Definition

Related Definitions

Crack Spread

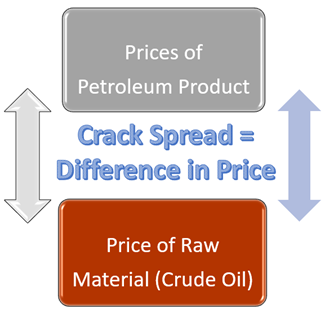

A crack spread is a distinction in cost between a refined item (or group of items) and raw petroleum. It is utilised as a market indicator of economic situations. It roughly estimates the price difference between the cost incurred in processing light crude through a cracking design processing plant to convert it in fractions of refined petroleum product. Normally, a crack is characterised in terms of single specific raw material and product. As an example, Hexane can be cracked into Butane and Ethene. This example can show how much the cost of the individual item has changed from as a raw material to a cracked petroleum product.

Understanding Crack Spread:

In the petroleum industry, the refiners' profit is mainly linked with the spread or the margin between the crude oil prices and the prices of refined products. Crude oil is used as a raw material for the production of refined petrochemical products which are sold to the users. The process of conversion of raw material to user-centric petroleum products is commonly referred to as "Cracking". And, that's why the hedge between this input cost and output prices is called "Crack Spread". Most of the times, the refinery professionals are concerned about this spread or gap.

Source: Kalkine Group Image

Crack Spread Variation:

Like most of the manufacturing industries, the operation of refineries is also dependent on two markets:

- the raw material market which supplies crude oil as a raw material for the operation of refineries and

- the other market is finished product selling market which the refiners use to sell their produced petroleum products.

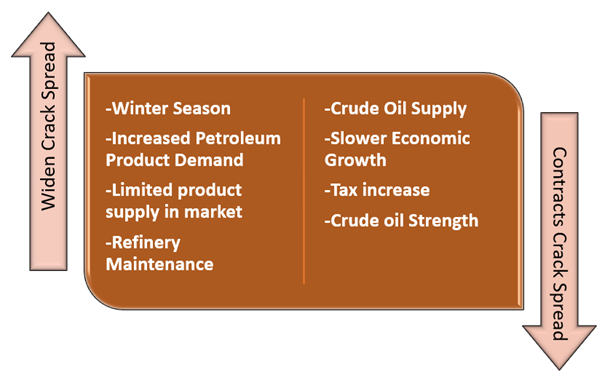

The demand, Supply and production economics of both the raw material and the end product’s market is independent. Refiners are the connecting links between both the markets and might face enormous risk when any of the markets face instability. For example, if the crude oil price rises but the prices of petroleum products remain the same or even decline, the risk for refiners increases and crack spread contracts.

Various other scenarios may also appear in the market, which can lead to increased crude oil prices like geopolitical issues, economics, environmental issues and foreign policy. These scenarios will limit the raw material supply to refiners and put them into a higher level of risk.

Crack Spread Hedging:

There are numerous ways to manage the risk associated with hanging on both sides of the market, as in the case of refiners. Since, there are a number of factors in which the operation of a refinery are dependent like demand, supply, plant-type, the configuration of refining plant and raw material that can be used in the plant. So, there are various types of Crack Spreads available to help refiners hedge various ratios of crude and refined products.

- 1:1 Crack Spread:

It is the most commonly used crack spread in which the profit of a refinery is solely dependent on the price difference of selling petroleum products and buying crude oil. Refiners used to buy crude oil, refine it and sell the refined products to the consumers. If refiners expect a raw material price hike while the product prices to fall, they will sell most of the stored products and will stock maximum raw material hedging a wide crack spread.

On the other hand, sometimes when the operations of the refinery are shut due to annual maintenance or any other issues, refiners reverse the strategy by buying petroleum products and selling crude oil. Refiners sell their excess stored crude oil at relatively higher on-spot prices in the market as it was purchased by them during price dips, and they buy products to supply their present orders and customers.

- 3:2:1 and 5:3:2 Crack Spreads:

There are two other types of crack spreads which are commonly used by refiners. One is 3:2:1 crack spread in which every three barrels of crude oil is refined to make two barrels of gasoline and one barrel of distillate fuel. The other one is 5:3:2 which uses 5 barrels of crude to produce 3 barrels of gasoline and 2 barrels of heating oil.

Crack Spread as Market Indicator:

Regardless of whether one is directly associated with exchanging the crack spread or not, it can go about as a helpful market signal on potential value moves in both the oil and refined item market. In the event that the crack spread broadens altogether, which means the cost of refined items is dominating the cost of oil. Additionally, if the spread is excessively close, financial specialists consider that to be an indication that refiners will dip the production to limit the supply and lift the selling prices and setting back the profit margin. This, obviously, might have an adverse effect on the crude oil market.

Components Affecting Crack Spread:

There are numerous factors that can affect the width of Crack Spread. Some of them are enlisted below:

Source: Kalkine Group Image