Definition

Related Definitions

Earnings before Interest Taxes and Amortisation (EBITA)

What is meant by the term EBITA?

Analysts and investors use various profitability measures to understand the source of profits and compare companies within and across sectors. Earnings before Interest Taxes and Amortisation (EBITA) is one such standard measure used to evaluate the operational profitability of companies. As the name suggests, EBITA refers to the profits earned by a company prior to deducting non-operational line items like interest, taxes and amortisation expenses. Other common measures of operating profitability are Earnings before Interest Taxes, Depreciation and Amortisation (EBITDA) and Earnings before Interest Taxes (EBIT).

© Stokdrozdirina | Megapixl.com

Highlights

- EBITA refers to the profits earned by a company before deducting non-operational line items like interest, taxes and amortisation expenses.

- Costs can be classified into operating and non-operating expenses.

- EBITA is effective in comparing software business, as they have high intangible investments/capex.

Frequently Asked Questions (FAQs)

Why is the EBITA value needed?

In accounting, a profit and loss statement is used to calculate the profits earned by a company by deducting all the costs incurred from the revenues generated in a period. However, there are several types of costs incurred by a business. These include the cost of goods sold, selling and administration costs, finance costs, taxes paid etc. On a broader basis, these costs can be classified into operating and non-operating expenses. Cost of goods sold and selling and administration are considered operating expenses since they are directly linked to the business's core operations. On the other hand, expenses like finance costs and taxes are considered non-operational. For instance, the finance cost is dependent on the financing mix or the debt level of the business. Hence, two companies operating in the same sector could have varying finance costs depending on the financing decision. Similarly, tax rates depend on the geography a business operates. So two companies with exactly the same business and having similar business models could pay different taxes since they are operating in different geographies.

Such variations in accounting often cause issues in comparability, even for companies within the same sector. To overcome this issue, operating profit is calculated to understand the core operational profitability of the business and compare businesses. Earnings before Interest and Taxes (EBIT) is the most commonly used operating profit measure as it excludes the aforementioned non-core expenses.

However, the flexibility provided by regulators for recording certain costs could create comparability issues across companies. Depreciation and amortisation expenses are some of the significant items which could create such issues.

Image Source: © Info40555 | Megapixl.com

Accounting rules allow multiple options to record depreciation and amortisation in the book of accounts. For instance, depreciation or amortisation can be recorded using straight-line method or declining balance method, amongst others. Expenses calculated from these methods could end up with huge variations. For instance, two companies with exactly the same business and business model could have considerable differences in depreciation and amortisation expenses, just because two different accounting methods have been used. Hence, adding back depreciation and amortisation to EBIT to arrive at EBITDA, makes comparison of companies easy.

© Josepalbert13 | Megapixl.com

While EBITDA is widely used across sectors, EBITA is a better measure for sectors with lower investments in tangible assets. For example, certain asset-light industries like IT and software sectors might have limited investments in tangible assets but huge investments in intangible assets. As a result, depreciation expenses might be limited, but amortisation expenses might be huge. Hence, EBITA, which includes depreciation but excludes amortisation is often used as an operating profit measure in such industries.

What are the advantages of EBITA?

- Proxy for operating cash flow: EBITA, similar to EBITDA, is used as a strong proxy for operating cash flow as a company's major non-operating cash flows (interest and taxes) and operating non-cash expenses (amortisation) are adjusted.

- Comparability: For companies in sectors with a high level of intangible assets, amortisation is a significant expense that can be tweaked based on accounting policies. Interest and tax expenses are also based on the company's financing mix and geography of operation. Hence, EBITA and EBITA margin is a measure that allows easy comparability of companies.

- Superior measure compared to net income: For companies with a significant investment in intangible assets, amortisation will be a significant expense. A company might be doing well in its core operations, but given its high investment in intangibles, it might have low or negative net income. So low net income must be analysed by looking at the movement in EBITA as well.

Calculating EBITA

There are two ways of calculating EBITA, depending on the availability of data.

In the first method, EBITA is calculated using a top-down approach. For this, all operating expenses other than amortisation are deducted from the company's revenue to arrive at the EBITA. Broadly, this can be written as follows:

EBITA = Revenues – Cost of Goods Sold – Operating Expenses (Excluding Amortisation)

However, in some instances, a breakup of a company's costs might not be readily available, especially in private companies. In such cases, a bottom-up approach to arrive at EBITA might be more manageable. For this, interest expense, tax charges and amortisation expense are added to the net profit or loss to arrive at EBITA.

EBITA = Net income + Interest + Taxes + Amortization

Practical example

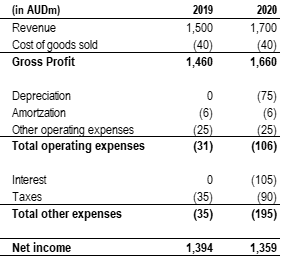

Let us take the example of a company XYZ which has reported the following in its financial statements:

The company's total revenue in 2019 was AU$1,500m, and the net profit was AU$1,394m. Interestingly, the company's revenues grew to AU$1,700m, but the net profits dropped to AU$1,359m.

As can be seen from the statement, the company’s gross profits have increased, but the net income has decreased. Does that mean that the company has not performed well operationally? To answer this question, let's calculate and analyse Company XYZ’s EBITA.

As discussed above, we can calculate EBITA using the second formula,

EBITA = Net income + Interest + Taxes + Amortization

2019 EBITA = 1,394m + 6m + 35m = AU$1,435m

2020 EBITA = 1,359m + 6m + 90m + 105m = AU$1,560m

The EBITA calculations show that the company’s operating profits have also grown in line with the gross profits. However, the increase in depreciation, interest and taxes have caused a drop in net profits. Increased depreciation could be a result of increased capital investments.

Similarly, higher interest expense results from higher debt, which could mean that the proceeds were used for capital investments when seen with higher depreciation. On the other hand, taxes have grown in line with the higher operating profits. So in effect, the net income decline is not precisely alarming given that the decline resulted from the aforesaid expenses, which could pave the way for future growth of the company. However, if one looks just at the movement in net income, it might be misinterpreted.