Definition

Related Definitions

Digital Wallet

What is a Digital Wallet?

A digital wallet, or an e-wallet, refers to software or an electronic device or online service that lets individuals and businesses transact electronically. It stores the users' information for various payment modes on several websites, gift coupons, and driver’s license.

With a digital wallet, a user can process the payment smoothly using the NFC (near field communication) technology.

Digital wallets are also used along with the mobile payment system, allowing users to make payments via smartphones.

Importance of Digital Wallets

- As digital wallets store all the user's payment information in compact form, individuals do not need to carry physical wallets.

- They reduce the need to carry cash, thus, lowering the chances of pick-pocketing.

- From a Company’s viewpoint, based on the buying habit, the companies involved in the marketing activities can improve the effectiveness of the marketing methodologies they follow. However, it could have an impact on data privacy.

- Digital wallets go beyond the geography barrier and help transfer funds to friends and family members worldwide.

- Digital wallets remove the need for physical banks and companies to open and maintain a bank account. Hence, with the help of a wallet, even people residing in rural areas can be connected.

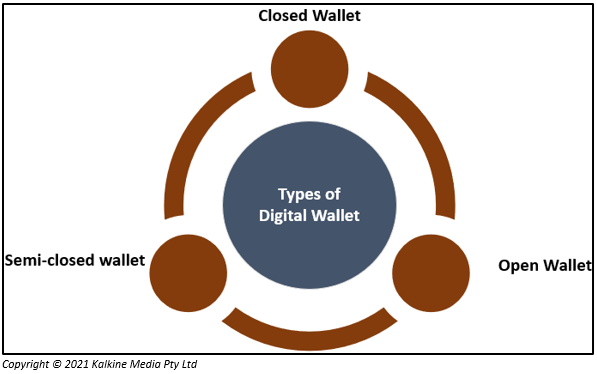

What are the different types of Digital Wallets?

There are three types of digital wallets – Open, closed, and semi-closed.

Closed Wallet: A closed wallet is one in which the wallet is used for storing funds. These funds can be used for making payment. Also, if any transaction is made using the wallet gets cancelled, the amount gets refunded in the same wallet. Amazon Pay is a prime example of a closed wallet.

A closed wallet is designed for making full or partial payment for the services that the wallet issuer directly offers. The best part is that it is an excellent tool for developing customer loyalty by providing reward-based cashback.

One cannot use a closed wallet to make payments to any 3rd party service provider or transfer money. Other than this, once the amount is added to a closed wallet, the user would not be able to withdraw cash. The money can be used to avail of the products and services offered by the wallet issuer.

Semi-closed wallet:

Through a semi-closed wallet, the user can transact at listed merchants and locations. These wallets have restricted coverage area for purchasing goods online or offline. For using this type of wallet, the merchants have to sign a deal with the issuer for accepting payments from the wallet.

In a semi-closed wallet, the users can do the shopping and transfer funds to another user in the same wallet network.

Open Wallet:

Banks and institutes partners with other banks to issue open wallet. Through an open wallet, the user can transact with a semi-closed wallet and withdraw funds from banks, ATMs and can also transfer the money.

How does a Digital Wallet or Mobile Wallet work?

The mobile wallet works using NFC technology or QR code technology. These QR code technology or NFC technology store payment-related details in an encoded format because of security reasons. There are different ways the payment information is stored, and it differs from one wallet to another.

A mobile wallet works by communicating with terminals with the help of several types of information transfer technology. Through NFC technology, these mobile wallets communicate with each other.

How to use a Mobile Wallet?

Using a mobile wallet involves four straightforward steps:

- Open the mobile app.

- Enter the PIN.

- Select the type of transaction.

- Process payment.

Advantages and disadvantages of a Mobile Wallet

While managing a mobile wallet has its fair share of benefits, they also have a few drawbacks. Let us delve into the advantages and disadvantages:

Advantages:

- One of the biggest advantages of using a mobile wallet is that the user need not enter the card details and password each time while making a transaction. In simple words, mobile wallets have made the payment process easy. The user only needs to link their credit card, debit card, or bank account once and then make hassle-free payments.

- Mobile wallet allows users to store their personal documents and money digitally. Hence, it reduces the requirement of carrying any physical document or physical wallet.

- Earlier users faced the problem of change while making payment at the point of sale. With the arrival of the digital wallet, the issue also got resolved.

- Digital wallet has also made it possible to make instant payments. The user can exchange and transfer money anytime.

- Mobile wallets are safe and secure. Carrying a substantial amount of money is unsafe as the chances of losing it goes up. The arrival of a mobile wallet eliminates the problem of carrying hard cash. It also lessens the fear of credit and debit card stolen and being misused. Digital wallets use encrypted data, which makes them secure.

Disadvantages:

- Although mobile wallets have several features to make the user's payment experience easy and comfortable, the user cannot avail of these features in the absence of network connectivity or network issues.

- Although wallets have reduced the problem of carrying cash, they have increased the threat of misuse of the money by hackers and frauds. Also, a digital wallet carries the risk of identity theft. It is possible that some other third party or business is tracking your personal data.

- Although smartphones are common amongst people today, still at different corners of the world, people are not comfortable with smartphones. Hence, they prefer carrying hard cash over the mobile wallet.

- In case of any software or hardware issue with the smartphone or shortage of space in the mobile, it isn't easy to download the app. The problem may also happen in case the wallet is not compatible with mobile software. These issues with smartphones can reduce the usage of the mobile wallet.

- In case someone wants to do business in this field, he/she needs huge capital for the development of the app, followed by its implementation.