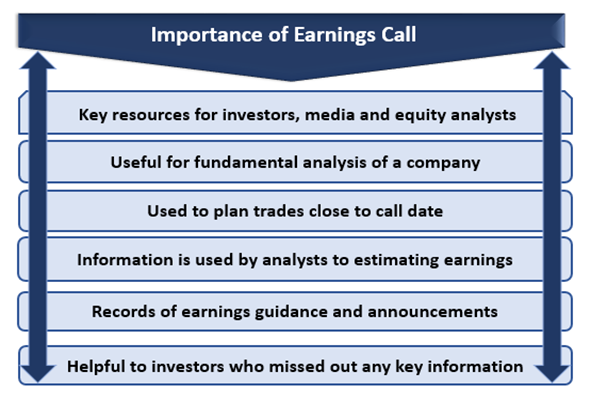

What is the Importance of Earnings Call?

Source: Copyright © 2021 Kalkine Media

Earnings calls are an essential resource for investors. Any vital detail missed out by an investor previously is reiterated here. The information provided in it is utilized for fundamental analysis by equity analysts. It is the best source for first-hand qualitative information. As it contains earnings updates and future strategies, it is very important for share traders.

Transcripts of the call are also made available to the public over the company website. It is very useful for investors, media representatives and analysts.

How Long is an Earnings Call?

Stereotypically, an earnings call has a duration of 45 to 60 minutes, i.e. 1-hour maximum. This is because the key managerial persons do not have a lot of time to spare from their hectic schedules. However, there are no strict legislative rules for determining an ideal call duration. It primarily depends on the amount of time used by participants in the question and answers session. All other segments are timed beforehand, as per the company's management.

What are the Advantages & Disadvantages of Earnings Call?

Advantages

- Opportunity for Investors, analysts and media personnel to discuss in person the declared financial results of a company.

- Important for the participants wanting to gather financial and strategic insights for the past, present and future of a company.

- It is a very useful first-hand data source for information used to undertake investment decision.

- Attending participants get a chance to ask questions and receive answers directly from the Key managerial persons of the company.

- It provides a futuristic insight for forecasting and valuation analysis.

Disadvantages

- It can sometimes become a repetition of already published data.

- Company managers may just run a pre-recorded script and choose to not answer/ delay investor queries.

- The choice given to management to take up only questions they wish to answer may sometimes work against investors or analysts who want to dig deeper.

- Analyzing information presented in the earnings call is a bit difficult, and immediately asking good quality questions on the same might not be possible.