Definition

Related Definitions

Dividend per share

What is meant by the term dividend per share?

Dividends per share are the dividends paid for each outstanding share for a particular period. Good dividends per share have the potential to attract customers to buy shares in the company. A good dividend indicates secure income for the investor because the company has a stable income. In addition, dividends often are correlated with a strong performance and better prospects of the business.

Summary

- Dividends per share are the dividends paid for each outstanding share for a particular period.

- The dividend per share tells an investor the income that they can expect for a share investment.

© Rummess | Megapixl.com

Frequently Asked Questions (FAQs)

What is the importance of dividends per share?

Estimating the dividend per share tells an investor the income that they can expect for a share investment. A consistent improvement in dividend per share weaves a resilient growth story for any company.

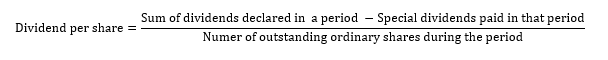

How do we estimate dividend per share?

The formula for estimating dividend per share is as follows-

In the above formula, special dividends are declared as a one-off case and may or may not be repeated in the future. Interim dividends are a part of special dividends. Interim dividends are declared and paid to the shareholders before the annual earnings have been estimated.

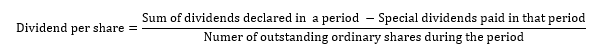

Let us take an example to understand the estimations. Suppose DJ limited paid US$ 100000 as dividends during 2020. There was also a special dividend of US$ 25000 during the year. DJ Limited has 50000 outstanding shares during the period. The dividend per share will thus be as follows

The dividend per share of DJ limited for the year 2020 will be US$ 3.75

What are the types of dividends?

Usually, dividends are paid in cash. Other forms of dividends may be property dividends, stock dividends, scrip dividends, and liquidating dividends. The various forms in which investors can receive dividends are as follows-

- Cash dividends are the most common form in which companies distribute dividends. The dividend is announced on the date of declaration, and then the shareholders are distributed their share in cash on the date of payment. The dividend payment is subject to the dividend assignment as of the date of record. Only companies with a positive balance of retained earnings and sufficient liquidity in the form of cash can give out cash dividends.

© Larryhw | Megapixl.com

- Bonus shares or stock dividends are given out by companies when they are low on cash flows from operations but want to meet the interests of investors. Bonus shares are declared on a pro-rata basis. For example, suppose an investor holds 100 shares, and a bonus share is announced in the form of one share for every 25 shares. In this case, this investor will get four more shares and become the holder of 104 shares. An increase in the number of shares will increase the issued capital of the business and thus will impact the earnings per share and dividend per share accordingly. Investors who need cash as a must can exercise the option of capitalisation of earnings by selling off their shares in the secondary market.

- Property dividends are given to investors in the form of physical assets at their fair value.

- Scrip dividends are issued in situations of lack of funds for dividend payments. The company instead gives a promissory note to the shareholders as a commitment to pay the mentioned dividend amount later.

- Liquidating dividends is often a sign of a business shutting shop because the shareholders are returned their original capital as dividends.

What are the types of cash dividends that an investor may receive during a period?

Cash dividends may be given to investors in the form of special, final, or interim dividends. Special dividends are a one-off case and are often a result of windfall gains made by a company due to any event. Interim dividends are those dividends declared before the income or profit for that financial year is estimated. As the name suggests, final dividends are declared after the accounts for the respective financial year are closed, and the final net profit is known.

Are there any drawbacks of paying very high dividends often?

High and frequent dividend distributions may mean lower retained earnings. Retained earnings are essential for any company to reinvest and expand their business. However, if strong retained earnings accompany dividend payouts, the company may be considered financially very strong and resilient.

Also, suppose there is a company that regularly pays good dividends. A very attractive investment opportunity comes it's way, and the opportunity cost of chasing it is dividend payment. It may be a one-time irregularity in dividends or a path being paved for regular dividends in such a case. Investors may end up judging the reduced dividends or non-payments as poor performance. Such wrong signals may be detrimental to the market value of the company.

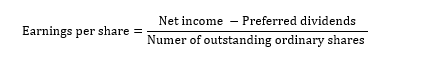

What is the difference between earnings per share and dividends per share?

Earnings per share and dividends per share are both indicators of a company's profits. But they are different ratios. Earnings per share assess the profit per share, while dividend per share is part of the profit paid out to investors for each share they hold.

Earnings per share are estimated as follows-

While dividends per share is estimated as follows-