Definition

Related Definitions

Days Working Capital (DWC)

What do you mean by Days Working Capital?

Days Working Capital (DWC) points out the number of days needed by a firm to transform its Working Capital as Sales Revenue. It is an essential check of the efficiency of the operating capital of any business. Investors and analysts use it to peers for judging operating cycle efficiency. It is a crucial metric used in the fundamental analysis of any company.

Summary

- Days Working Capital indicates the number of days a business needs to generate Sales Revenue from working capital.

- Average working capital and Sales revenue are used to understand a firms’ operational efficiency.

- It is used by investors and analysts to fundamentally compare a company’s results with its peers.

Frequently Asked Questions (FAQ)-

How is Days Working Capital (DWC) computed?

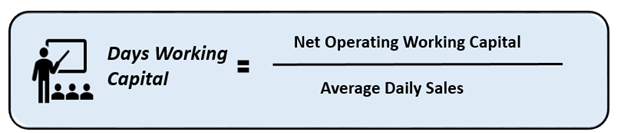

The Formula for computing the ratio is as follows-

Source: Copyright © 2021 Kalkine Media

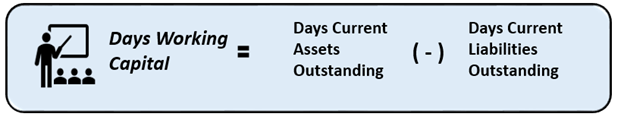

Another way of computing it is:

Source: Copyright © 2021 Kalkine Media

Working capital is the result of subtracting all current liabilities from all the current assets listed on the balance sheet of a firm. When expressed in the number of days, it shows the number of obligations a business can pay within a short duration using its liquid asset. When tracked over a trend line, it can be useful to gauge the uptrends and downtrend overtime for the industry. An additional peer comparison can give even further insights into individual firms and their efficiency during different market phases.

Example-

Suppose a company X Ltd. makes US$20 million of revenue from sales in its current reporting period. It reports current assets of US$0.8 million and current liabilities of US$0.3 million.

Using the first Formula,

Net Operating Working Capital would be the difference between Current assets and Current Liabilities for the period. This will be = US$0.8 million – US$0.3 million, which will give us US$0.5 million.

Now, average daily sales would be = US$20 million divided by 365 days in the reporting period. This will give us US$0.05 million appx.

Now replacing the numbers in the above-mentioned Formula, we will compute Days Working Capital (DWC) as US$0.5 million divided by US$0.0547, which will give us 10 days.

This means that, on average, the company takes 10 working days to convert its Net operating working capital into revenue from sales.

If we use the second Formula mentioned above-

Then X Ltd.’s Days Current Assets Outstanding would be US$0.8 million divided by US$20 million multiplied by 365 days of the year. It will give us approximately 15 days of Current Assets Outstanding.

Similarly, Days Current Liabilities Outstanding will be computed as US$0.3 million divided by US$20 million multiplied by 365 days of the year. It will give us approximately 5 days of Current Liabilities Outstanding.

Now using this, Days Working Capital will be Current Assets Outstanding Days minus the Days Current Liabilities Outstanding = (15 - 5 days) = 10 days.

However, if the company made US$22 million of revenue, the computation would change, and we would get Days Working Capital would become = [(0.8/22) *365 – (0.3/22) *365] days = (13 – 5) days = 8 days.

As sales increase, keeping other things constant, the number of days working capital decreases indicating the firm is able to convert working capital to sales at a faster rate.

How is Days Working Capital (DWC) interpreted?

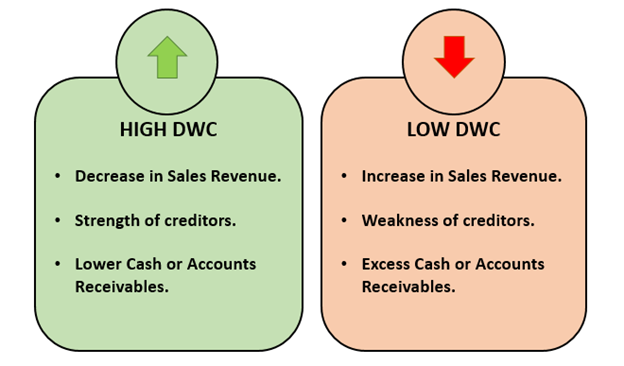

Source: Copyright © 2021 Kalkine Media

If a number of days working capital number are on the higher side, it shows inefficient operations of a firm. While a lower means a company is the quicker conversion of working capital to revenue from sales. If the number is decreasing over a period, it may because of an increase in sales. Conversely, the reverse may be an indication of decreasing sales or a longer duration of payables.

What are the uses of Days Working Capital (DWC)?

- It is used to analyze the operational efficiency of a firm.

- It shows the number of days needed to realize working capital into revenue.

- The ratio is used by analysts to compare the operating cycle of funds of peers.

- It is very useful in financial modelling and valuation.

- It can indicate the different operating environments persistent in different industries.

- It is a measure of liquidity of a firm during the short term.

- The ratio is very vital for a firms’ management as they constantly try to improve it.

- It is useful to implement techniques like Just in Time, Economic Order Quantity, etc.

- Investors use it for comparisons in the same sector.

- It is essential for fundamental analysis.

What are the Limitations of DWC?

- It doesn’t elucidate as an absolute number. It has to be compared.

- It depends on the nature of business and is influenced by it.

- As a lot of current assets numbers are used to compile it, it is a little complex to comprehend a forecast using it.

- Individual Assets and Liabilities have an impact on the ratio.

- It could be easily manipulated as multiple accounts are used for computation.

- Fraudulent and unfair representation of the actual picture of the ratio is possible.

- Unexpected events may have an adverse or favourable effect on the Days Working Capital.

How can a company improve its DWC?

Increasing the Revenue from Sales will mean a speed up in the capacity of the company to get sales revenue from its working capital. It will reduce the DWC showing operational efficiency.

Delay in payment to creditors can also reduce the DWC as an entity will reflect a better bargaining capacity with creditors and cash availability in the near term for operations.